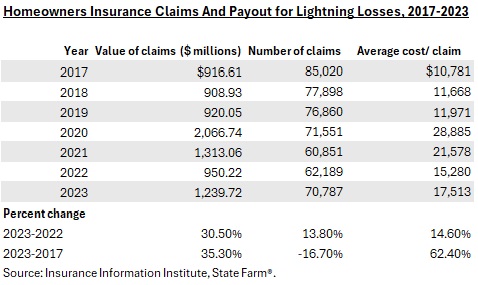

Damage to U.S. homes due to lightning resulted in $1.2 billion in homeowners insurance claims in 2023, up 30% from 2022..

The number of lightning-caused U.S. homeowners insurance claims increased by 13.8% over 2022, with numbers from the top 19 claims states contributing to 57% of the total, according to the Insurance Information Institute (Triple-I). The average cost per claim increased 14.6% from $15,280 in 2022 to $17,513 in 2023, added in the industry trade association who compiled the data to coincide with Lightning Safety Awareness Week (June 23-29).

“Rising inflation, including higher replacement, construction and labor costs impacted claim costs for the year,” said Sean Kevelighan, CEO, Triple-I.

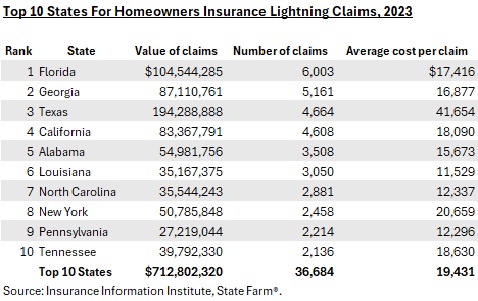

Lightning affected 700,000 policyholders in 2023, and the top 10 states accounted for $712.8 million of the total claims payments. Texas led all others in lightning-claim costs—$194.3 million, or an average of about $41,650 per claim.

Florida, the state with the most thunderstorms, led the states in the number of claims at about 6,000, with a total cost of claims of about $104.5 million.

The Lightning Protection Institute (LPI) said lightning can strike 100 times per second. Tim Harger, executive director of the organization that provides resources for lightning protection systems, said they “play a crucial role in safeguarding homes, businesses and communities from the potential downtime and destruction caused by lightning strikes.”

Topics Claims Homeowners

Was this article valuable?

Here are more articles you may enjoy.

The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’