The latest culprit for cooling U.S. inflation: safer driving.

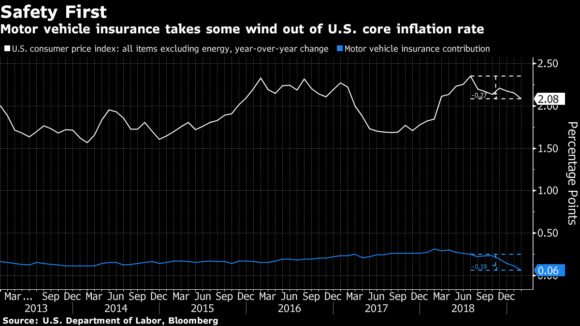

A measure of underlying price pressures watched closely by policy makers continued to moderate in February, missing forecasts, according to data published Tuesday by the Labor Department.

The gauge of consumer prices excluding food and energy rose to a nearly 10-year high in July. But since then, it’s fallen almost three tenths of a percentage point, and a single category accounts for most of the decline: motor vehicle insurance.

The category comprises just 3 percent of the basket of goods and services used to calculate so-called core inflation, but over the last three years, a surge in premiums has given it outsize importance. The pace of motor vehicle insurance inflation slumped to 2 percent in February from a three-decade high of 9.7 percent a year earlier.

That surge in premiums was caused by an uptick in auto accidents in 2015 and 2016, according to Allstate Corp.

“We had to respond pretty aggressively to a spike up in auto accident frequency,” Mario Rizzo, the insurer’s chief financial officer, said at a recent investor conference. “We took prices up, as did a number of our competitors, and others have kind of, may have started a little bit later but are effectively through that cycle now.”

Topics Auto

Was this article valuable?

Here are more articles you may enjoy.

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds