Overall agent satisfaction with insurers of both personal lines and commercial lines has held strong despite a challenging underwriting environment, says a new J.D. Power study, with commercial lines satisfaction reaching an all-time high.

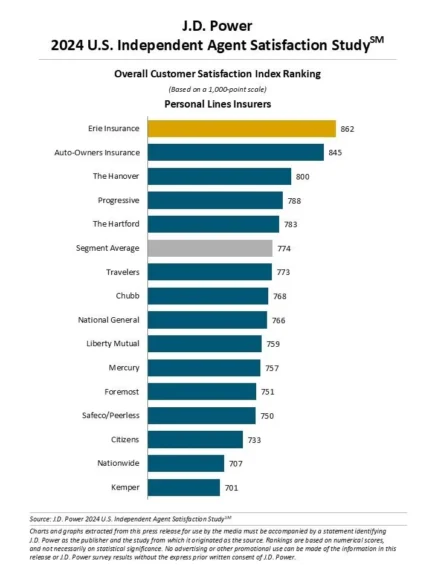

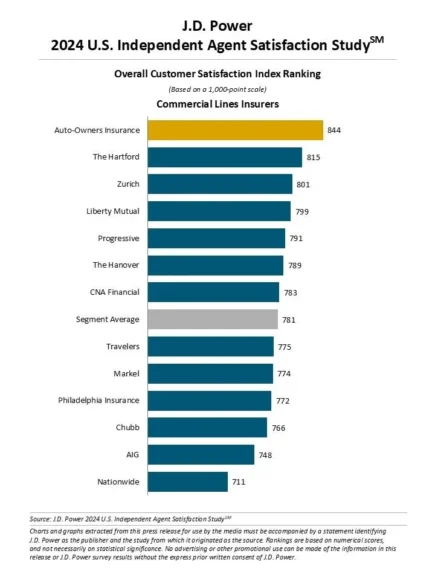

According to the J.D. Power 2024 U.S. Independent Agent Satisfaction Study, overall satisfaction for independent agents with personal lines insurers is 774, the same as last year. Satisfaction came in at 781 for commercial lines, up from 762 last year. J.D. Power noted this is the first time that agent satisfaction with commercial lines has surpassed that of personal lines. (All scores are on a 1,000-point scale.)

Key findings:

- Stricter underwriting standards and a reduction in the number of clients who qualify for a policy have made it more difficult for independent agents to work with insurers. Across both commercial and personal lines, agents cite higher effort to work with insurers and reduced flexibility in the onboarding process.

- Most independent agents in commercial (54 percent) and personal (62 percent) lines say they are proactively shopping for clients more now than they were two years ago, searching for lower rates and better product coverage.

- Carriers that have been able to maintain the strongest relationships with independent agents have done so by improving quoting platforms to make it easier to initiate new quotes; increasing communication with agents, both during the claims process and through educational and career development initiatives; and offering incentives such as cash rewards, trips and prizes.

“Carriers that recognize the challenges independent agents are facing—and help them navigate those obstacles through a combination of education, easy access to quoting tools and incentives—are managing to earn agent loyalty and satisfaction despite the tough market,” said Stephen Crewdson, senior director of insurance business intelligence at J.D. Power, in a statement. “Agents’ jobs have gotten harder, and a larger portion of agents are proactively shopping ahead for clients. Insurers that want to keep earning agents’ business are finding ways to partner with them every step of the way.”

Erie Insurance ranks highest among insurers for personal lines in 2024, with a score of 862, followed by Auto-Owners Insurance (845) and The Hanover (800) to round out the top three.

On the commercial side, Auto-Owners Insurance ranks highest for a fourth consecutive year, with a score of 844, while The Hartford (815) ranks second and Zurich (801) comes in third.

Was this article valuable?

Here are more articles you may enjoy.

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Trump’s EPA Rollbacks Will Reverberate for ‘Decades’

Trump’s EPA Rollbacks Will Reverberate for ‘Decades’  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters