While the aggregate InsurTech funding level for the first-half of 2021 soared past the amount raised for InsurTech businesses for the entire year 2020, InsurTechs continued to quietly shut their doors with much less fanfare.

When Willis Towers Watson reported a surge in InsurTech funding to $7.4 billion in the first-half of 2021 last week, just one paragraph of the firm’s Quarter InsurTech Briefing referred to the fact that more than 450 InsurTechs have failed over the past decade. But it’s an important update, the study’s author, Andrew Johnston told Carrier Management in an interview two weeks before the report’s release, noting that he’s been collecting failure data for the last 14 months.

“Most of the InsurTechs that we know about are the very, very successful ones or the ones that have attracted a lot of capital,” he said, referring to knowledge of the general public. “But they really are not reflective of the global InsurTech scene. I reckon that it might be something like 3,000 InsurTechs globally, and a lot of them come and go, right? They’re quite serious but their successes are limited,” said Johnston, who is global head of InsurTech at Willis Re.

One such InsurTech business is Traity, a Madrid, Spain-based insurance startup, which Carrier Management profiled in 2016 and which won several InsurTech awards, according to information on the LinkedIn profile of the founder and CEO. But the business that scored online reputations using a patented predictive data analytics solution “had to turn off the lights,” after many years of ups and downs, the CEO’s profile summary says. “The line between success and failure was very thin, but we could not cross it,” the summary says.

Johnston previously made observations about the soaring mortality rate of InsurTechs around the world in the fourth-quarter 2019 edition of the Quarterly InsurTech Briefing published by Willis Re and CB Insights. In that prior report, the estimate of InsurTech businesses that had ceased trading was roughly 184.

The updated figure—456 failures—presented in the second-quarter 2021 briefing is still a rough estimate, according to the text of the report. To come up with the figure, Willis Towers Watson totaled up those businesses that:

- Have raised less than $10 million overall

- Have not exited (through and IPO or M&A

- Have not raised any capital in over 24 months, and

- Are outside the top 25 percentile in CB Insights’ platform Mosaic Score.

CB Insights Mosaic Score is a predictor of individual company health, the Briefing report noted.

“While the actual number of InsurTechs that have ceased trading could be drastically different, our sense is that it is probably at least this many businesses if we consider 2010 our starting point,” the report said.

Bubble Set to Pop?

Johnston discussed the InsurTech failure rate with Carrier Management for a separate article (soon-to-be published in the third-quarter print magazine) about talent movements between InsurTechs and incumbents, noting that job candidates might jump ship to incumbents if an InsurTech is on shaky ground. (Related article: “Are InsurTechs Losing The Talent War? It’s Debatable”)

Separately, Johnston and Chris Downer, a principal of Brewer Lane Ventures, speaking at the Casualty Actuarial Society Seminar on Reinsurance in June, said there is a bubble is being created by exuberant investors in the InsurTech space stoking high valuations.

But in nuanced answers to the question—”In what way are InsurTech bubble fears justified?”—Johnston and Downer also stressed that there are many InsurTechs starting to show their potential to improve the industry, when asked by panel moderator David Wright, chief insurance officer of Acrisure Technology Group.

“If the fear is about an overvaluation being crushed under these businesses’ inability to deliver profitable long-term [results], then I think we are seeing a confluence of short-term investment bullishness meeting the realities of what’s required to deliver return,” Johnston responded. “But it speaks to a bigger issue, which is you have all of these different stakeholders that are looking at InsurTech for all manner of reasons. And the term now is so ubiquitous that InsurTechs are no longer just risk originators with a great brand, but they’re software for the entire industry—and in some cases doing some really fantastic things,” he continued.

Still, “before long, there is going to be a version of a bubble bursting where it’s just no longer possible to justify certain valuations and rely on public investment bullishness to support those investments. I don’t know what the time frame of that is going to be, and I don’t know if it will be bubble-esque in that it sort of bursts overnight, or whether it will be a slow, hot air balloon with a hole making it back to planet earth. But I do think that we’re at a point now where the fuse is certainly lit on those businesses that have gone public. And there’s increasing pressure on those businesses to deliver from a long-term perspective,” he said.

