State Farm Insurance and its subsidiaries owe the state of Florida more than $2.6 million in back taxes and interest after a state appeals court ruled against the insurer on an interpretation of state and federal tax laws.

“We disagree with State Farm and affirm” a Leon County Circuit Court ruling that sided with the Florida Department of Revenue, the state’s 1st District Court of Appeals said Wednesday.

The issue arose after the Department of Revenue conducted an audit and found that State Farm had incorrectly calculated its income in 2011, 2012 and 2013 and owed extra corporate income tax – plus $668,000 in interest.

The DOR had argued that the insurance giant had failed to include the full amount of tax-exempt interest earned on state and local bonds. State Farm officials countered the tax exemptions lowered its losses, which affected its federal income tax and the amount of state tax owed in those three years.

The court did not indicate if other insurance companies have followed similar practices, or if State Farm’s federal tax bill would be affected. Corporate tax attorneys could not be reached for comment late Wednesday.

The appeals court warned that the case made for some compelling reading.

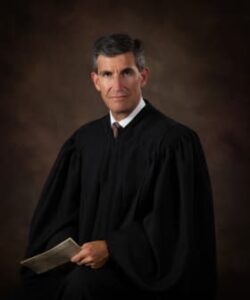

“This opinion contains discussion of some dense tax-code material. Equal doses of patience and attention will be required,” Judge Adam Tanenbaum wrote for the 1DCA panel of judges.

The dispute hinged on the wording of the Florida corporate tax statute. “Net income,” as defined by the law, is based on a corporation’s adjusted federal income, the appeals court explained. And an insurance company’s adjusted federal income is its gross income (investment plus underwriting income) minus the allowed deductions.

One of those deductions is interest earned from state and local bond purchases. The Florida revenue department said that state law requires that all tax-exempt bond interest to be added back to its reported underwriting income. State Farm, now one of the largest property insurers in Florida, took a different approach, the court noted. The company said that when it calculated losses incurred, which impacts its underwriting income, it had to reduce the amount of its losses by 15% of its tax-exempt interest.

Paraphrasing State Farm’s position, the appeals court said: “Because it had to subtract from its losses (thereby increasing its income) an amount equivalent to fifteen percent of the state-and-local, tax-exempt interest—among other amounts—it effectively paid federal tax on that amount,” the court explained. “So even though that interest otherwise was fully deductible from its gross income, in application the interest was not fully ‘excluded’ from its gross income.”

But the exclusions should apply to taxable income, not gross income, the court noted. State Farm’s approach was inconsistent with the specific wording of the Florida tax law, Tanenbaum wrote.

“To be sure, the analysis would be different had the Legislature specified that the ‘excluded’ amount to be added back to taxable income under section 220.13(1)(a)2 (Florida code) is reduced by ‘an amount equal to’ the ‘portion’ of the interest included in the formula that serves either to ‘reduce’ the losses-incurred deduction or to ‘reduce federal taxable income for the taxable year.'”

Judges Joseph Lewis Jr. and Kemmerly Thomas concurred in the opinion.

State Farm officials could not be reached late Wednesday to comment on whether the higher tax bills could affect the insurer’s purchase of state and local government bonds, or if State Farm will ask the Florida Supreme Court to review the case.

Topics Florida State Farm

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial