Analysts with the AM Best financial rating firm and other stakeholders are cautiously optimistic about the resurrection of the Florida property insurance market, 18 months after state lawmakers approved monumental litigation reforms.

That was the sentiment gleaned from a Thursday webinar hosted by the rating company and from an AM Best report on the Florida market, released the same day.

“It’s still a little too early to declare a win in the marketplace, but signals do look promising,” AM Best analyst Josie Novak said.

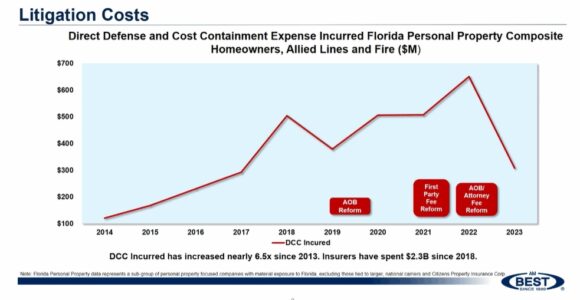

Notably, since the legislation was enacted in late 2022, direct defense and cost containment expense – considered a key measure of the claims litigation burden on carriers – has dropped sharply. In 2022, Florida carriers reported the highest DCC-to-direct-premiums-earned-ratio of all U.S. states, at 8.4%, for homeowners, allied and fire lines. The next-closest state was Louisiana, at 3.6%, AM Best reported.

By the end of 2023, that measure had been cut in half, falling to about $307 million for the 47 insurers that write most of the Florida market, including the state-backed Citizens Property Insurance Corp., but excluding some major national carriers.

By the end of 2023, that measure had been cut in half, falling to about $307 million for the 47 insurers that write most of the Florida market, including the state-backed Citizens Property Insurance Corp., but excluding some major national carriers.

“While still early, a downward trend has been observed, indicating the reform has positively impacted results,” the report noted.

While 2023 was a year that saw only one relatively minor hurricane hit Florida, claims and defense costs would have been two to three times higher under under Florida’s pre-reform statutory regime, which had allowed assignments of benefits and one-way attorney fees, said Randy Fuller, the Florida leader for Guy Carpenter, the global reinsurance firm.

Another sign of health in the patient: The combined ratio for Florida-focused carriers, excluding Citizens, dropped to the break-even mark in 2023, outpacing AM Best’s national property insurance composite measure. Citizens’ combined ratio fell to less than 81%.

“These are results that have not been seen since the earlier part of the latest decade,” the report noted.

The expense ratio for the Florida specialists fell to about 26%, down from a high of 35% in 2019. Loss-reserve development for Florida insurance carriers also is showing promise, with favorable numbers for the first time in years, AM Best said.

Florida carriers also added significantly to policyholder surplus last year – without major cash infusions. From 2019 to 2023, the Florida-focused insurers, including those that became insolvent, received $2.6 billion in capital contributions, but surplus grew by just $239 million, the analysis showed.

But in 2023, surplus had jumped by $532 million and that was was not dependent on capital contributions.

The news about the reinsurance market was a little more of a mixed bag. After three years of turmoil, spiking reinsurance rates, limits on coverage and higher retention levels, the 2024 renewals for most Florida carriers seem to be “incredibly stable,” Fuller said.

The legislative changes have created some optimism among most reinsurers, analysts said.

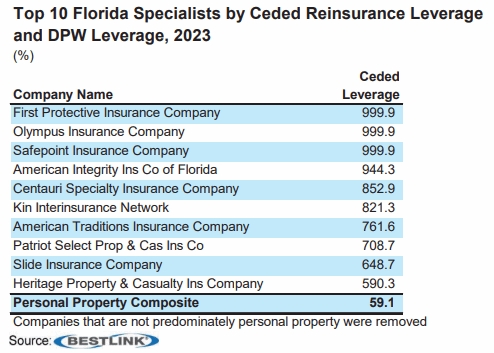

But reinsurance costs are still weighing heavily on insurers, and Florida carriers have a much higher dependency on reinsurance than insurers in other parts of the country – almost 10 times the national average, the AM Best report noted. From 2019 to 2023, unaffiliated ceded premium for the Florida insurers more than doubled, from $3.1 billion to $6.4 billion.

Although many carriers have sharply raised rates for policyholders in recent years, the growth in direct premium written has not kept pace with the growth in ceded premium, the report found.

“The materially higher position indicates greater direct risk borne by Florida specialists, necessitating more effective risk transfer, underwriting, pricing, and risk exposure management,” the report said.

Still, other signs point to improved market conditions, including modest rate decrease requests from several insurers and the approval of eight new carriers for Florida this year. Most of those new companies are reciprocal exchanges, a model that some insurance agents until recently had been unfamiliar with, said Dave Newell, vice president of membership and industry relations for the Florida Association of Insurance Agents.

But once the model was explained to agents, “they have become more comfortable with it,” Newell said in the virtual conference.

Access to the full report can be found here.

Topics Trends Florida Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk