Trust impacts customer satisfaction, loyalty and brand advocacy more than other factors when small businesses choose a commercial insurance provider.

J.D. Power’s 2024 U.S. Small Commercial Insurance Study found that among small businesses with the most trust in their insurers, 81% said they “definitely will” renew with their carrier, and 79% said they “definitely will” recommend their carrier.

“Trust is the single most important variable in the customer relationship with commercial insurance providers,” said Stephen Crewdson, senior director of global insurance intelligence at J.D. Power.

The survey, now in its 12th year, measured trust, price for coverage, product/coverage offerings, ease of doing business, people, problem resolution and digital channels.

“Across virtually every business metric that matters to insurers—customer loyalty, advocacy, premium retention, share of wallet—small business owners who trust their insurers represent significantly higher value,” said Crewdson. “While some insurers are doing a great job cultivating that trust, others have a lot of work to do.”

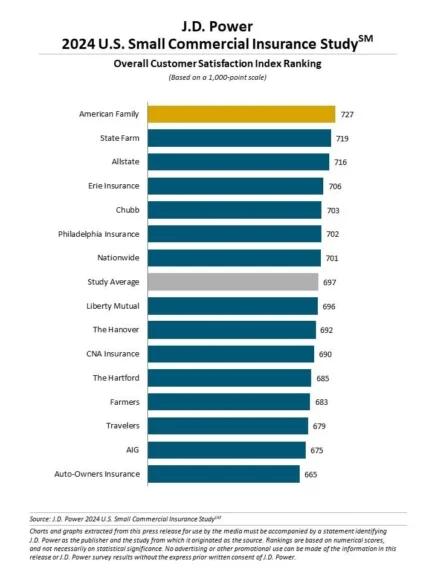

On the survey’s 1,000-point scale, American Family ranked highest in overall customer satisfaction with a score of 727. State Farm ranked second, and Allstate ranked third. Small-business (50 or fewer employees) customers’ average overall satisfaction with commercial insurers is 697.

Small-business satisfaction and trust are up against the challenges of premium increases. In 2024, 36% of small businesses saw a premium increase, up from 34% in 2023. Of those, the insurer initiated 51% of increases, 16% were due to changing business needs, and 13% resulted from changes customers made to their policies. When customers are notified in advance and understand the reasons behind a premium increase, trust is 142 points higher than when they are blindsided by unexplained increases, the survey found.

Insurers ranked with the highest levels of trust also provided personalized products. However, only 55% of small businesses surveyed said they’ve received personalized information from their insurer. Personalization drives an average overall trust score of 761, and trust is 106 points lower (655) among those who have not received personalized information.

Topics Commercial Lines

Was this article valuable?

Here are more articles you may enjoy.

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial

Jury Finds Johnson & Johnson Liable for Cancer in Latest Talc Trial  Preparing for an AI Native Future

Preparing for an AI Native Future  US Supreme Court Rejects Trump’s Global Tariffs

US Supreme Court Rejects Trump’s Global Tariffs  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears