According to industry rating agency AM Best, there are enough positive factors to give the cyber insurance market a ‘stable’ outlook despite a stall in premium growth.

Analysts at AM Best issued a segment outlook and report Monday, and said the cyber market in 2023 was essentially flat following a tripling of the market’s premium growth from 2019-2022.

“The reduction in rates has been due to various factors, including increased competition from the supply side,” said Christopher Graham, senior industry analyst at AM Best. “In addition, improving cybersecurity practices and decreases in claims frequency have also led to rate reductions after a period of accelerated rate increases driven by a surge in ransomware attacks in 2020 and 2021.”

AM Best’s comments on market growth were based on filings from the National Association of Insurance Commissioners, but the agency believes a good amount of premium comes from non-NAIC filers like captives and Lloyd’s.

Surplus lines carriers in 2022 accounted for a majority of the cyber market and expanded market share in 2023, said AM Best, who believes this market in particular will continue to grow since these insurers can respond quickly to insureds’ needs, especially for small- and medium-sized enterprises—a customer base AM Best expects to grow as these business move to digital platforms.

“We expect that cyber coverage will continue to grow over time, as the heightening awareness of cyber risks contributes to an increase in exposures and, correspondingly, an increase in demand for cyber insurance,” Fred Eslami, associate director, said.

Cyber insurers rely heavily on reinsurance, with over 50% of premiums ceded to reinsurers with sufficient capacity. The market has led additional underwriting standards, such as exclusions for cyber war and silent cyber. Still, systemic risk has become more of a concern for the cyber insurance marketplace, and models have yet to adequately be tested, AM Best said. If reinsurers were to pullback in any way to limit their exposure, the primary market could change it’s appetite for cyber insurance.

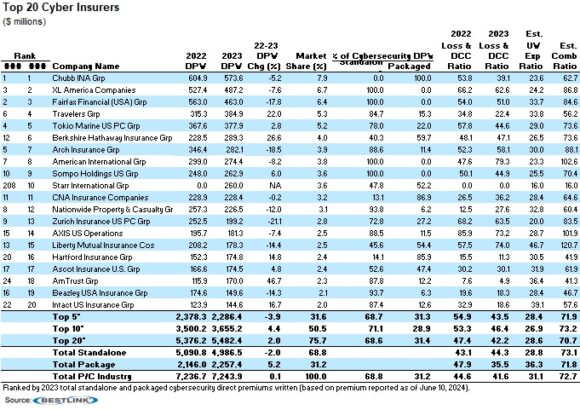

Chubb is the largest writer of cyber insurance, with 100 % of direct premiums from packaged products. XL America and Fairfax Financial are next, with 100% of DPW in standalone coverage.

Travelers moved up two places in the ranking, having increased DPW 22% in 2023 compared to 2022. Berkshire Hathaway, moved from 12th to 6th largest with DPW growth of 26.6%.

Was this article valuable?

Here are more articles you may enjoy.

California Smoke Damage Act Would Enable Wildfire Victims to Expedite Claims

California Smoke Damage Act Would Enable Wildfire Victims to Expedite Claims  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’