Tom Gallagher, an éminence grise or elder statesman of the Florida property insurance world and current chief operating officer for...

Florida insurance commissioner News

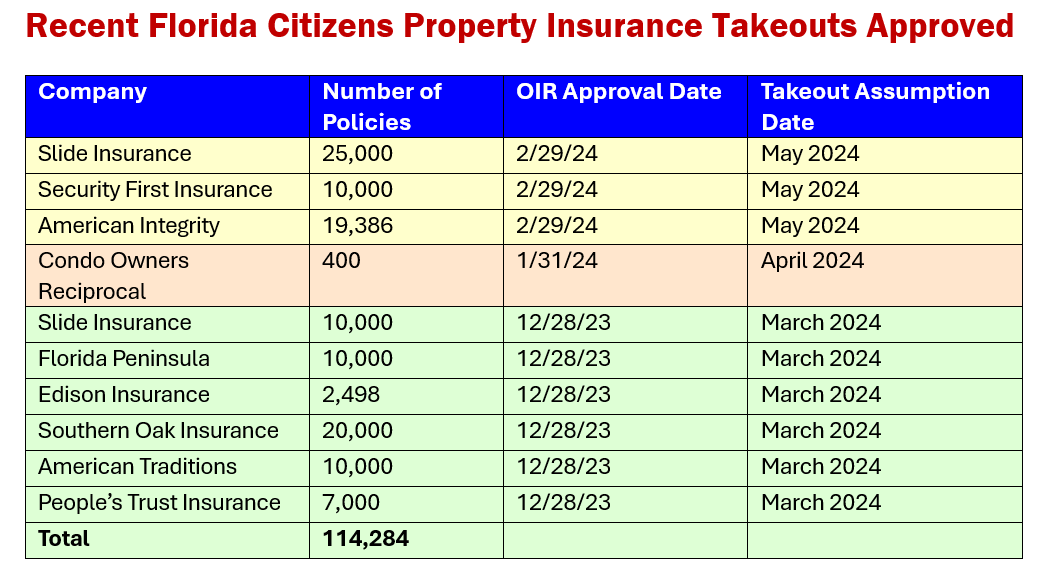

Florida’s insurance commissioner last week approved another round of takeouts from the state-created Citizens Property Insurance Corp., with assumption dates...

Former Florida Insurance Commissioner David Altmaier has been hired as a lobbyist and consultant by one of the largest and...

Florida officials could name a new state insurance commissioner as soon as next month, the state’s chief financial officer said...

Florida’s insurance commissioner on Thursday announced his resignation, effective Dec. 28, surprising some in the industry despite rumors that have...

In the wake of massive protests last year focused on racial equity and social justice, insurers are among the many...

Florida has 90,000 private flood insurance policies in force now– a 300% increase since passing legislation to encourage private insurers...

A bill passed by the Florida Legislature to address the state’s property insurance crisis has created optimism among some stakeholders,...

Florida lawmakers passed two bills on the last day of their 2021 legislative session that make major changes to the...

New information from Florida’s insurance regulator paints a stark picture of the extent of litigation facing the state’s domestic insurers....