TigerRisk Partners LLC, the Stamford, Conn.-based re/insurance broker, announced it has appointed Christopher Conway to a newly created senior role...

retrocessional market News

The January 2020 reinsurance renewals saw significant variation in pricing and capacity depending on geography, line of business, cedents’ loss...

Reinsurers’ earnings are likely to see further erosion in 2019 after another year of major catastrophe losses, which is prolonging...

Markel Corp. announced it has hired Brenton “Brent” Slade as president of Lodgepine Capital Management Ltd., its new retrocessional insurance...

Markel Corp. announced the launch of Lodgepine Capital Management Ltd., its new retrocessional Insurance Linked Securities (ILS) fund manager in...

Some global reinsurers have chosen to stop retrenching from catastrophe risks, deciding instead to take advantage of higher premium rates...

TigerRisk Partners LLC, the Stamford, Conn.-based insurance and reinsurance broker, announced it has appointed Jonathan Hughes as partner. Hughes will...

Guy Carpenter & Co. has launched a new unit offering dedicated retrocession services to clients in the Asia Pacific region...

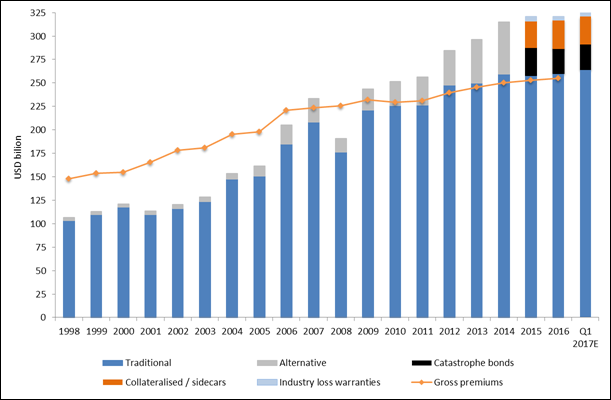

Reinsurance rates fell for the sixth consecutive year at the June 1, 2017 renewals, according to a market commentary published...

Most global reinsurers have been able to maintain underwriting discipline despite the ongoing soft market, but there is a danger...