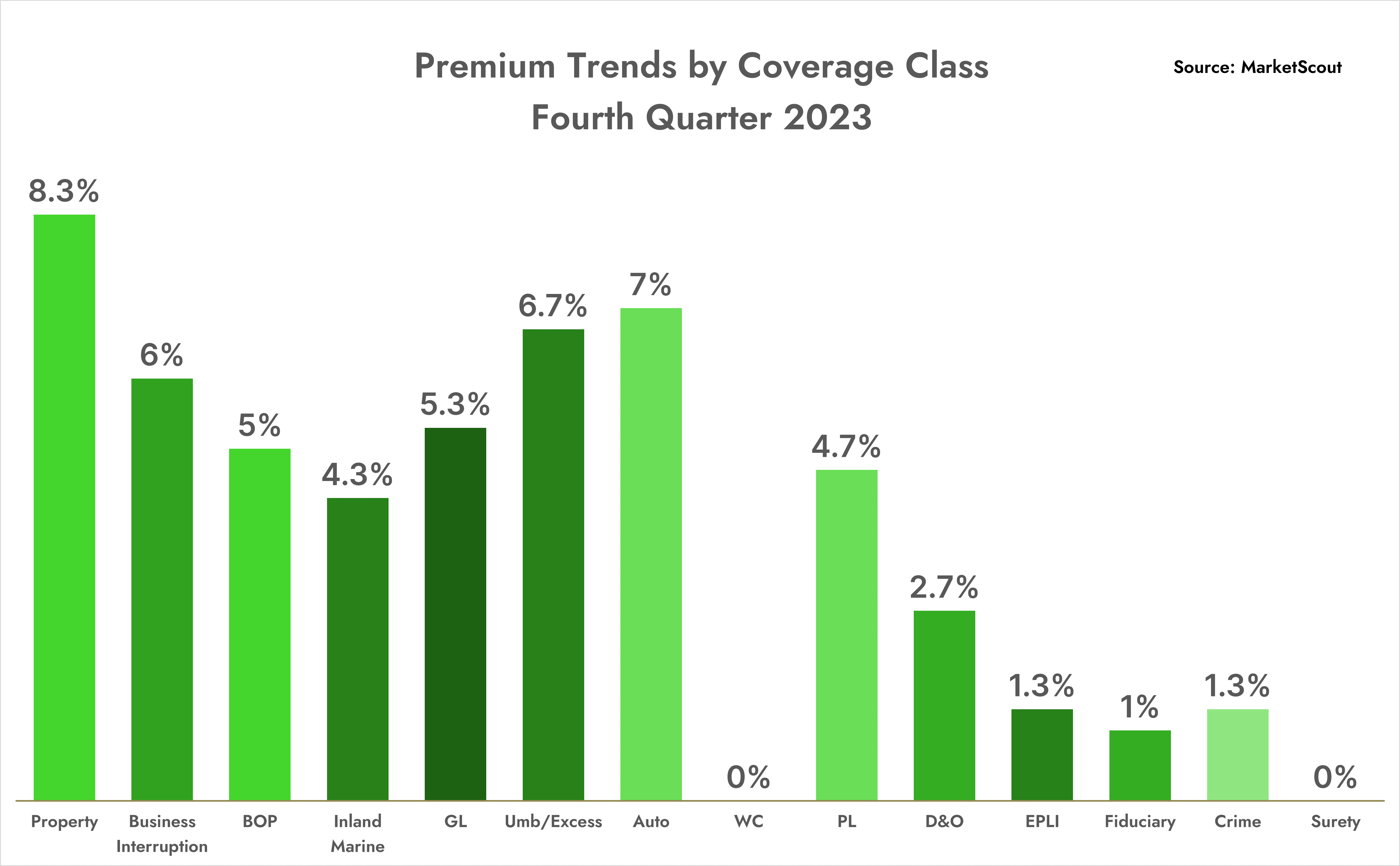

According to the MarketScout Market Barometer, U.S. commercial property/casualty insurance rates rose 5.6% in the fourth quarter of 2023, resulting in a total composite rate increase of 4.56% for the whole of 2023.

“Calendar year 2023 settled down a bit as compared to the last few years,” Richard Kerr, CEO of Novatae Risk Group, said in a press release. “Property insurers are still cautious, but they are optimistic 2024 could yield good returns, especially with the rate increases of the last several years. Throughout 2023, liability insurers assessed sensible rate increases.”

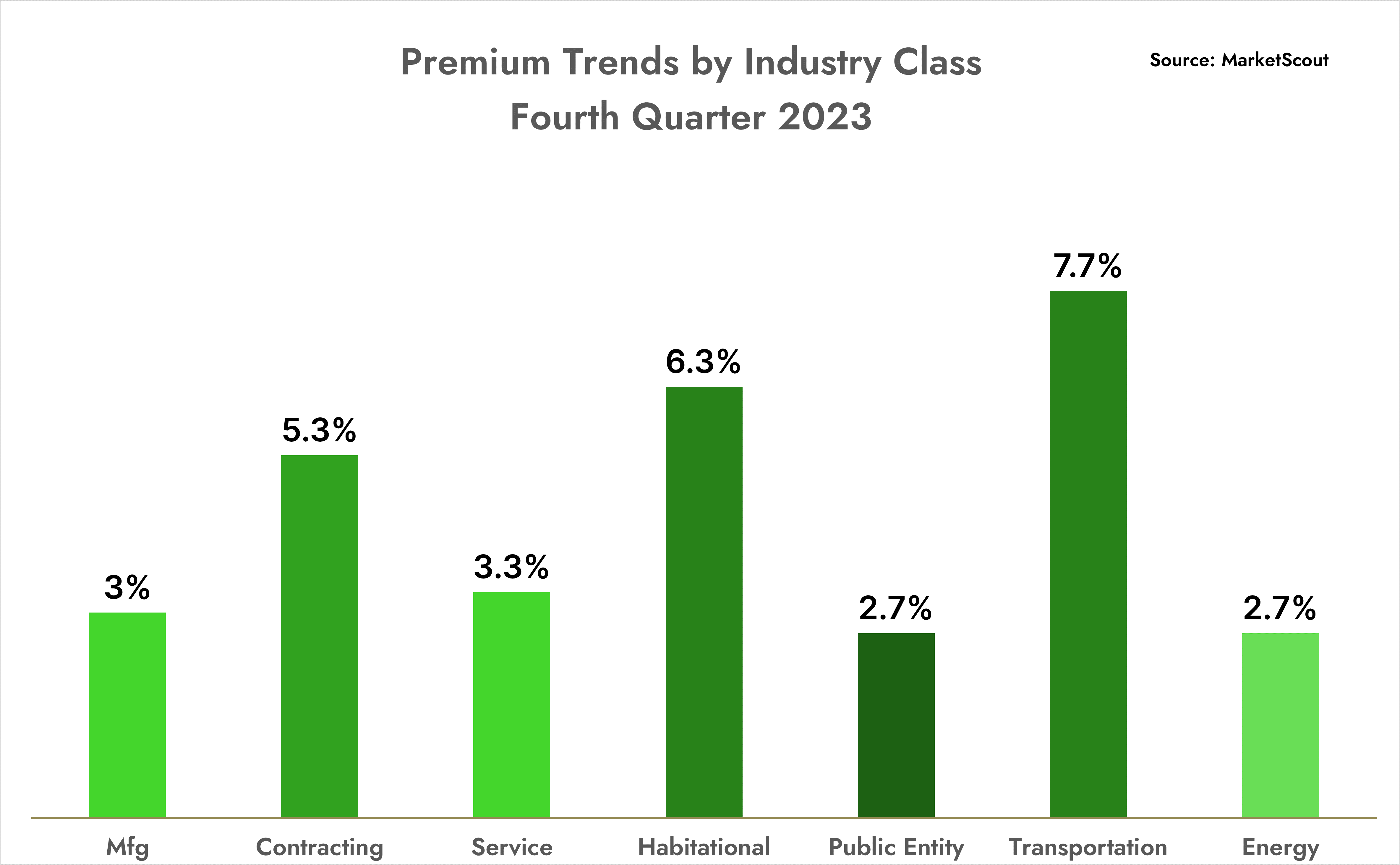

MarketScout found that, by coverage classification, property and auto rates were up the most in 2023, at plus 9.33% and plus 7.33%, respectively. The transportation industry was assessed the largest rate increases by industry group at plus 7.26%.

Workers’ compensation was flat, with no rate adjustment on average. Some states had workers’ compensation rate decreases. Cyber liability was up 8% in Q4.

Large Increases Continue for Catastrophe-Exposed Homes

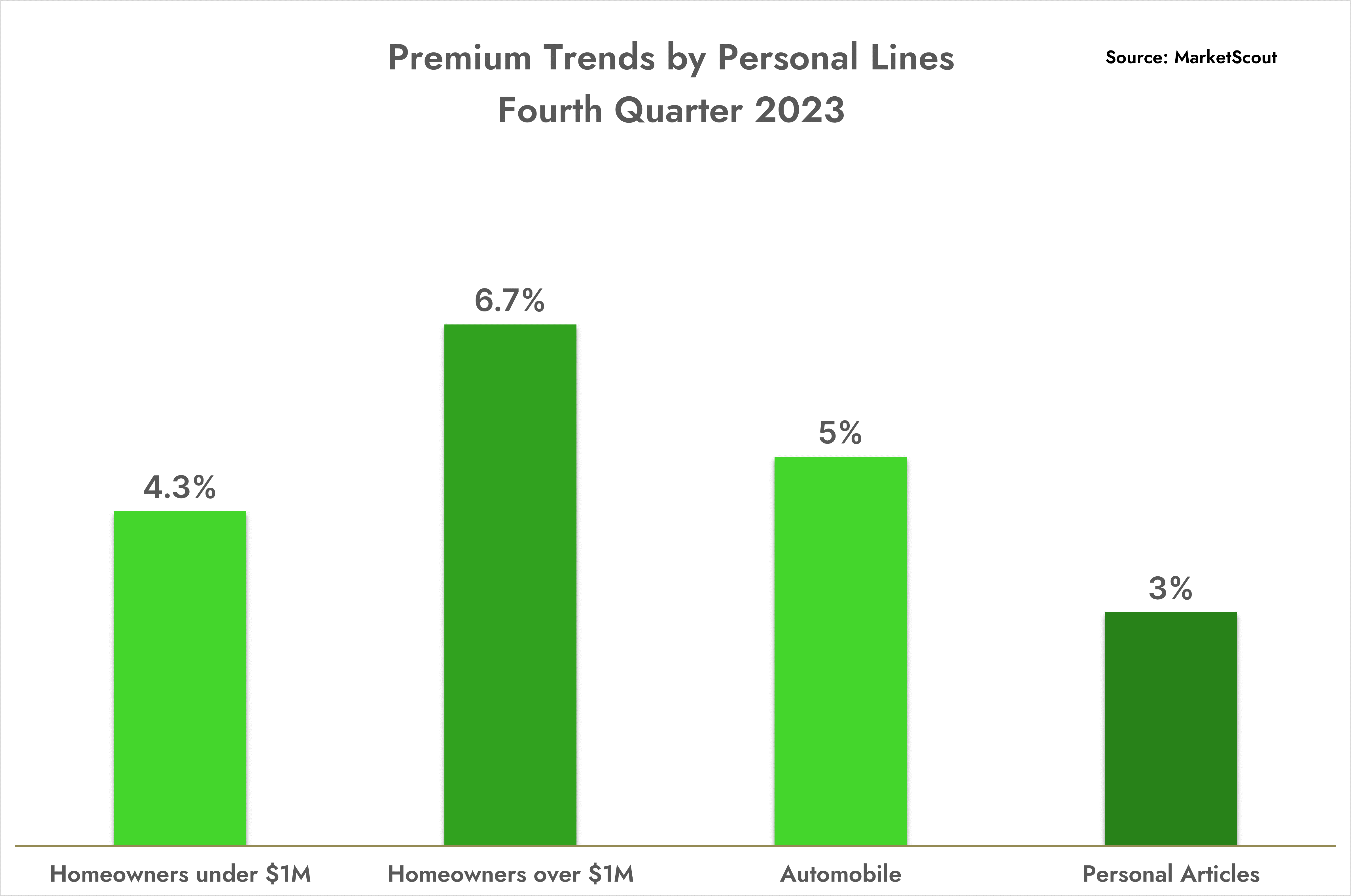

MarketScout also reported that the composite rate increase for personal lines insurance across the US was plus 4.75% for the fourth quarter and plus 4.61% when examining the entirety of 2023.

“We continue to see the largest composite rate increases in homes over $1,000,000 in Coverage A value, most likely because this includes all of the large homes in catastrophe-exposed locations,” Kerr explained. “While the composite rate for large homes was 5.9% for 2023, some homeowners in tough areas or with prior losses are experiencing rate increases as high as 50%.”

MarketScout shared that homes under $1 million in Coverage A value averaged a rate increase of 4.32% for 2023. Auto insurance and personal articles came in at 5% and 3%, respectively.

MarketScout’s Market Barometer is a quarterly report of the industry’s composite rate index for property and casualty insurance and personal insurance. MarketScout is an insurance distribution and underwriting company headquartered in Dallas, Texas.

Topics Trends USA Commercial Lines Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’