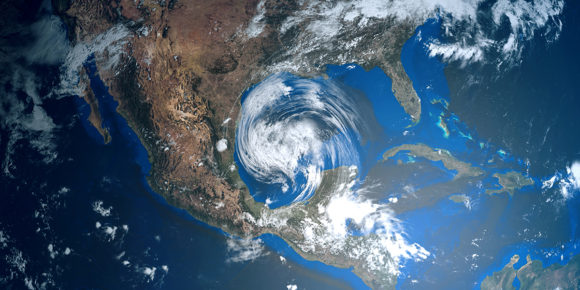

Texas’ insurer of last resort for properties in counties along the state’s coastline says it has $4.2 billion in available funds as this year’s hurricane season gets underway.

By comparison, at the start of the hurricane season in 2017 the Texas Windstorm Insurance Association (TWIA) had $4.9 billion available funds, including $737 million in its Catastrophe Reserve Trust Fund (CRTF). In its annual report dated May 31, 2019, TWIA said that amount had proven sufficient to cover its “policyholders needs from Hurricane Harvey,” which struck the Texas coast in late August 2017.

TWIA reported that as of March 31, 2019, its incurred loss and loss adjustment expense from Harvey amounted to $1.61 billion and that it had paid out a total $1.25 billion payments to policyholders as a result of the storm.

TWIA noted that the number of complaints and claim disputes from Harvey has been low, especially compared with the association’s experience after Hurricane Ike in 2008.

“Claims complaint and dispute ratios from Hurricane Harvey remain extremely low at 0.38% and 5.4% of claims. In contrast, TWIA’s claim dispute ratio from Hurricane Ike was more than 11% with the disputes largely composed of lawsuits; lawsuits from Hurricane Harvey amount to less than 1% of claims,” TWIA’s report states.

As of the end of April 2019, TWIA had 197,391 policies in force, down from 219,818 at the end of April 2018. While TWIA insures both residential and commercial policies, residential coverages represent the bulk of the association’s exposure. Nearly 190,000 of TWIA policies currently in force are residential in nature and about 7,500 are commercial.

TWIA’s policy count peaked in 2014 when it had more than 275,000 policies in force. TWIA attributes the decreased policy count to increased interest by the private insurance market in providing wind and hail coverage along the coast. Since 2015, the association has conducted several rounds of depopulation efforts, whereby private insurers participating in the program make offers to take policies off the association’s books. The offers must be approved by agents and policyholders have the choice of whether to stay with TWIA or transfer to the offering carrier.

TWIA was established in 1971 by the Texas Legislature to insure properties that are unable to find coverage in the private insurance market for wind and hail in 14 first-tier counties along the Texas coast and in parts of Harris County.

Topics Catastrophe Natural Disasters Texas Carriers Windstorm Hurricane

Was this article valuable?

Here are more articles you may enjoy.

Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial