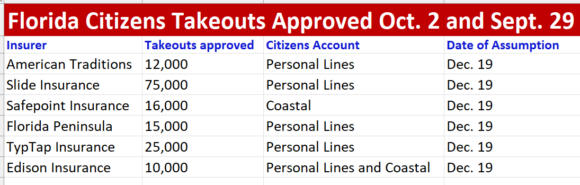

Florida’s Office of Insurance Regulation has approved the take out of another 153,000 policies from Citizens Property Insurance Corp., the state’s price-controlled residual insurer.

Almost half of the takeouts were approved for Slide Insurance, which has grown rapidly in the last two years, partly by assuming policies from other carriers, including ones in financial trouble. The Oct. 2 and Sept. 29 approvals for Slide and five other insurers are in addition to more than 350,000 approved earlier this year – welcome news for the Florida insurance market, which has encouraged Citizens’ depopulation efforts.

The news was tempered by the announcement that Progressive Insurance has decided to non-renew more than 100,000 homeowner and landlord policies in Florida early next year. Loggerhead Reciprocal Interinsurance Exchange has agreed to offer replacement policies, but some worry that many affected property owners will turn to Citizens, with its statutorily limited rate increases.

“I don’t see Citizens slowing down. I see it picking up,” Rob Norberg, president of Arden Insurance Associates in West Palm Beach, told WPTV News. Norberg was one of a “select group” of independent agents that Progressive has decided to discontinue its association with.

Even if Loggerhead picks up several thousand of Progressive’s policyholders, thousands more will likely find better rates with Citizens, he noted.

The take-up rate for the Citizens’ takeouts approved earlier this year seems to support that assertion. Of 92,000 takeouts approved by OIR through August, for example, about 30,600 were actually assumed by the carriers making the takeout offers, a Citizens report shows. Many insureds have elected to stick with Citizens, at least for now.

Former Florida Deputy Insurance Commissioner Lisa Miller reported last month that of about 28,000 takeout offers in August, less than 9,000 were assumed on the day of assumption.

At the Sept. 27 Citizens Board of Governors meeting, corporation President Tim Cerio reiterated the concern among many in the insurance industry that Citizens’ rates are too low, which is hindering the growth of the primary market.

“As long as the rates remain artificially low, we will continue to distort competition and hamper the speed of market recovery,” Cerio said. “As Florida’s residual insurer, we should never be competing with the private market, and that’s exactly what we’re doing right now.”

Also this week, Florida Gov. Ron DeSantis reappointed Carlos Beruff to the Citizens Board of Governors. He is the current chairman of the board and owner of Medallion Home Gulf Coast Inc., a large housing development corporation.

DeSantis also named Jamie Shelton, president of Jacksonville-based BestBet Holdings, which operates poker tournaments and simulcast wagering venues in the state. Shelton is former chair of the Jacksonville University Board of Trustees.

Shelton’s appointment is considered to be for the consumer representative spot on the board, which does not require insurance business experience, Citizens spokesman Michael Peltier said. State law requires that, other than the consumer representative, at least of two appointees from each appointing officer have some insurance experience.

Two bills in the Florida Legislature in 2022 would have required most board members to have significantly more insurance industry experience, but that requirement failed to pass last year.

Chart at top: Source: Florida Office of Insurance Regulation consent orders.

Topics Florida

Was this article valuable?

Here are more articles you may enjoy.

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’  Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles

Florida Engineers: Winds Under 110 mph Simply Do Not Damage Concrete Tiles  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch