This article is part of a sponsored series by Cotality.

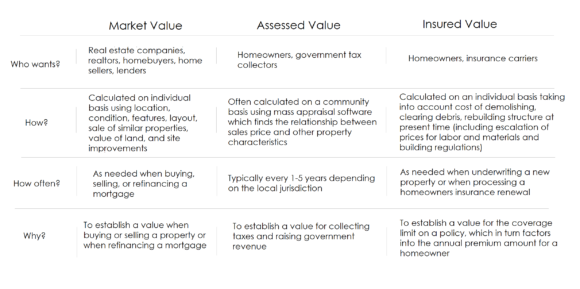

Accurate valuation is critical to the primary functions of the real estate economy. From the listing of a property all the way through acquiring insurance, there are 3 critical moments when the property will have a distinct value associated with it—the market value, the assessed value, and the insured value.

Market Value

Under federal code, market value is defined as the most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale.1 In layman’s terms, market value is the price a buyer is willing to pay for a property. Among professional real estate companies, market value often includes the value of land, site improvements to the land, buildings, and sometimes personal property and intangible assets.

Appraisers are often engaged by their lender clients to inspect properties and determine market value based on factors such as location (i.e. waterfront, golf course view, etc.), condition, features, layout, and the sale of similar properties in the local community.

Assessed Value

The assessed value is a value calculated by the local property tax assessor. The property tax assessors are tasked with finding the value of a property so that it can be taxed properly. Because assessments are often carried out periodically (usually every one-to-three years), the assessed value may not keep up with the fluctuations of the local real estate market.

Assessors, rather than evaluating one property at a time, are estimating the value of an entire neighborhood at once. They do this by using mass appraisal techniques.

Computer-assisted mass appraisal (CAMA) defines any software package used by the government to establish real estate appraisals for property tax calculations. These programs use mathematical modeling (multiple regression analysis) to find the relationship between the sales price and other property characteristics like square footage or the age of the property. This relationship is then used to calculate the property valuation.

Mass appraisal programs are particularly effective because they take into account data from all sales rather than using limited data from only a few comparable properties. This also eliminates any bias when assessors are deciding what property qualifies as comparable.

Insured Value

The insured value is the cost it would take to reconstruct a property in its entirety. This is a value that is used by insurance carriers to help establish coverage limits on a policy, which factors into the annual premium calculation

The insured value includes the cost of demolishing the existing structure, clearing the site of debris, and building the structure at the present time. This means that future escalation of prices for labor and materials are accounted for, as well as new building codes, building plans, site access and permits.

Why Value Matters

Insurance carriers understand the need to use “insured value” for Coverage A to make sure that their policyholders receive the adequate amount of payment to rebuild when faced with the loss of their property. However, a common point of confusion for homeowners is the inconsistency between reconstruction cost values (insurance coverage) and market or appraisal values. Many homeowners wrongly assume that the reconstruction cost is equal to the amount they paid for the property. Reconstruction costs are typically higher than market or appraisal values because they leverage current material and labor costs within a certain geographical area.

Another point of confusion is often the term “Replacement Cost New” used by the assessor and appraisal industry. The Replacement Cost New often uses the building codes and labor and material costs at the time the property was built, rather than using present day codes and costs. They also do not include demolition, debris removal, and site accessibility costs which are common in post-disaster rebuilding scenarios. The Replacement Cost New is not recommended for determine the cost to rebuild a home.

It’s important for consumers to understand the many ways value is defined and the role each value plays in a property’s life-cycle. Realtors, assessors, insurance carriers and the data used to aggregate valuations are all critical in ensuring that property valuation is conducted accurately.

Sources:

- Comptroller of the Currency. 12 CFR § 34.42. Retrieved from https://www.law.cornell.edu/cfr/text/12/34.42

Topics Property

Was this article valuable?

Here are more articles you may enjoy.

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Zurich Reveals Beazley Stake After UK Insurer Spurns Bid

Zurich Reveals Beazley Stake After UK Insurer Spurns Bid  Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer