Eight years after the introduction of managed competition for private passenger auto insurance and the influx of direct writers and direct response companies into Massachusetts to compete with independent agencies, a new study commissioned by the Massachusetts Association of Insurance Agents (MAIA) says independent agencies continue to have a significant impact on the state’s economy and continue to control both the personal and commercial lines markets by wide margins.

Earlier this year MAIA commissioned a study to measure the impact of independent agencies on the economy of Massachusetts. The study, conducted by professional services organization Towers Watson, revealed that the 1,300 member agencies of MAIA play a significant role in Massachusetts as employers, taxpayers, consumer spenders and charitable contributors. MAIA said its member agencies represent 84 percent of the total number of property/casualty agencies in the state.

Towers Watson surveyed 15.5 percent of MAIA’s membership. The agencies surveyed represented all areas of the state, were of various sizes based on employees and premium volume and wrote different mixes of personal and commercial lines business. Towers Watson then extrapolated the survey results for all MAIA member agencies to reach the conclusion included in the study. All study results are for the year 2014.

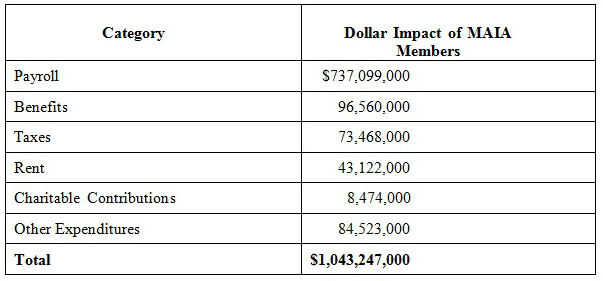

The study said financial contribution of MAIA’s property/casualty member agencies in Massachusetts during 2014 was $1,043,247,000.

The $1,043,247,000 figure relates only to the financial contribution of MAIA’s member agencies, the study said, adding that there are some 250 property/casualty agencies in Massachusetts that are not members of MAIA. And based on the locations of these agencies, Towers Watson estimates that these non-member agencies produce an additional financial contribution in Massachusetts of at least $53.3 million. Combining this amount with the MAIA members estimates leads to a total contribution of approximately $1,097,547,000.

The total number of full time equivalent employees of MAIA member agencies is 9,809, MAIA also said. The average independent agency employs 7.8 employees, with approximately 86 percent of the agencies having 10 or fewer employees. Thus, independent insurance agencies can be characterized as the traditional “small business,” MAIA said.

According to the study, Massachusetts independent agencies provided the state’s economy with a payroll of over $737 million in 2014. In addition to providing jobs for thousands of Massachusetts residents, independent agencies expended over $96 million in 2014 for employee benefits, including health insurance, pension and profit sharing and training costs. MAIA said these expenditures are evidence of independent agencies’ commitment to their employees and their families and to the consumers of Massachusetts who benefit from well-trained insurance professionals.

In addition to over $800 million in wages and benefits paid to their almost 10,000 employees, Massachusetts independent agencies contributed over $73 million in state and local taxes during 2014, the study said. This amount reflects property/real estate taxes, unemployment taxes and state income taxes. Federal income taxes and social security taxes were excluded from the study.

The study also said approximately 71 percent of MAIA members rented, rather than owned, property for at least one agency location. During 2014, these agencies paid rent totaling in excess of $43 million, provide additional income to local communities throughout the state.

Massachusetts independent agencies are also significant spenders in the economy when it comes to technology, office furnishings, supplies, equipment, advertising, legal and accounting services, repairs/maintenance/security and remodeling and construction, according to the study. In 2014, over $84 million was spent by independent agencies in these areas of the economy.

MAIA added that traditionally, independent agencies have been very involved in their local communities, volunteering their time, talent and dollars to numerous charitable, religious, civic and cultural activities. In 2014, independent agencies contributed over $8.4 million to charities, an average of over $6,700 per agency. The average charitable contribution by MAIA’s 176 largest agencies, those with more than 10 employees, was over $22,000.

The study also examined the longevity of Massachusetts independent agencies and found that the majority of agencies are mature, well-established businesses in their communities. Thirteen percent of the agencies are over 100 years old. Sixteen percent of the agencies are between 76 – 100 years old and 24 percent of the agencies are between 51-75 years old.

In addition to their economic impact on Massachusetts, independent agencies also write and service the great majority of personal and commercial lines insurance written in the state. The Independent Insurance Agents and Brokers of America’s (IIABA) most recent property/casualty insurance market study from 2013 shows that Massachusetts independent agencies write 74 percent of the personal lines (first in the nation) and 83 percent of the commercial lines (fifth in the nation) in the state.

MAIA said these percentages reveal that Massachusetts independent agencies lead the nation in market share when compared with independent agencies in other states. Nationally, independent agencies write an average of 35 percent of the personal lines, and 80 percent of the commercial lines.

“The financial contribution of independent insurance agencies to the Massachusetts economy continues to be impressive evidence that the predictions of the demise of independent agents in the wake of the introduction of auto insurance competitive rating in Massachusetts were unfounded,” MAIA President and CEO Francis A. Mancini said.

“Massachusetts independent insurance agencies remain the distribution channel of choice for consumers in the Commonwealth for both personal and commercial lines,” Mancini added. “MAIA members should be very proud of the role they play in both the economy and the insurance marketplace of the state and for being a vital part of the communities where they operate. Massachusetts independent insurance agencies have proven that expert knowledge, superior products and personal service will always make a market leader.”

Source: The Massachusetts Association of Insurance Agents

Topics Agencies Property Property Casualty Massachusetts Independent Agencies

Was this article valuable?

Here are more articles you may enjoy.

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears