Treasury Secretary Janet Yellen said on Wednesday it is important to “look carefully” at systemic risks posed by asset managers,...

systemic risk designations News

Congressional Republicans are taking aim at the regulatory process through which some financial institutions become subject to heightened regulation because...

A judge’s ruling that MetLife Inc. is not “too big to fail” opens up an opportunity for insurer American International...

MetLife asked a federal judge on Monday to force the U.S. government to hand over 500 pages of confidential records...

A Republican congressman and a Democratic colleague have introduced a bill to shed more light on the workings of the...

A measure that would ease capital and liquidity standards for insurers under the Dodd-Frank Act was approved by the U.S....

The U.S. Federal Reserve on Tuesday announced plans to study the potential effects of forcing big insurance companies to meet...

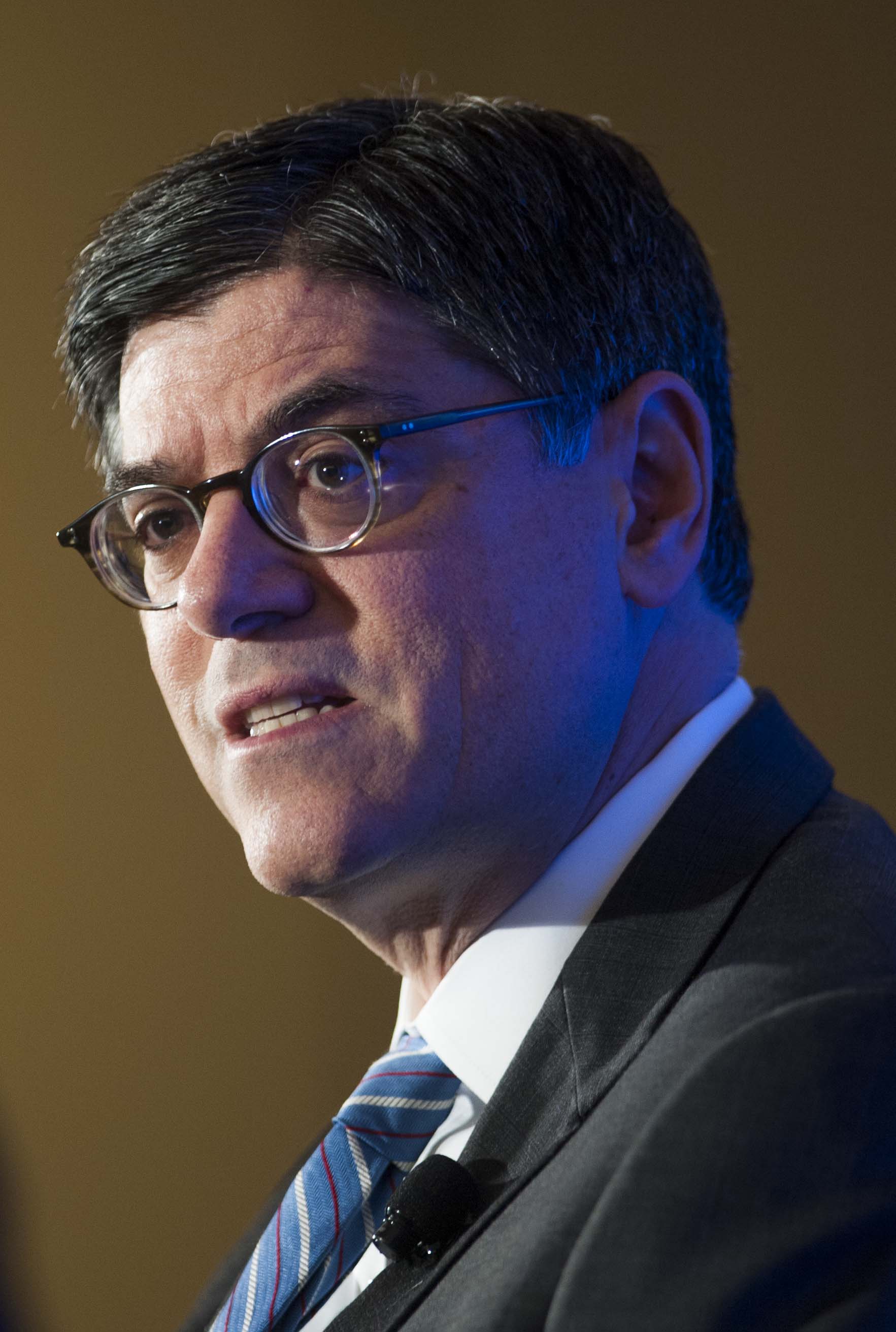

U.S. Treasury Secretary Jacob J. Lew pushed back against Republican efforts to curtail the work of a council of regulators...

Steven Kandarian got MetLife Inc. out of banking to escape Federal Reserve oversight. Now, the insurer is fighting again to...

A group of Republican lawmakers demanded documents on Friday from U.S. regulators, voicing concerns that decisions about whether to designate...