The private insurance industry is ready and anxious to take on flood risk, and politicians should reform the federal program...

Biggert Waters flood reform News

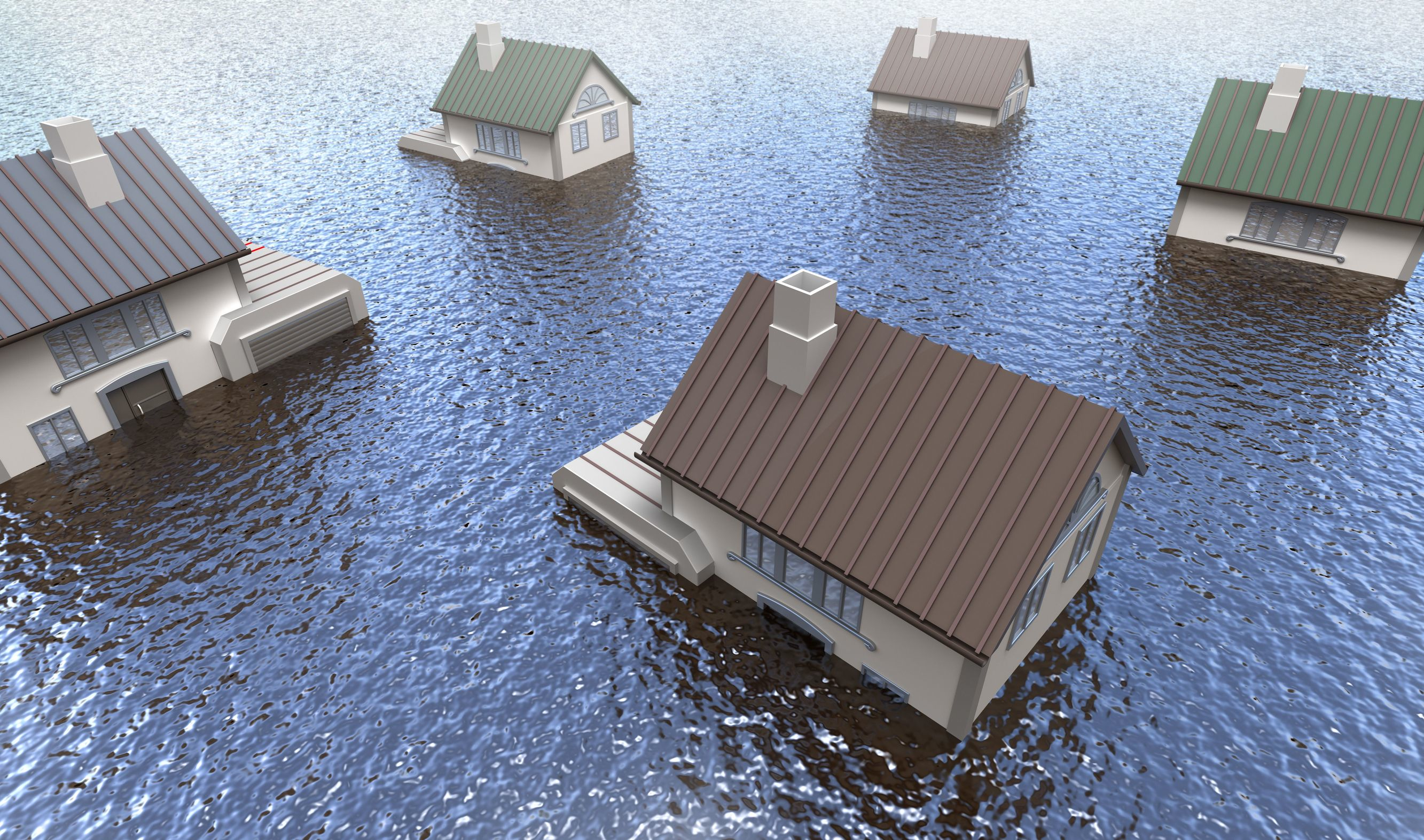

A $24 billion sea of red ink has millions of Americans in vulnerable flood zones, including homeowners still struggling to...

Starting today, when flood insurance policyholders go to renew their policies, they could be quoted premium increases ranging from 15...

There’s no easy fix for the National Flood Insurance Program, now drowning in a $24 billion sea of red ink....

The Florida Legislature is moving forward on a plan to entice private insurance companies to sell flood policies in the...

President Barack Obama is set to sign into law a bipartisan bill relieving homeowners living in flood-prone neighborhoods from big...

House GOP leaders last week put the final touches on legislation that would significantly water down a recently enacted overhaul...

Yesterday the National League of Cities joined the Florida League of Cities, Florida Association of Counties and others in meetings...

Some flood insurance premiums required under a 2012 law now won’t be raised until the fall of 2015 at the...

Senate Majority Leader Harry Reid will do just about anything to help Louisiana’s Mary Landrieu. He arranged the chamber’s floor...