Downer, whose firm has been investing in InsurTechs since 2015, said that if the principals had been asked about a potential InsurTech bubble back in 2016 or 2017, they would have answered, “There might be,” even then. “We’ve only accelerated from that point….What we are seeing is a lot of interest from venture capitalists, private equity, hedge funds who are coming to the space and saying, ‘Look, there’s something going on here in InsurTech. We want to be involved.'”

“So with the amount of capital that is coming in, there’s a lot of competition when it comes to these deals. Therefore you’re seeing a lot of companies raising money quickly, raising a lot of money and raising money at valuations that are, I think, stretched to put it nicely, and probably absurd to put it frankly,” he said.

“I think valuations are rising in a manner that is concerning,” Downer added. “But I think the impact that InsurTech can and should have on the insurance sector—we’re really just seeing the beginning of it. And so yes, while there may be valuation concerns and things of that nature, the relative impact is still quite small,” he concluded.

“As a venture capitalist, we believe very much that InsurTech can, should and will have a much more impactful presence in the insurance space. And so I guess somewhat politically, we are in a relative bubble. We are not yet concerned quite yet that that bubble will burst.”

Later during the CAS session, the panelists weighed in on the question of whether the rate of new startup ventures will rise, remain the same or decline. While 41 percent of actuaries in the audience said the rate would climb and only about a quarter (26 percent) said it would fall, the panelists said they believed it would decline.

“I think that there will be a steady rate of decline of brand new ventures,” Johnston said. “There’s just increasingly less and less space to squeeze new businesses.” Expanding on his answer, the Willis Re executive predicted that “the creation of new businesses who are identifying as InsurTech…will slowly start to see a drying up at the embryonic stage. But from a lifecycle stage as it relates to fundraising, we might not actually see that until three, four or five years down the line.”

“In terms of actually creating something from scratch, I think that there will be a slow decline there,” he reiterated.

Pressed for drivers of the slowdown by Wright, Johnston first noted the presence of “a backlog of companies who were already in this space” for a long time, that weren’t calling themselves InsurTech. “We would meet with lots of people saying, ‘We’ve been doing this for 10 years, and now we finally have a term that we can latch onto and sell into the industry.’ And that group of people have worked their way through now,” he said, also pointing to changing investment conditions overall.

In addition, he said, “there are things afoot that incumbents are doing that will require fewer InsurTechs, or outside businesses coming in to help solve for certain problems.”

“And it’s just that there are so many businesses in this space right now. I just don’t think it’s sustainable over time.”

Downer agreed that startup rates will decline. The early wave of InsurTech startups consisted of “folks who weren’t necessarily from insurance, but came in to start an InsurTech on the parts of insurance they touch—home renters, auto, maybe some life, maybe portions of distribution. I don’t think the InsurTech market needs another five renters insurance companies. I don’t think the InsurTech market at this point needs another 10 auto insurers,” he said. “And I think that the barriers to entry [for] folks who don’t know insurance have increased,” he said. “There’s still plenty of room to run on the commercial side, but you need to know about commercial insurance in order to start that InsurTech.”

“Don’t forget—these InsurTechs that are currently in business as they mature, they themselves are going to have to start to adopt a defense strategy,” added Johnston. “When they start biting back, that’s going to be particularly interesting [in terms of] how it affects these nascent businesses.”

A final panelist, Isaac Espinoza, vice president of reinsurance for Root agreed that the number of new ventures will decrease. “The hurdle’ is now becoming higher,” he said. “I think reinsurance capacity is harder to come by. I think there’s a number of people that have skepticism, and the first-mover advantage has gone away for these new tech companies,” added Espinoza, who previously worked in a VC-type role for Greenlight Re.

Funding Levels Balloon

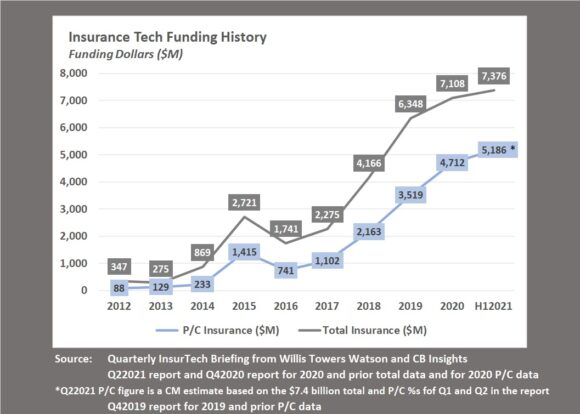

As for the current state of the InsurTech market, global InsurTech funding ballooned to $4.8 billion in the second-quarter of 2021. While that was 89 percent higher than the $2.6 billion tallied for the first quarter, funding for the two quarters together—roughly $7.4 billion—surpassed the full year 2020.

According to the report, the portion of those totals that went to property/casualty InsurTechs was 71 percent of second-quarter 2021 and 69 percent for first-quarter 2021, producing a first-half P/C total of roughly $5.2 billion (Carrier Management’s calculation).

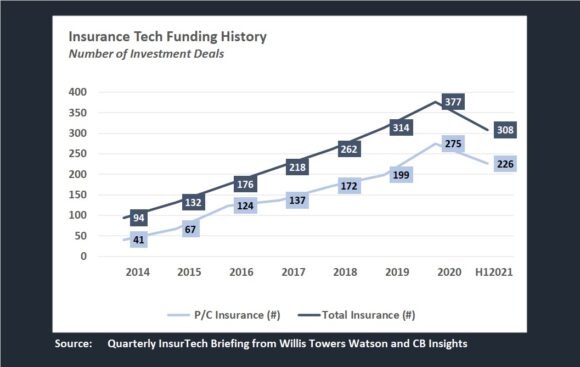

There were 107 P/C deals in the first quarter and 119 more in the second quarter, bringing the first-half total to 226, a figure that is 82 percent of the full-year 2020 total and above all of the prior full-year totals that Willis Towers Watson and CB Insights have calculated since 2012.

An article published by Carrier Management last week highlights some of the report details about differences in deal counts and dollar amounts by funding stage and geography.

The text of the latest Briefing comments on overvalued InsurTechs and the speed at which InsurTechs are going public. The rush to IPO is either a sign that some InsurTechs are “ready for prime time or [that] investors may be a bit overeager in a very bullish market,” Johnston said, on a video accompanying the report.

The report also highlights some InsurTechs that have gone public or plan to do so, which are performing very well, giving the particular example of Doma (formerly States Title). Doma announced it would go public through a special purpose acquisition company with Capitol Investment Corp. in March., reporting Q2 revenues of $128 million, up 80 percent from Q1 2020 and a gross profit of $26 million, up 98 percent from Q1 2020, the report said.

In the forward to the report, Johnston also commented on a a recent trend for most InsurTech stock prices to move up and down together, “almost regardless of how the businesses themselves are performing.”

“Currently, most public InsurTech stock is experiencing a downward trend, as is so often the case with relatively exciting new investment opportunities during periods of volatility and uncertainty. This is not to suggest, however, that there will not be a positive future for many InsurTechs that can survive this uncertainty, and to this point, some individual businesses are demonstrating some impressive resilience already,” he wrote.

The HPIX, an index of InsurTech stock prices administered by Hudson Structured Capital Management, rose about 2 percent during the second quarter (from 155.92 on April 1 to 159.14 on June 30), but has fallen about 8 percent since (to 145.86 on Aug. 2).

A section of the Willis Towers Watson briefing includes an interview with Adrian Jones, managing director of HSCM, who created the index.

Asked for advice he would give to an InsurTech startup, Jones responded that the characteristic, which distinguishes great InsurTech entrepreneurs is “enormous persistency.”

“Insurance is not a business that is entranced by brilliant founders straight out of business school sprinkling pixie dust,” he said, noting that those who are poised to change the industry going forward “take the time to study the industry and its history,” and then spend years building companies.

“Insurance is a ‘get rich slowly’ business” that is “ripe for disruption” by those founders that are in it for the long haul, he said.

This article is republished from Carrier Management.

Topics Mergers & Acquisitions InsurTech Tech

Was this article valuable?

Here are more articles you may enjoy.

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio

Chubb Posts Record Q4 and Full Year P/C Underwriting Income, Combined Ratio  Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud

Former Ole Miss Standout Player Convicted in $194M Medicare, CHAMPVA Fraud  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets