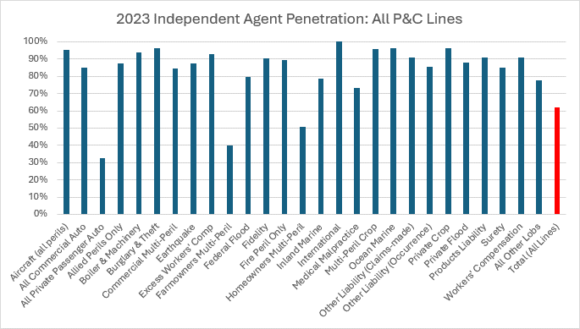

Independent agents placed more than 62% of all property/casualty insurance written in the U.S., according to the Independent Insurance Agents & Brokers of America (the Big “I”).

The association’s 2024 Market Share Report said independent agents have high penetration rates in commercial lines, with “room for growth” in personal lines.

Exclusive or captive agents and direct sales accounted for 21% and 16%, respectively, of premium placements in 2023, according to the report.

Total P/C direct written premiums reached $952 billion in 2023, up from $861 billion in 2022. Overall, the independent agency channel placed 87% of commercial lines premiums in 2023, and 39% of personal lines—up a point from 2022. Since 2019, the percentage of placements by independent agents has gone up a point in personal lines, where they face the most competition from exclusive/captive agents (35% of placements in 2023) and direct sales (25%).

Independent agents wrote nearly 33% of private passenger auto and more than half of homeowners muti-peril premiums in 2023. Among the top 10 lines of business, the highest penetration rate was workers’ compensation, at 91%.

“Despite the significant challenges posed by the hard market, independent agencies’ market share held steady and even continued making gains in key lines—a testament to the strength of the independent agency channel,” says Charles Symington, Big “I” president & CEO. “In this current environment, choice is more important to customers than ever before, and independent agents continue to prove themselves as trusted advisors for their clients and indispensable partners in the insurance marketplace.”

The use of surplus lines grew in all states, said Big I. Five years ago, about 6.2% of premiums went to surplus lines carriers. In 2023, 9.4% went to these unregulated carriers.

Turning to commissions, the 2023 average rate in the U.S. was 11.4%—matching the 5-year average—with the highest commission rate in the District of Columbia (13.8%) and the lowest in Delaware (9.9%). By line of business, the highest commission rate was in surety, at nearly 27%. The lowest was private passenger auto and excess workers’ comp—7.7% and 7.8%, respectively. Homeowners multiperil paid 12.4% commission.

The report compiles and analyzes property/casualty premium data from AM Best and provides insights for agencies and carriers on current market shares by distribution types.

Topics Trends Agencies Independent Agencies

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds