Wealthy Florida residents and developers are looking to raise at least $300 million for Vanderbilt University to build a sprawling...

Florida property insurance crisis News

Florida’s beleaguered property insurance market is starting to look normal again, with the top insurers in the state showing a...

The CEO of Citizens Property Insurance Corp. has denied that corporation representatives have been unresponsive to Congressional requests for financial...

A number of property insurance-related bills were introduced in the Florida Legislature this year – from a fundamental change to...

A Florida pilot program to fortify coastal-area condominiums is on its way to the governor but other property insurance bills...

The head of two property insurance companies set to enter the Florida market this year is warning state lawmakers that...

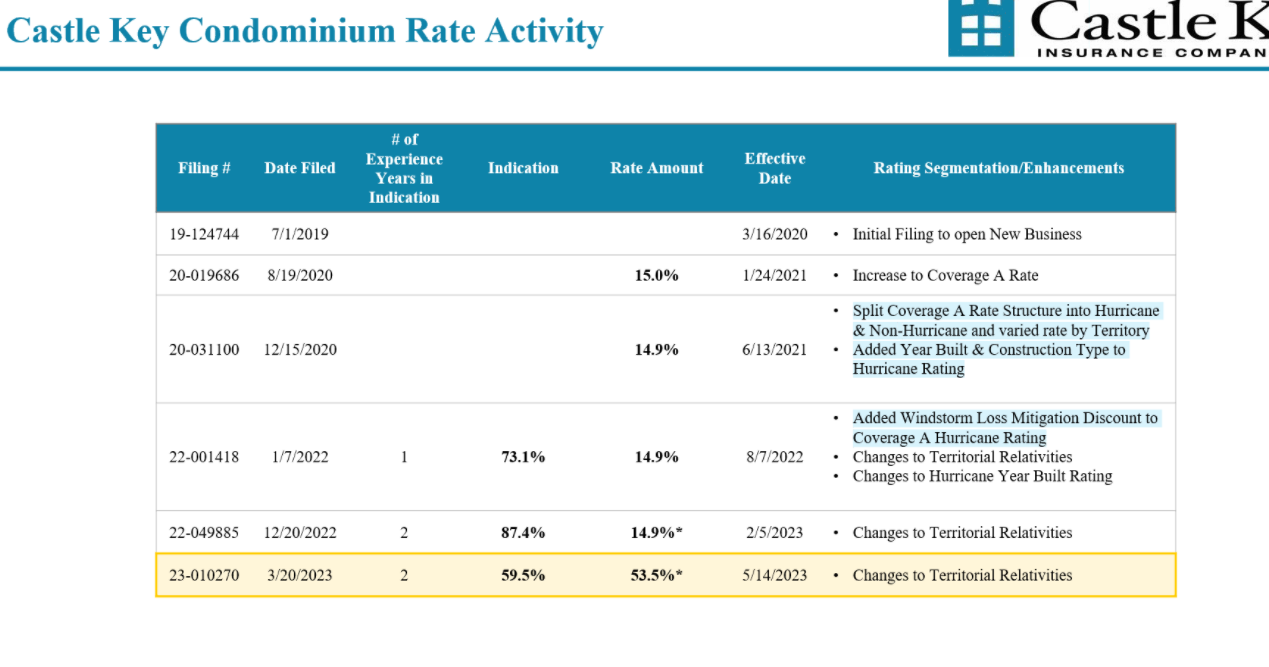

When Allstate’s Florida unit, Castle Key Indemnity Co., entered the surging condominium insurance market in 2020, it looked like it...

(Bloomberg) — Florida’s southwestern coast — long one of America’s fastest-growing regions — is losing some of its boomtown swagger...

The Florida Office of Insurance Regulation next week will hold hearings on two property insurers’ requests for 54% average rate...

First came the My Safe Florida Home program, providing matching grants to homeowners who fortify their homes against wind damage...