Executive Summary: For a multinational insurance company like Zurich Insurance Group, which can find itself delivering large, complex policies in multiple languages to a single international customer, there’s a logical use case for Gen AI’s large language models in providing consistency across markets. But that’s just one of the ways in which the global insurer has deployed $1.8 billion in technology investments to improve customer experience and efficiency. Zurich says it’s using more than 160 AI-powered solutions to help transform the entire insurance value chain.

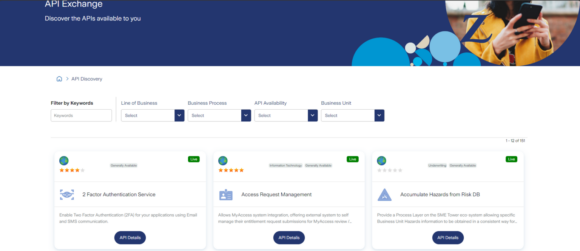

During a tech roundtable held by Zurich in March, executives described a suite of APIs, Zurich eXchange 2.0, allowing the company to seamlessly scale Gen AI solutions—such as coverage checks, policy comparisons and claims insights—to boost internal efficiencies and to offer services and embedded insurance products externally.

Early adopters of generative artificial intelligence (Gen AI) tools are working hard to employ the technology, which can help insurers innovate, enhance customer experience and boost internal business efficiencies. At the same time, they are carefully containing the potential risks of this new technology.

Tech executives at Zurich Insurance Group described their “digital transformation journey,” which embraces AI and Gen AI tools while putting in place all the necessary safeguards—to protect their customers and themselves.

Ericson Chan, group chief information and digital officer for Zurich Group, said the company’s business digitization enabled some of Zurich’s record profit in 2023 of $7.4 billion with a “very good combined ratio of 94.5.”

During tech media roundtable held in March, Chan said that Zurich is “leading in AI usage” in the insurance industry, is “definitely an early adopter” and is already “realizing benefits.”

“Over the last three years, Zurich has invested $1.8 billion in technology, mostly focused on digitalizing the business and improving efficiency and customer experience,” according to Zurich in its 2023 annual report.

As a result of Zurich’s digital investments, Chan said, almost 90 percent of its retail distribution is digitized, providing straight-through quotations, for example. Zurich said it is using more than 160 AI-powered solutions to help transform the entire insurance value chain.

Chan detailed Zurich’s efforts to employ the benefits of AI—via its Zurich eXchange 2.0 platform—and how the insurer is leveraging these advanced tech tools internally.

Zurich eXchange 2.0 includes new developments and features that aim to transform the customer and developer experience by enabling embedded insurance, said Zurich in a statement to media attending the roundtable. (Embedded insurance is an insurance add-on, offered by corporations, such as airlines, car manufacturers or travel platforms, as a part of a digital sale.)

“Through a new suite of APIs (application programming interfaces), Zurich eXchange 2.0 will be able to seamlessly scale Gen AI solutions—such as coverage checks, policy comparisons and claims insights—and reuse them globally,” Zurich added.

Zurich handles around 70 million API transactions per month, said Frank Verkerk, group chief platform officer, at the meeting. This rapid growth translates into approximately 1 billion API transactions a year, he added.

“With these latest developments, Zurich is making it easier than ever for partners to work with us,” said Chan in the media statement.

“Tech is a key enabler to transform the customer experience, and this is what we’re doing by supercharging AI through our open partnership platform,” he added.

“The fundamental business model of insurance continues to be the same, but we … digitize our business, our processes, our products, our services, how we communicate with our customers.” The insurance is the same, but it’s now more efficient, Chan explained.

Under Zurich’s digital program, the company is going to the customers via embedded insurance, offered in its API “digital superstore,” Chan said. “For example, when you buy a plane ticket, we are already part of your purchasing journey [if you want to buy travel insurance]. All you need to do is one-click, and we have you covered,” he continued.

With Zurich eXchange 2.0, Zurich offers a digital superstore, where the API is a product that corporate developers can quickly find, test and use in order to begin offering a Zurich insurance product, Verkerk said.

“APIs are often neglected, yet they have huge potential to transform how insurance is delivered. We are now able to leverage its full power, which will bring scale and agility to insurance,” explained Verkerk in the media statement.

During the tech meeting, he said Zurich has created a marketplace that “is actually gateway agnostic.” “This means it’s not important which underlying technology is used in the marketplace. Everything comes together. It makes it way easier to scale across the globe for us for our internal use.”

He explained that this makes it easier to scale Zurich’s partners. “If we have enabled something for a partner in one region,” it also is accessible for partners in other parts of the world, Verkerk said, noting that this saves time for Zurich and for its partners, which can often go to market in weeks rather than months.

To help internal and external users better navigate eXchange 2.0, which contains a large number of APIs (approximately 1,700), Zurich has enabled multiple “stores.” The API stores are housed in Zurich Edge, the company’s business proposition for more than 200 partnerships, which provides different integration models from which partners can choose.

“The idea is basically we can open this up with any partner to integrate with us,” said Chan. “The open platform will have all the component code” to make it easier for developers from Zurich’s partners “to link with us.”

Verkerk explained the APIs provide essential connectivity to the outside world—they are enablers to connect Zurich with its partners. “APIs are often neglected, yet they have huge potential to transform how insurance is delivered. We are now able to leverage its full power, which will bring scale to insurance,” he said in the statement.

Verkerk asserted that there could be no artificial intelligence without API “because API, if you think about it, that’s the intelligence. It needs data in, and it needs data output,” he continued.

Without the data input and output provided by APIs, AI would be a brain in isolation, with no way to communicate with the outside world.

Essential to Zurich eXchange 2.0 is Gen AI, the Zurich executives agreed. Indeed, Chan said a Gen AI prototype was up and running in May 2023, which has helped the company “leapfrog” its digital capabilities.

Gen AI is helping to fast-track embedded insurance via eXchange by going where its customers are. Chan describes this as the future of insurance distribution, or “Insurance 2.0.”

A Zurich representative explained that eXchange leverages Gen AI by using it to generate API documentation, which “allows us to better connect with our partners and quickly understand the integrations.”

Practical Internal Uses for Gen AI

The tech team then went on to detail Zurich’s AI-powered solutions, including an employee bot called ZuriChat, which uses Gen AI and has been rolled out to over 50,000 employees to support with day-to-day tasks.

In addition, the company offers “a high-end Gen AI solution for the analysis of policy wordings under multinational programs to support the issuance of local policies and provides greater visibility to customers on their coverage in each country,” said Zurich in a statement.

“Finally, an AI-based system that analyzes complex claims such as medical liability or accident and health to support claims handlers and underwriters, through which Zurich was able to improve its operating profits in the first market rollout by more than €9 million,” the company continued. “Through the exposure of such solutions on Zurich eXchange 2.0, these solutions can now be leveraged globally, through Zurich’s partnership network.”

Managing Complex Policies

Another major benefit of Gen AI is its ability to understand and manage languages—for companies like Zurich, which operates across many markets, according to Christian Westermann, group head of AI, at the tech event.

Policy wordings can be quite complex and quite long, with 100 or 200 pages, issued in different countries—sometimes by Zurich, sometimes by third-party insurance companies, said Westermann.

For Zurich’s international customers, it often has to cover four or more languages. “You have different types of policies and sometimes different formats,” Westermann said, explaining that Gen AI, with its use of large language models, helps provide policy consistency across all markets.

The team said that Gen AI is helping Zurich improve its underwriting, risk engineering and its loss adjustment capabilities. For example, loss adjustment reports are written around the world in all formats and languages. Zurich uses Gen AI to access those reports and extract all the knowledge, so that going forward, risk engineers can give advice to customers in how they can prevent future losses.

“You can even ask [the Gen AI tool] what was the chain of the event—how did this loss really occur?” he said. “You can extract information from loss adjuster reports in any language, at any detail. This functionality is something [risk engineers] can access from everywhere in the world because it comes together within the Zurich eXchange,” Westermann added.

Safe Transformation

During the tech roundtable, Chan said the key to Zurich’s AI approach is doing digital transformation “the right way”—both technically and safely—by making sure all projects take “a proactively compliant approach.”

“AI brings tremendous opportunities to improve the ways we work, meanwhile we are cognizant of the risks it brings. A comprehensive framework is necessary so we can leverage AI with confidence. Even with that, it will not be bulletproof yet. Therefore, we always practice a ‘human-in-the-loop’ principle when leveraging Gen AI,” said Chan.

Even before the use of Gen AI, Chan told journalists, Zurich had developed an AI risk framework, which is compliant with the latest EU AI regulations, so it already knew “how to manage the risk.”

For example, the employee chatbot, ZuriChat, is only used privately, so the data is not shared externally with any other company; employees can use it in a safe zone that is “technically safe and compliant,” said Chan.

In addition, Chan explained that Zurich is only using this tool to assist employees and all AI-generated information has to be validated before being shared with customers.

He described Zurich’s management team as having “TQ,” or “technology quotient.” “Our management TQ is quite mature, so we understand the potential of this technology. We know how to use the technology [to benefit the business],” while minimizing potential risks.

This article first was published online on May 13, 2024 in Insurance Journal’s sister publication and in CM’s Q2 2024 printed edition.

Was this article valuable?

Here are more articles you may enjoy.

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk  A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?