In June 2007, a California woman was awarded $4.3 million for injuries she received in a golf car crash that left her too disabled to continue her successful photography and jewelry design careers. A wheel of the car she was driving unexpectedly hit a drop-off on a poorly maintained path, throwing her into a nearby 15-foot ravine overgrown with bushes.

In Iowa in 2003, a man who was blinded in one eye by an errant golf ball won $200,000. The golf course operator was found liable because the tree-line barrier between adjoining holes had not been properly maintained.

Overturned golf cars, poorly hit balls and golf clubs in mid-swing are the risks that anyone could quickly list when thinking about the liability that golf course operators face every day. According to the U.S. Consumer Product Safety Commission, the game of golf is responsible for more than 50,000 emergency room visits each year for injuries that require immediate medical attention.

But as golf clubs have increasingly embraced the role of family entertainment centers, the liabilities that they face have grown more complex. With the publication in 2006 of “Safety on the Fairway: Injuries and Losses at Golf Facilities,” a study by Travelers that examined the type of claims involved in general liability and property losses in its Eagle 3 golf insurance program, the importance of making clubhouse safety a priority has never been clearer. Yet tales of avoidable injuries continue to make headlines, indicating that many golf club operators are not taking the right steps. Insurance brokers and agents can play an important role, not only in working with their customers to reduce liability, but also in helping clubs avoid injuries and property damages that all too often become human tragedies.

Closer look at risks and claims

Today’s golf facilities typically include far more than a course and practice ranges. Many include a restaurant, bar, retail shop, swimming pool and other recreational facilities. They may have a fleet of vehicles used by employees, as well as golf cars used by a wide variety of players with differing driving capabilities.

To understand the risks involved in operating golf clubs today, the Travelers study looked at 12,000 property and 9,000 general liability claims incurred by more than 1,400 golf courses between 1987 and 2004. Several patterns emerged.

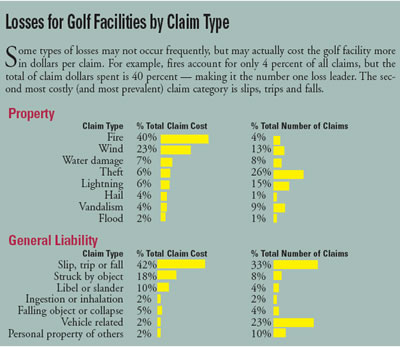

Fires caused the most destruction at golf facilities, even though the actual number of claims filed was small. Fires constituted 4 percent of the claims but were responsible for 40 percent of the property loss costs. The most common cause of fire was from electrical deficiencies, particularly in golf cart storage areas.

Slips, trips and falls are prevalent at golf courses, which often have rolling terrain, water hazards and a large number of walkways and paths. These types of accidents were responsible for 33 percent of general liability claims and 42 percent of general liability loss costs. Most slip, trip and fall accidents in the study involved stairs (both indoors and outdoors), wet floors, icy sidewalks or holes on the course.

Wind damage accounted for only 13 percent of property claims but 23 percent of property loss costs. While weather cannot be controlled, golf facility managers can avoid damage by removing dead limbs before storms and cleaning up debris quickly after storms.

Struck-by-object claims were the second most costly general liability category at 18 percent, but were less frequent (8 percent) than other sources of liability.

Vehicle-related claims were frequent but not as costly as other issues. They accounted for 23 percent of general liability claims, but only 2 percent of general liability loss costs.

If the statistics for claims since 2004 were added, much of the data would probably be similar to those in the study, which was completed in 2006. An added area may include claims related to the significant property damage from hurricane related activity. Developing a disaster property-management plan can lessen the likelihood or severity of losses. And it can be a critical tool to help golf courses recover their essential functions and to inform individual employees about their roles and responsibilities in the event of a hurricane.

With so many clubs offering swimming facilities today, claims related to pools, diving boards and slides may also be included. More attention should be paid to the “water envelope,” the clearance space when swimmers jump or dive into a pool as too many have been injured by hitting the sloping sides or edges of pools.

Despite the many hazards that are present at golf clubs, injuries and damages do not have to be “par for the course.” Many facilities have worked to improve their safety records.

For example, one clubhouse instituted a routine inspection program to identify hazards and ensure prompt attention to solutions. The program was implemented after a man was permanently paralyzed from a fall on a slippery sidewalk that was kept constantly damp by a leaking sprinkler.

Another club saw a sharp drop in falls caused by food and beverage spills after management created a “spill drill” that placed buckets and mops near problem areas and required employees to clean up messes as soon as they occurred.

One club bought more golf cars, but did not realize the circuit in the storage area did not have enough capacity to provide electricity to the additional cars — and the circuit breaker was no longer the correct size to prevent a fire. Fortunately, the inadequate wiring was discovered before a fire occurred.

At another facility, a club guest who had been drinking at the bar hit a golf car when he was driving away, killing a child passenger. The guest had a blood alcohol level three times the legal limit. To prevent future similar incidents, the club immediately began a training program to educate employees on responsible alcohol service.

In each of these cases, club management stepped up to the responsibility of creating a safety program. Such programs focus on hazards and risks, often putting safety under the purview of a committee that meets regularly. In addition, the best clubs make sure that these are not just shell programs but instead are overseen by active committees that are both responsible and accountable for the safety culture of the club. When employees see that management is committed to safety, the whole staff is more likely to become dedicated participants in spotting hazards, identifying solutions and making appropriate fixes in a timely manner.

Safety management

Proactive safety management isn’t sexy. When it is done well, the outcome is a “non event.” When done poorly, the results can be tragic. Insurance brokers and agents have an opportunity to partner with golf club management to reduce risk and enhance safety.

They are also in a good position to help golf clubs identify insurers that can provide advice and assistance in setting up effective safety programs. Many insurers offer online resources, and golf-oriented safety courses to raise employee awareness and sensitivity to safety issues. By making use of such risk control expertise, clubs can improve their track record and protect their future viability while increasing membership satisfaction.

Dana Blose is a national accounts risk control coordinator for Travelers National Programs. He works with Travelers’ golf programs and is responsible for coordinating risk control services to more than 1,400 golf courses throughout the United States. He also coordinates risk control services for more than 80 PGA Tour, Senior PGA Tour, and LPGA Tour events.

Was this article valuable?

Here are more articles you may enjoy.

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud  Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half

GEICO Settles Call-Center Worker Suits for $940,000; Attorneys Get Half