Driveway Software and Pinnacle Actuarial Resources have teamed up to offer the auto insurance industry a coordinated usage-based insurance (UBI)...

usage-based insurance (UBI) News

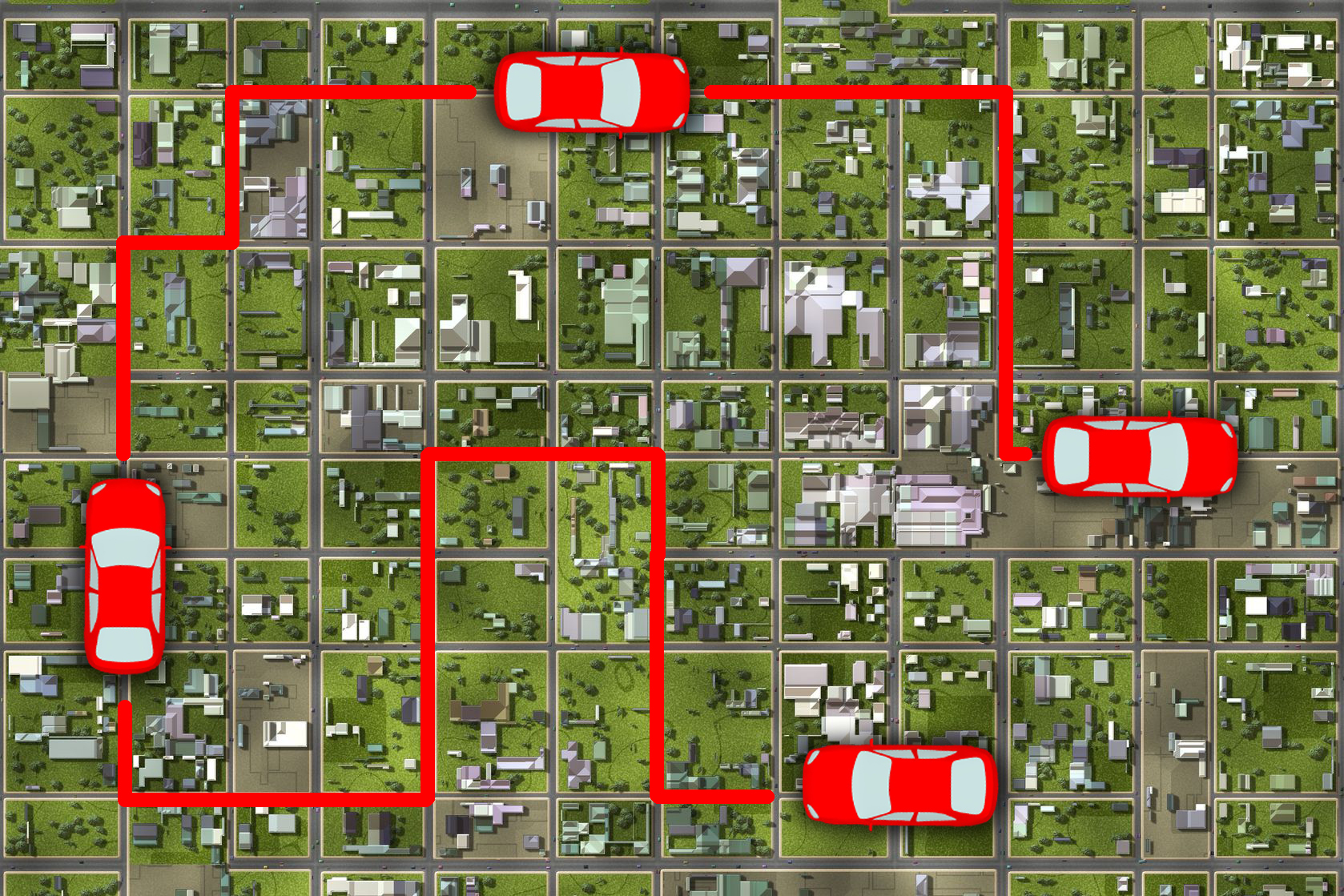

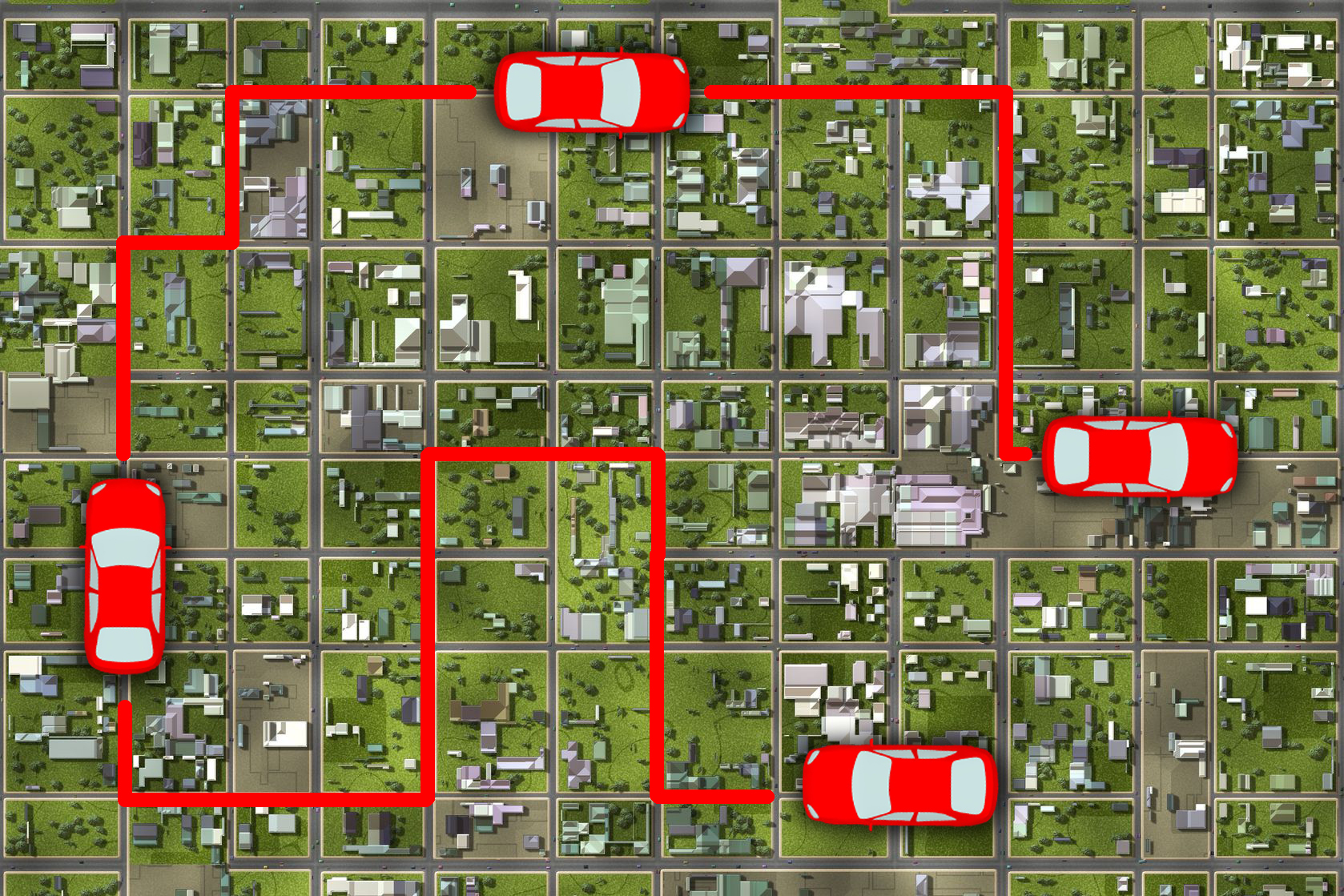

The crossroads of auto insurance these days is telematics, the use of an electronic device to monitor how an automobile...

San Francisco-based , a provider of smartphone-based telematics products for the usage-based insurance market, has introduced its SmartUBI Platform, a...

U.S. drivers are open to purchasing usage-based auto insurance (UBI) policies, or “pay as you drive” insurance, and are even...

DriveFactor has partnered with Admiral Group plc to expand usage-based insurance (UBI) offerings throughout the U.K. Through this partnership, DriveFactor...

Progressive Insurance is making the intellectual property it owns available to companies interested in implementing usage-based insurance (UBI) programs under...

Allstate announced this month that it has expanded its usage-based auto insurance product, Drive Wise, to four additional states including...

Professional services firm Towers Watson is teaming with Hughes Telematics, Inc. (HTI), a Verizon company, to provide U.S. auto insurers...

DTRIC Insurance will begin offering Akamai Rater, Hawaii’s first program that aligns individual driver behavior with auto insurance rates. DTRIC’s...

Communications firm Sprint has begun selling driver tracking services to auto insurers. Sprint said its integrated, end-to-end usage-based insurance (UBI)...