An international group of 27 climate scientists have concluded that the recent heat wave in the Pacific Northwest was “virtually...

Moody’s News

The most recent tallies of financial results by rating agency analysts reveal that the property/casualty insurance industry weathered the storms...

AM Best kept its stable market segment outlook on the U.S. personal lines insurance segment for 2021, citing the segment’s...

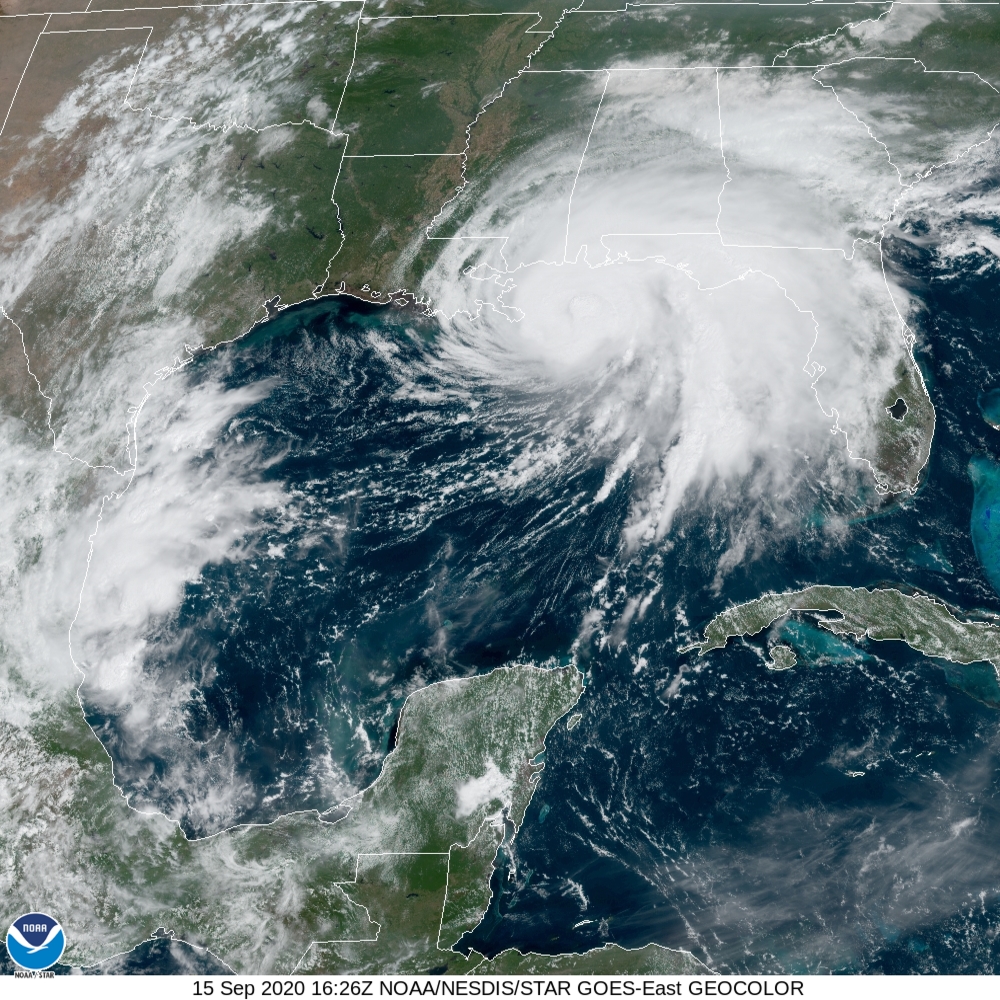

Insured losses from Hurricane Sally could reach as much as $3 billion, according to catastrophe modelers, but ratings agency Moody’s...

Even though investment returns rebounded from first-quarter levels during the second quarter of 2020, claims from COVID-19 created an “anemic...

The coronavirus outbreak has had an adverse, but manageable, impact on the European insurance sector, leading to a drop in...

The acquisition of California-based Four Twenty Seven, Inc., by Moody’s Corporation could signify the beginning of a major shift in...

Underway for some time now, the disruption of the insurance industry has moved into a new phase, following the announcement...

Ratings agency Moody’s Corp. and Israeli cyber group Team8 launched on Thursday a joint venture to assess how vulnerable businesses...

A Moody’s Corp. managing director fired for lashing out at a junior co-worker who criticized his team’s work won his...