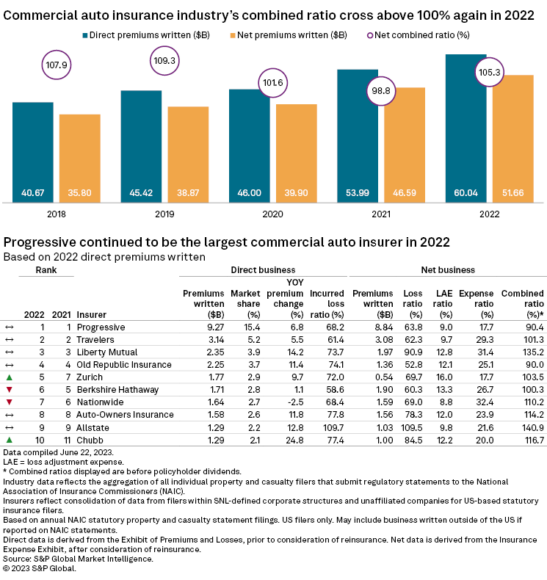

Though the U.S. commercial auto insurance industry’s 2022 combined ratio came in above 100 for the fourth time in five years, Liberty Mutual and Auto-Owners started 2023 with double-digit growth in direct premiums, according to S&P Global Market Intelligence.

Compared to the first three months of 2022, Liberty Mutual saw direct premiums written (DPW) increase 29.8% while Auto-Owners DPW increased 12.7%.

“Carriers benefited from resilient pricing in key commercial lines of business during the first quarter,” said S&P.

Nationwide Mutual Group, Chubb Ltd., Old Republic Insurance Co. and Berkshire Hathaway Inc. were the only commercial auto insurers with a decline in DPW year-over-year.

Related: Nationwide E&S Exits Commercial Auto Effective July 15

The industry’s total commercial auto loss ratio deteriorated to 68.6% in Q1 from 64.1% in Q1 2022. Chubb and Zurich each recorded loss ratios in the segment of more than 75%.

Progressive maintained it’s top spot as the largest writer of commercial auto in 2022, according to S&P.

Topics Auto

Was this article valuable?

Here are more articles you may enjoy.

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’