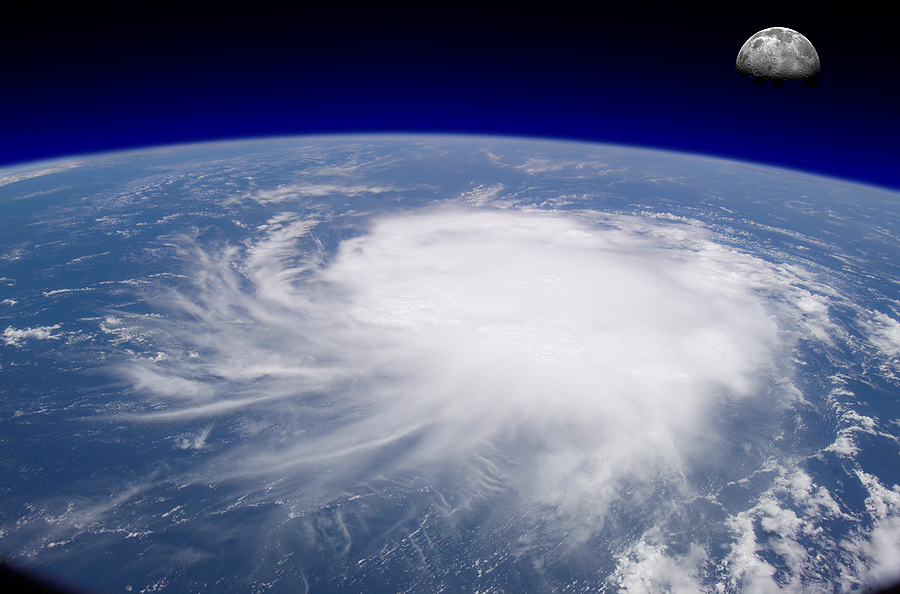

Catastrophe modeling firm Risk Management Solutions (RMS) issued the following advisory on Tropical Storm Debby this morning: Tropical storm winds...

RMS News

A report from Willis Re notes that “UK insurers may see increases of up to 97 percent in their capital...

A severe line of thunderstorms and isolated super cells moved into the Dallas-Fort Worth-Arlington metropolitan area in the early afternoon...

Damaging hailstorms in Australia. Unprecedented tornadoes in the southeastern United States. Constant windstorms in northern Europe. Sound familiar? This year...

Hurricane Irene caused between $2.5 billion and $5.5 billion in insured losses in the United States and the Caribbean, excluding...

Loss estimates from Hurricane Irene continued to fall and ratings agencies said insurers would have no problem with claims, helping...

When it comes to revised hurricane models, AIR Worldwide CEO Ming Lee has one basic question, “What really is all...

Standard & Poor’s Ratings Services today has removed its ratings on 10 natural peril catastrophe bonds from CreditWatch with negative...

The catastrophe bond market seems to have survived the Japanese earthquake, its biggest test since the Lehman Brothers bankruptcy, with...

Property/casualty insurers appear to be in no rush to adopt a controversial revised catastrophe model that dramatically raises certain estimates...