AlphaCat Managers Ltd., the Bermuda-based subsidiary of Validus Holdings Ltd., announced the appointment of Bernard Van der Stichele to the...

insurance linked securities (ILS) News

Reinsurance rates fell for the sixth consecutive year at the June 1, 2017 renewals, according to a market commentary published...

Catastrophe bond issuance made a robust start during the first quarter of 2017 with seven catastrophe bond transactions that totaled...

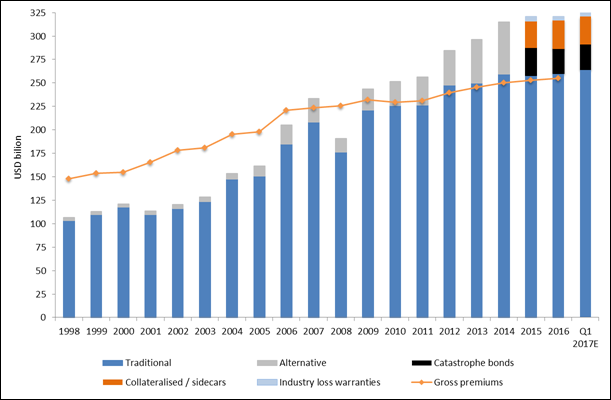

Non-life insurance-linked securities (ILS) capital grew again in Q1 2017, continuing the trend from 2016, according to the latest ILS...

The Cayman Islands Insurance Industry saw a “buoyant” start to 2017, with eight new insurer licenses issued in the first...

With abundant capacity, aggressive capital market competition and acceptable returns for global reinsurers, it’s no wonder that the elusive bottom...

PERILS AG, the independent Zurich-based company that provides industry-wide catastrophe insurance data, has released the 2017 update of the PERILS...

When someone gets to be a CEO at the age of 36, perhaps it’s a good idea to listen to...

Despite the rising profile of cyber risks, buyers have failed to widely embrace cyber coverage. At the same time, insurers...

Despite increased awareness of rapidly evolving cyber threats, relatively few corporations have integrated cyber security into their mainstream risk management...