For the first time in more than a year, overall U.S. auto insurance shopping growth registered as ‘cool’ on the LexisNexis Risk Solutions Insurance Demand Meter in the third quarter of 2023, continuing a downshifting trend that began in June.

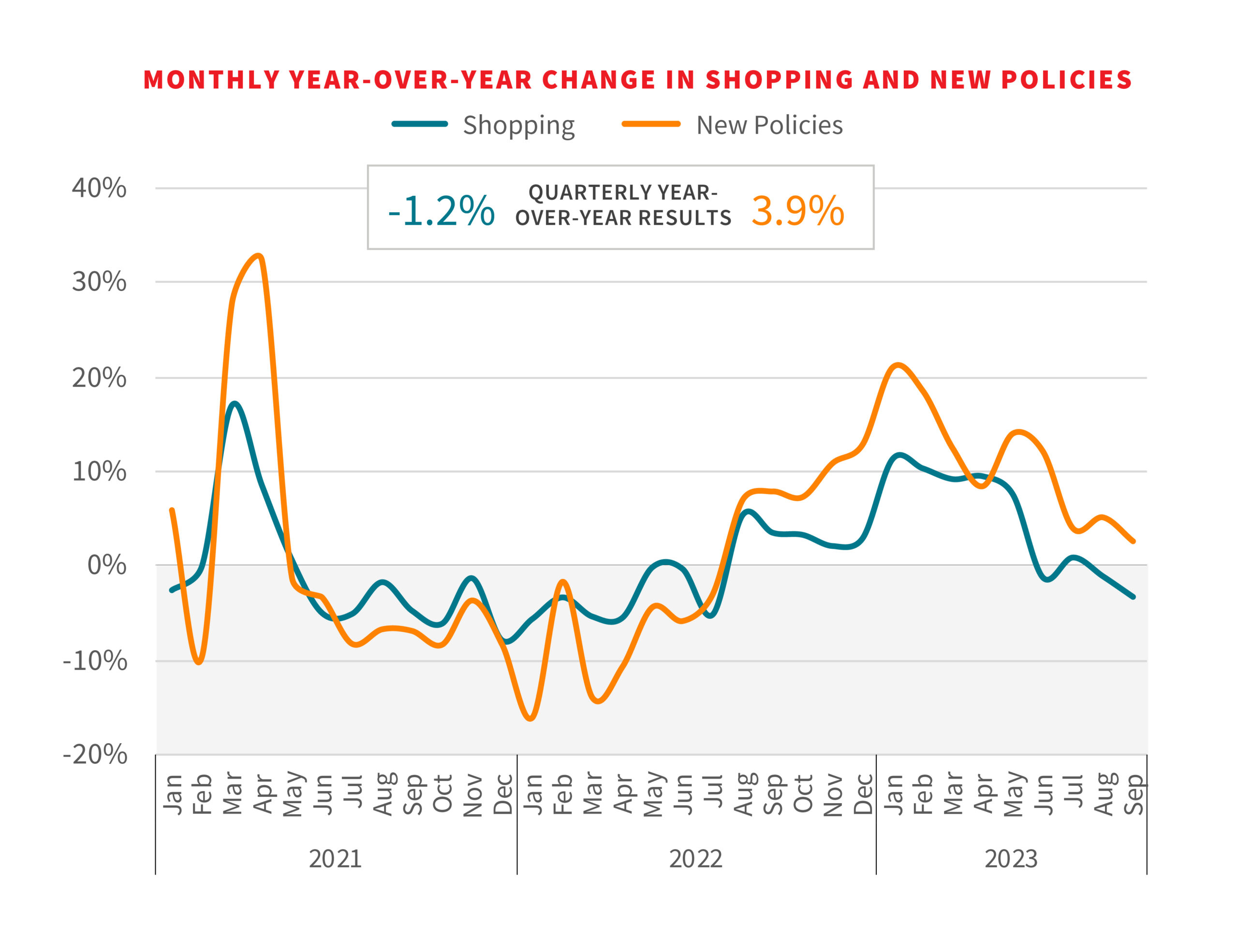

The quarterly year-over-year shopping rate fell to -1.2% in Q3 2023 and was down from the 5.2% growth registered in Q2. In a recent report, the data analytics provider shared that the market is beginning to hurdle the high market activity that began in August 2022.

Nevertheless, LexisNexis reported that consumers are still shopping at high volumes in response to ongoing rate increases. The quarterly year-over-year growth for new policies — the rate at which consumers either switched or purchased new coverage — was 3.9% for Q3 2023.

Even though this was down from the 10.2% year-over-year new policy growth spike in Q2, LexisNexis reported “record volumes” of new policies in August and September.

“This quarter’s Demand Meter reminds us that the industry is still reconciling with significant macro trends that have shifted the auto insurance market significantly,” said Adam Pichon, senior vice president of auto insurance and claims at LexisNexis Risk Solutions. “Ongoing rate increases and changing demographics continue to contribute to near-record shopping volumes, while claims severity continues to drive profitability challenges for insurers.”

Related: Auto Claimants More Satisfied Even Though Repairs Taking Longer: J.D. Power

LexisNexis analysis showed shopping growth in the 65+ age group and declines in younger age groups, specifically those under 35 years old. Those 65 and over now make up 14% of new auto insurance policy purchases, LexisNexis said, which is up from 10% in early 2022.

New policy purchases for those under 35 have dropped from 40% to 35% in that same period.

“Key to explaining this demographic shift has been the larger trend of household consolidation, which we first saw influencing insurance shopping trends in Q2 of this year,” a press release said. “The average number of drivers per policy continues to grow, as parents add their adult children to their policies or adult children add their retired parents.”

LexisNexis also reported that the percentages of shopping and new policy volumes linked to the purchase of a new or used vehicle are at four-year lows, despite sales beginning to rebound from levels following last year’s microchip shortages.

Related: Struggles in Personal Auto Insurance to Subside More Slowly Than Expected: S&P

In Q3, electric vehicles (battery/plug-in hybrid/fuel cell electric vehicles) and hybrid vehicles rose to 1.4% of all new policy business. Purchase volumes of electric and hybrid vehicles through Q3 of this year have already outpaced those from 2022.

“Record-setting rate increases have framed the auto insurance shopping and new policy growth narrative for the past several quarters,” Pichon said. “As we close out the year, claims frequencies remain flat and security levels are still well above historical averages, fueled by high vehicle repair costs.”

He continued: “As these trends prevail, we anticipate continued rate increases and strategic pullbacks into the new year for some carriers, while those that are already moving toward profitability will likely gain market share.”

Topics Auto

Was this article valuable?

Here are more articles you may enjoy.

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs

Munich Re Unit to Cut 1,000 Positions as AI Takes Over Jobs  Kansas Man Sentenced for Insurance Fraud, Forgery

Kansas Man Sentenced for Insurance Fraud, Forgery  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting  Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway