According to the Insurance Research Council (IRC), the average homeowners insurance expenditure has become less affordable for U.S. consumers over time.

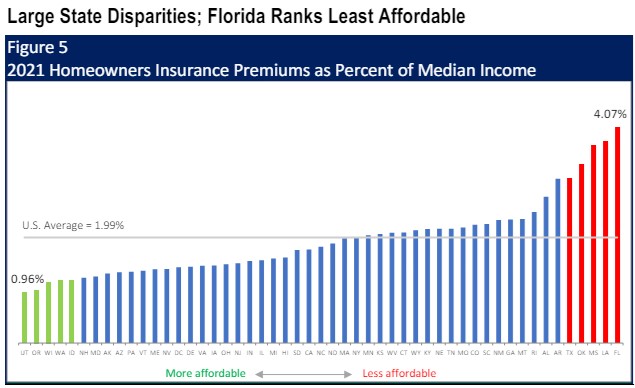

Looking at the the years 2001 to 2021—the latest year in which relevant data is available—homeowners spent about 2% of household income on homeowners insurance, with what the IRC called “striking disparity” between states. The U.S. average expenditure on homeowners insurance increased from $508 in 2001 to $1,411 in 2021, or a 5% annualized rise.

The IRC’s analysis, meant to be a resource guide for policymakers looking to improve affordability, measures homeowners insurance affordability by calculating the ratio of average homeowners insurance expenditures (from data derived from the National Association of Insurance Commissioners) to median household income.

For instance, Utah is the most affordable state with consumers spending 0.96% of household income on home insurance. Florida ranks as the least affordable, with consumers per household paying slightly more than 4%—more than double the national average—on home insurance, the IRC’s analysis concluded. Louisiana had held the distinction of the least affordable state for many years but the state improved in 2021 due to a drop in median household income to offset an 11% increase in insurance spending.

The IRC concluded that from 2001 to 2021, homeowners insurance expenditures showed a general upward trend, driven by factors such as natural disasters, economic conditions, rising construction costs, and litigation activity in some states. Meanwhile, the average household income also grew during the same time. However, the IRC found, the increase in insurance spend outpaces the increase in household income, with an annualized growth rate of 2.5%. It is important to note the report does not include the rapid increases in insurance rates since 2021, IRC said.

“An understanding of what drives the cost of insurance is essential for consumers navigating the current insurance market,” said Dale Porfilio, president of the IRC and chief insurance office for the Insurance Information Institute (Triple-I). “Efforts to promote homeowner awareness and adoption of protective measures, strengthen state and local building codes, and encourage community resilience programs can all improve insurance affordability.”

Topics Profit Loss Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’

Judge Tosses Buffalo Wild Wings Lawsuit That Has ‘No Meat on Its Bones’  AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers

AI Claim Assistant Now Taking Auto Damage Claims Calls at Travelers  Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance

Florida Regulators Crack the Whip on Auto Warranty Firm, Fake Certificates of Insurance