For hurricanes with erratic paths that prove difficult to predict, property insurers could soon find it trickier to justify some claims denials for boats, yachts and other movable marine structures, thanks to a recent appeals court decision.

The 11th U.S. Circuit Court of Appeals last week overruled a lower court and sided against Lloyd’s of London in litigation over a prominent Florida businessman’s 61-foot yacht that was destroyed in Hurricane Dorian in 2019.

Lloyd’s argued that the owner, Serendipity at Sea, a corporation headed by Mikael Oakley and wife Jacqueline English of Orlando, had jeopardized the yacht by not moving it from the Bahamas to Florida as Dorian bore down. That breached the insurance contract, Lloyd’s said.

But the appeals court found that significant disagreement remains over the safest mooring spot for the ship, after the hurricane initially appeared to target central Florida but then shifted into the flank of Great Abaco in the Bahamas.

“The district court erred in granting summary judgment for Lloyd’s when a disputed question of material fact remains about whether Serendipity LLC’s breach of the captain warranty increased the hazard posed to the Serendipity by Hurricane Dorian,” the 11th Circuit panel of judges wrote in its Jan. 4 opinion.

The case now goes back to the district court in south Florida for a jury to decide if the owners were at fault by leaving the boat in the Bahamas.

The chain of events began in July 2019. Oakley, an experienced helmsman, sailed the yacht from its home port in Cape Canaveral, Florida, to the Bahamas, an 11-hour trip. He had just made $100,000 of upgrades to the boat and had it insured through SeaWave Yacht Insurance. The broker was USI Insurance Services. The policy was underwitten by Lloyd’s and the vessel was valued at $565,000, according to court documents.

At the end of the trek, Oakley docked the boat in the Bahamas and returned home to Florida.

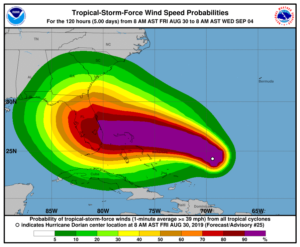

A month later, on Aug. 23, Hurricane Dorian started churning through the Atlantic Ocean. Oakley had left the docked boat in the hands of two captains known as Lightbourne and McIntosh. They agreed with Oakley that the storm, although erratic, appeared to be headed to central Florida, mostly bypassing Abaco. They concluded that the Bahamas was the safest place for the yacht.

On Aug. 30, the storm, now an extremely powerful Category 5, suddenly turned south and slammed directly into the area where the Serendipity was moored. The boat was lost, the court said.

Lloyd’s denied Oakley’s insurance claim, asserting that the policy language included a captain warranty, requiring that a “full-time, licensed captain” be employed for the maintenance and care of the vessel and to be on board while the boat was underway.

The appeals court panel said the wording of the policy was ambiguous. It wasn’t clear if “full-time captain” meant a boatsman whose only job was to manage the Serendipity, or one whose regular job was skippering boats and the Oakley yacht was part of his or her duties.

Many Florida courts that have found that unclear or unspecific wording is injurious to an insurer’s arguments. But the appellate judges in this case said the language wasn’t ambiguous enough to sink Lloyd’s case altogether.

“In the end … the fact that the warranty may have been ambiguous does not save Serendipity LLC because under any reasonable interpretation of its text, Serendipity LLC failed to fulfill its obligations,” Chief Judge William Pryor and two other judges wrote. “Under any reasonable interpretation of the policy, Serendipity LLC was required to hire a licensed captain either to care for the Serendipity full time, or whose full-time job was as a licensed captain. Plainly, Serendipity LLC did neither.”

Oakley, who has had a number of business interests in Florida, including Encore Risk Management and property companies, said in deposition that he never hired a full-time captain.

“The full-time captain was me,” he said, agreeing that he was not licensed. That concession was fatal to one part of his claim, the court noted.

But an equally important question concerned an aspect of state law: In order to escape coverage, Lloyd’s had to show that the breach of the captain warranty sufficiently “increased the hazard” posed by Dorian, the court explained.

The insurer produced an expert witness, another seaman known as Capt. Danti, who testified that any licensed captain would have sailed the yacht back to Florida before Dorian hit the islands.

The lower court bought into Danti’s argument and found that Oakley’s attorneys had failed to rebut it. But the appellate judges disagreed, noting that the Serendipity team had, in fact, disputed Danti’s assertions. Some forecasts indicated it would have been more of a hazard to try and move the boat during a storm in the open sea, the boat owners argued.

Florida law is clear, the appeals court said: “A breach or violation by the insured of a warranty, condition, or provision of a wet marine or transportation insurance policy, contract of insurance, endorsement, or application does not void the policy or contract, or constitute a defense to a loss thereon, unless such breach or violation increased the hazard by any means within the control of the insured.”

The law is designed to prevent an insurer from avoiding coverage on a technical omission that plays no part in the loss, the judges said, citing previous court rulings.

Danti had referred to the Dooley SeaWeather report sometimes used by mariners to track storms at sea. But other weather reports forecast different paths for the wobbly storm. It should be left to a jury to determine the most credible reports, the 11th Circuit panel noted in remanding the case to the district level.

Oakley and attorneys in the case could not be reached Wednesday for comment on the decision.

This is not the first time that federal courts have had to consider conflicting hurricane-path predictions and erratic storm movements in liability and property litigation. In 2021, one of the world’s largest construction firms, Skanska, argued that an obscure hurricane report had suggested that Hurricane Sally was not such a threat to 27 barges that later broke loose and damaged property along the shore of Pensacola Bay.

U.S. District Judge Lacey Collier found that most other forecasts had made it obvious that Sally was a danger and the barges should have been better secured.

Other storms in recent years have shown erratic paths, creating confusion and vulnerability for insureds and insurers. When Hurricane Ian struck the southwest coast of Florida in September 2022, it caught some, including government officials, by surprise. Earlier weather predictions had the eye of the storm moving more to the north.

Meteorology scientists have said that most hurricanes’ precise movements are difficult to predict. But as the oceans warm and human activity impacts the planet, new variables enter the equation. One study suggests that reductions in air pollution in the United States and Europe have led to more frequent cyclone activity in the North Atlantic.

Other research indicates that climate change is leading to slower-moving but more intense storms. Some storms, like Ian, may see rapid intensification, spinning up quickly from a tropical storm with relatively low winds to one with powerful gusts.

Photo: Stock photo of a yacht, not unlike the one at issue in the 11th Circuit decision.

Was this article valuable?

Here are more articles you may enjoy.

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters