The North Carolina Rate Bureau (NCRB) has requested a statewide average rate increase of 18.9 percent, varying by territory, on dwelling insurance policies, according to a statement from the North Carolina Department of Insurance.

The dwelling insurance rate filing was received by NCDOI from the Rate Bureau, which is not part of the NCDOI and represents all companies writing property insurance in the state, on, Feb. 7 with a requested effective date of Oct. 1, 2018.

The filing includes a requested increase of 40.5 percent for extended coverage (wind) policies, but a decrease of 20.8 percent for fire polices, making the statewide average request an increase of 18.9 percent.

Dwelling insurance policies are not homeowners insurance policies. Dwelling policies are offered to non-owner-occupied residences of no more than four units, including rental properties, investment properties and other properties that are not occupied full-time by the property owner.

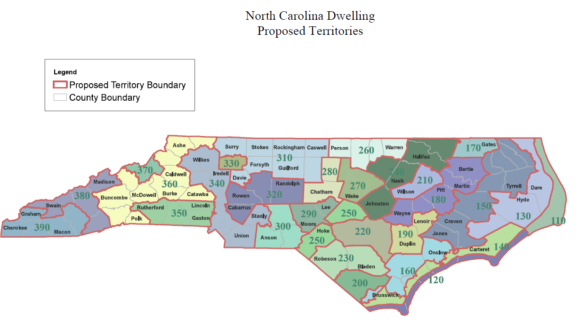

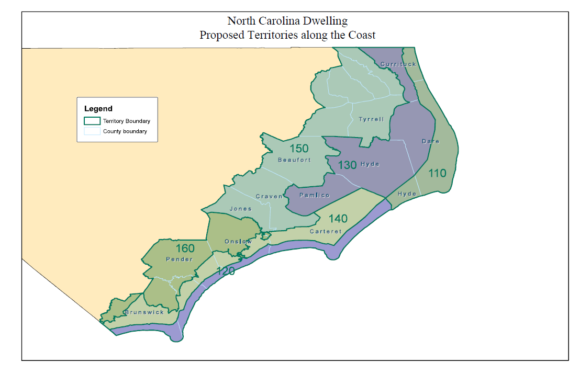

The Rate Bureau has also requested revisions to the current geographic rating territories. The proposed territory revisions are the same territory definitions applicable to homeowners’ policies.

NCDOI said the filing will be reviewed by its experts to determine what, if any, rate adjustments are warranted. If NCDOI and the Rate Bureau do not initially agree on the proposed rate changes, a public hearing will be called in which both parties would present their cases to a hearing officer, who would then determine the appropriate rate level.

The filing is available for public review on the NCDOI website and the SERFF Filing Access; SERFF Tracking Number NCRI-131370773.

Opportunity for Public Comment

People wanting to comment on the rate request may do so in person during a public comment forum from March 23, 2018, in Raleigh; by email to: 2018DwellingandFire@ncdoi.gov through March 23, 2018; or by mail sent to the North Carolina Department of Insurance.

Source: North Carolina Department of Insurance

Topics Pricing Trends North Carolina

Was this article valuable?

Here are more articles you may enjoy.

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case