MS Amlin announced an upgrade of of a digital trading solution to upgrade its “Countrywise insurance” service, which provides agricultural...

Markets/Coverages News

Prime Property & Casualty Insurance Inc. has entered the North Carolina commercial auto markets as an admitted carrier specializing in...

Prime Property & Casualty Insurance Inc. has entered the New Mexico commercial auto market as an admitted carrier specializing in...

Nsure, an all-digital licensed insurance agency based in Florida, has introduced technology to provide real-time quote comparisons for home and...

Willis Towers Watson has launched a new advisory capability designed to help chief financial officers and risk managers reduce volatility...

Atlas General Insurance Services has collaborated with Bascule Underwriting, specialists in equine insurance, to provide an exclusive workers compensation product...

Vault, an insurer focused on the needs of the high net worth market, has received approvals to underwrite in Connecticut,...

Arch Insurance (UK) Ltd., the London-based subsidiary of Arch Insurance International, is set to enter the cyber insurance market with...

Everest Insurance has released a new Everest Elevation Management Liability Policy, which provides comprehensive coverage for publicly traded companies across...

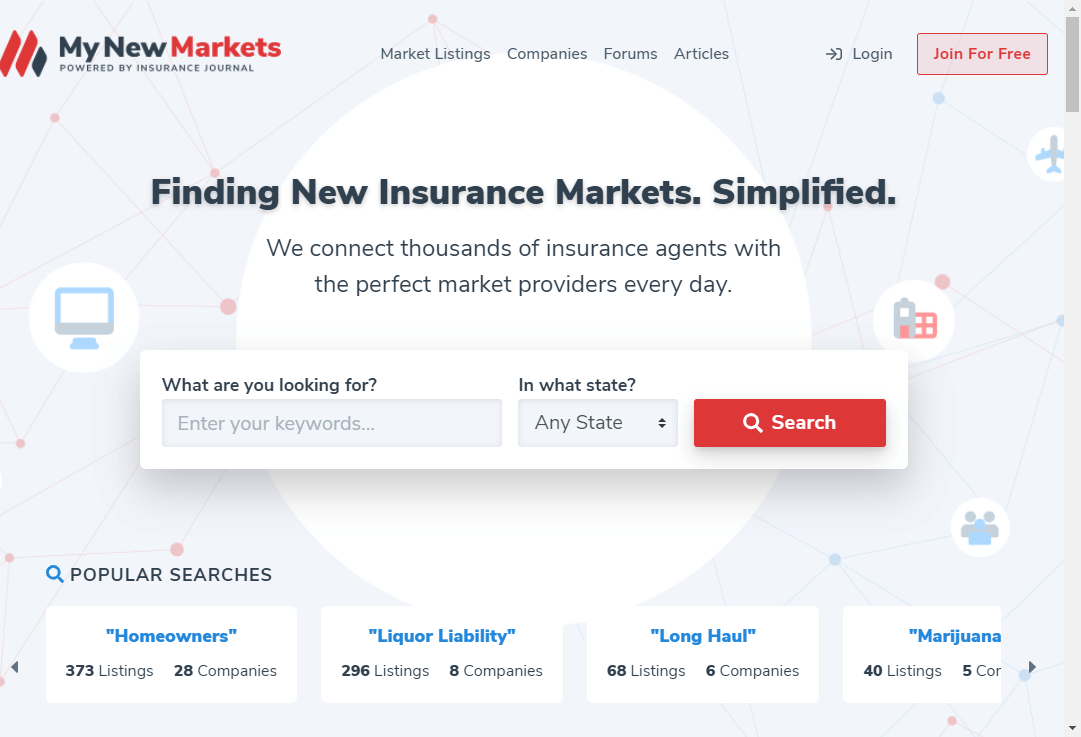

MyNewMarkets.com today unveiled a redesign with new features for both agents hunting for insurance markets and providers offering solutions. The...