The blocking of the Suez Canal and resulting disruption to global shipping is likely to cause a large loss event for the reinsurance industry, according to Fitch Ratings.

This event will reduce global reinsurers’ earnings but should not materially affect their credit profiles, while prices for marine reinsurance will rise further as a consequence of the container ship “Ever Given” grounding in the canal, said Fitch.

Canal officials said on March 29 that Ever Given, which has been stuck in the canal since March 23, had been partially freed and that they hoped traffic along the Suez Canal could resume again within hours.

Fitch said the ultimate losses will depend on how long it takes the salvage company to free the container ship completely and when normal ship traffic can resume. However, Fitch estimated that losses may easily run into hundreds of millions of euros.

Accidents involving large container ships can cause property claims of over US$1 billion, but these are mostly related to salvage, said Fitch, noting, however, that the Ever Given should still be able to travel once freed. As a result, claims related to hull and cargo insurance, including salvage (which will be borne by the shipowner’s hull insurer), should remain significantly below this level, Fitch continued.

However, the shipowner’s protection and indemnity club will probably also face claims from the owners of the cargo on the Ever Given and of the other ships that are blocked in the Suez Canal for losses related to perishable goods and supply chain disruptions, affirmed the ratings agency.

In addition, they may face claims from the Suez Canal Authority itself for loss of revenues, said Fitch, citing press reports revealing that more than 300 ships are stuck at either end of the canal.

A large share of those losses will probably be reinsured by a global panel of reinsurers, said Fitch.

In isolation, this large loss event should be neutral to reinsurers’ credit profiles. However, it will add pressure to global reinsurers’ H1 2021 earnings – earnings that already have been knocked by catastrophe events such as winter storms in the U.S. and flooding in Australia, as well as by additional coronavirus pandemic-related losses.

Last year, global reinsurers reported heavy declines in earnings due to paid claims and claims reserves related to the coronavirus pandemic. However, underlying performance improved due to significant price increases in non-life primary and reinsurance. Their capital positions remained very strong at end-2020. The sequence of catastrophe events in 2021 will put additional strain on commercial insurance and reinsurance markets, pushing prices even higher in an already hardening market.

The canal blockage therefore does not change Fitch’s view that communicable disease exclusions in renewed treaties and a hardening market should lead to better results in 2021.

Source: Fitch Ratings

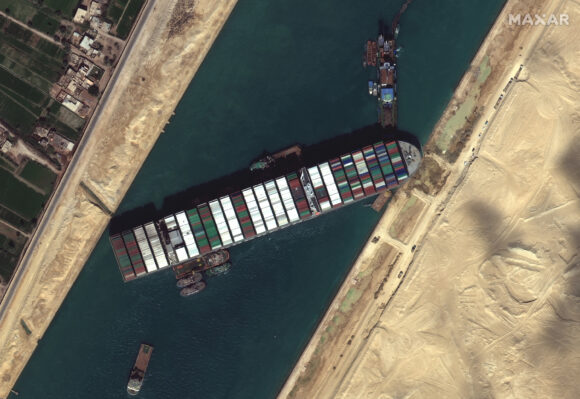

Photograph: This satellite image from Maxar Technologies shows the cargo ship MV Ever Given stuck in the Suez Canal near Suez, Egypt, on Saturday, March 27, 2021. Photo credit: ©Maxar Technologies via AP.

Topics Lawsuits Profit Loss Reinsurance

Was this article valuable?

Here are more articles you may enjoy.

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Pipeline Explodes at Delfin LNG Planned Project in Louisiana

Pipeline Explodes at Delfin LNG Planned Project in Louisiana  Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples

Allstate Doubles Q4 Net Income While Auto Underwriting Income Triples  Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals