Hurricane Melissa is forecast to dissipate in the Atlantic Ocean next week, bringing wet and windy weather to northern Europe...

catastrophe bonds News

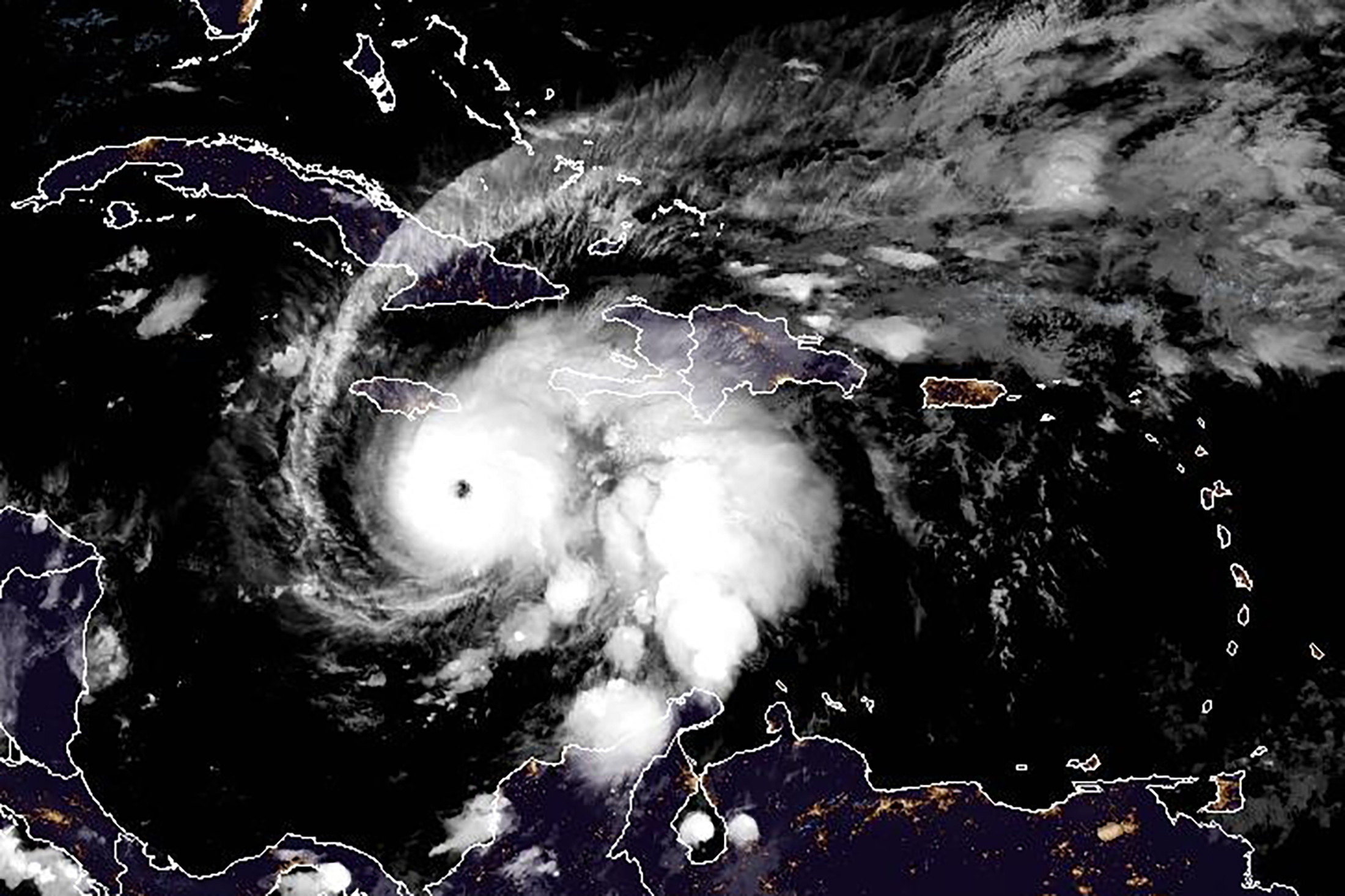

As Hurricane Melissa sweeps past Bermuda, new satellite data of Jamaica has revealed devastation for tourist center Montego Bay and...

The devastation from Hurricane Melissa came into focus after the record-setting storm moved past Jamaica, Haiti and Cuba with at...

Hurricane Melissa made landfall in Jamaica as a powerful category 5 storm – a record for the Caribbean island nation...

Investors in Jamaica’s catastrophe bond now face a full trigger event that would force payment of the entire $150 million...

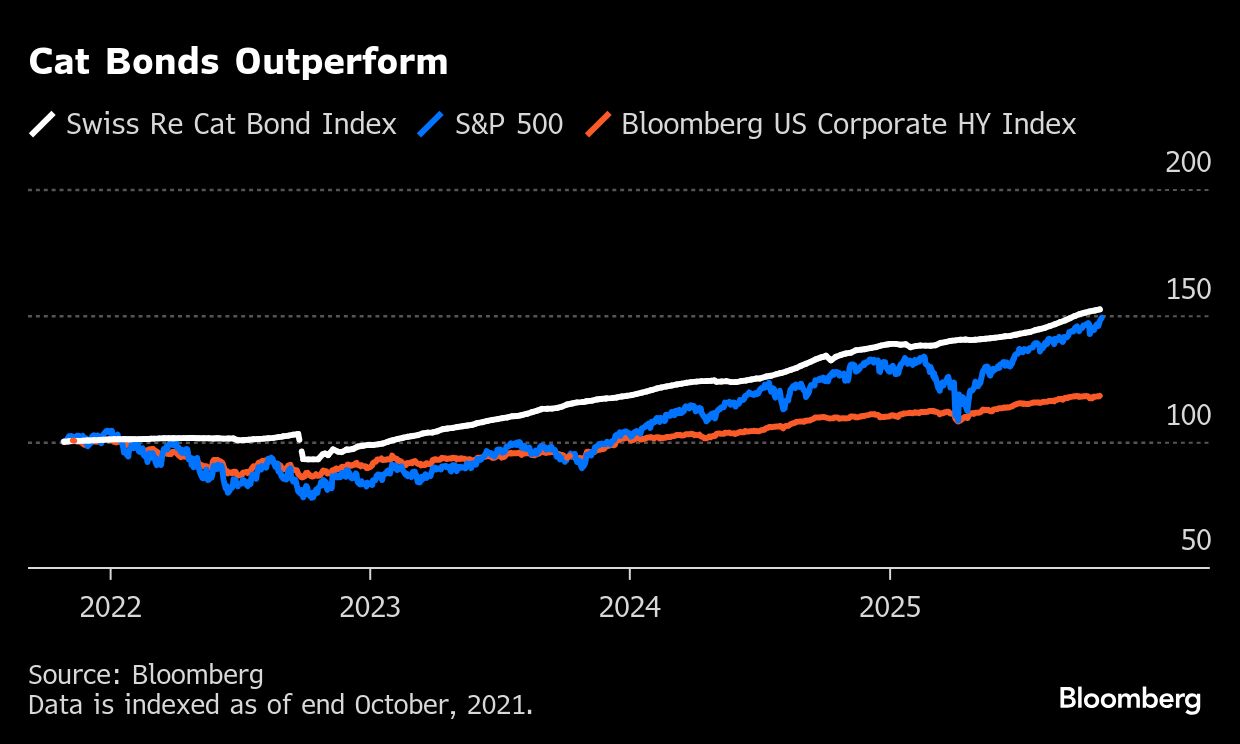

Europe may soon get its first exchange-traded fund based on catastrophe bonds. An application to register the ETF was filed...

Investors in a catastrophe bond tied to Jamaica look set to experience a trigger event as Hurricane Melissa barrels toward...

The seemingly unstoppable rise of catastrophe bonds may now be eroding the market share of reinsurers. After years of raising...

Asset managers with sizable holdings of catastrophe bonds are watching to see how a recent recommendation by Europe’s markets watchdog...

Collaboration between the public and private sectors, beyond just insurance, is essential to narrowing the so-called protection gap, as losses...