A turnaround in the personal lines insurance segment results was a key driver of an overall $3.8 billion profit from underwriting for the U.S. property/casualty insurance industry, according to a new report from AM Best.

Best’s Special Report, titled, “First Look: Six-Month 2024 U.S. Property/Casualty Financial Results,” reveals financial highlights for the industry’s first six months, which are similar to those reported by Verisk and The American Property Casualty Insurance Association in late August. The AM Best report, however, is more up-to-date with data derived from companies whose six-month 2024 interim period statutory statements were received as of Sept. 4, 2024—representing roughly 99% of total industry net premiums written. (The earlier Verisk/APCIA results were based on statements for roughly 91% of the private U.S. P/C market.)

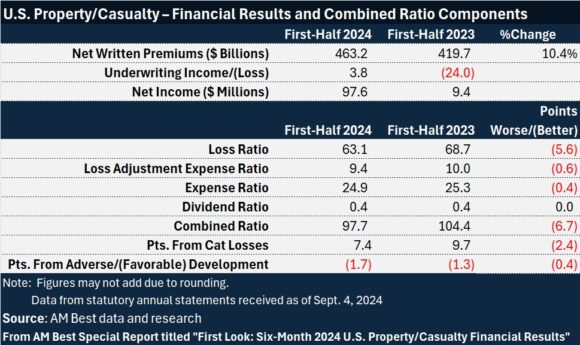

Both reports indicated that net written premiums grew just over 10%, with AM Best putting the tally at $463.2 billion.

Incurred losses, however, rose only 2.5% for first-half 2024, fueling a 5.6 point drop in the industry loss ratio.

With the LAE ratio dropping 0.6 points and the expense ratio dropping 0.4 points as well, AM Best estimates the combined ratio for the first half of this year to be 97.7, compared to 104.4 for last year’s first half.

The AM Best report also adds details information about the impacts of catastrophe losses and prior-year loss development on the first-half combined ratios for the 2024 and 2023 periods.

AM Best estimates that catastrophe losses accounted for 7.4 points on the six-month 2024 combined ratio, down from an estimated 9.7 points during the first six months of 2023. In 2023, the higher point total reflected the impact of record losses due to severe convective storm losses.

AM Best also estimates that $8.0 billion of favorable reserve development during the first six months of 2024 shaved 1.7 points off the industry combined ratio (1.8 points of favorable development for core reserves reduced by 0.1 points for additional reserves for asbestos and environmental losses). In first-half 2023, favorable development was 0.4 points lower—taking 1.3 points off the industry calendar-year combined ratio.

Neither the AM Best report nor the Verisk/APCIA report breaks down underwriting profit and loss figures by lines of business but an appendix to the AM Best report reveals direct premiums for each six-month periods in each of the last five years.

That line-by-line summary indicates that:

- Private passenger auto direct written premiums, representing more than one-third of P/C direct premiums overall, rose 15.6% to $176.9 billion in the first-half of 2024. The increase followed a 12.7% jump for first-half 2023 compared to first-half 2022.

- For just the liability component of personal auto, the jump for the first-half 2024 period was 13.7% while premiums for the physical damage piece rose 18.1%.

- Since first-half 2020, private passenger auto liability direct written premiums have risen more than 33% according to the dollar figures for the first-half 2020 period ($74.2 billion) and first-half 2024 ($99.1 billion) calculated from the report. (Note: CM could not calculate comparable figures for physical damage because private passenger and commercial auto physical damage premiums were reported on a combined basis for the half-year periods 2020, 2021 and 2022).

- Over the same five-year time span, homeowners premiums soared 59% to almost $82 billion in first-half 2024, compared with $51.6 billion in first-half 2020.

- The homeowners direct written premium jumps for the last two years were 14.8% for first-half 2023 compared to first-half 2022, and 13.5% for first-half 2024 vs. first half 2023.

- As for major commercial lines, the first-half 2024 direct premium growth percentages (calculated based on the premium dollars shown in the report) were 12.0% for commercial auto, 10.9% for other liability-occurrence, -0.8% for workers compensation and -0.9% for other liability-claims made.

Across all lines, the $3.9 billion underwriting gain, along with a 26.6% increase in earned net investment income, drove pre-tax operating income up to $47.3 billion, compared with $10.0 billion in first-half 2023, the report says.

A $50 billion change in net realized capital gains at National Indemnity Company resulted in the industry’s net income skyrocketing to $97.6 billion in the first half of this year from $9.4 billion last year.

Industry surplus increased to $1.1 trillion at June 30, 2024, compared to roughly $1.05 billion at year-end 2023.

Topics USA Underwriting Property Casualty Market

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  ‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT