FOLLY BEACH, S.C. (AP) — The husband of a bride who was killed in a South Carolina beach road collision on her wedding night last year will receive nearly a million dollars in settlement connected to the crash, which a drunk driver allegedly caused.

The Post and Courier reported that Aric Hutchinson will receive about $863,300 from Folly Beach bars The Drop In Bar & Deli, the Crab Shack and Snapper Jacks; Progressive auto insurance; and Enterprise Rent-A-Car, according to a settlement approved earlier this week by Charleston County Circuit Court Judge Roger Young.

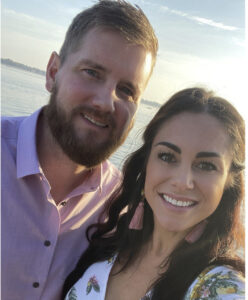

Hutchinson sued the businesses after driver Jamie Lee Komoroski crashed a rented vehicle into a golf cart carrying Hutchinson and his new bride, 34-year-old Samantha Miller, away from their wedding reception on April 28, 2023.

The golf cart was thrown 100 yards (91.44 meters). Miller died at the scene, still wearing her wedding dress. Hutchinson survived with a brain injury and multiple broken bones. Komoroski was driving 65 mph on a 25 mph road, the newspaper reported.

Hutchinson charged in the wrongful death lawsuit that Komoroski “slurred and staggered” across several bars around Folly Beach before speeding in her Toyota Camry with a blood-alcohol concentration more than three times the legal limit.

The settlements amount to $1.3 million but will total less than that after attorney and legal fees are paid.

Komoroski is out on bond as her case makes its way through the court system. In September, she was charged with felony driving under the influence resulting in death, reckless homicide and two counts of felony driving under the influence resulting in great bodily injury.

The settlement could tighten an already hard liquor liability insurance market in South Carolina, where a number of eating and drinking establishments have closed due to the high cost of insurance.

A report by the state Department of Insurance noted that the coverage is extremely unprofitable for insurers. Critics have blamed a 2017 law that requires $1 million of liability coverage for most establishments that sell liquor. Others have said South Carolina’s joint-and-several liability tort law makes it too risky for insurers to cover bars, restaurants and convenience stores, while some contend that the state has more than its share of drunken driving incidents.

Topics Liability South Carolina

Was this article valuable?

Here are more articles you may enjoy.

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Pipeline Explodes at Delfin LNG Planned Project in Louisiana

Pipeline Explodes at Delfin LNG Planned Project in Louisiana  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch