The recent upticks in the frequency and severity of weather events has also affected insurance premiums for rental properties.

According to S&P Global Ratings, insurance is an increasing percentage of total expenses for rental properties and the trend is expected to persist.

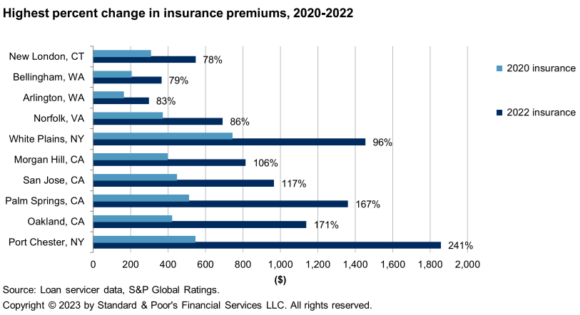

The weighted average for property insurance was about $590.30 in 2022, compared with about $473.60 the year before and about $386.90 in 2020. S&P Global Ratings analyzed 2020-2022 expense trends on 60 loans on U.S. affordable housing properties receiving low-income housing tax credits. The properties contain over 6,500 units.

“We expect property and casualty insurance premiums for commercial properties, including multifamily, will keep rising through 2023,” S&P Global Ratings said. “This is in part due to the material increases in insurance claims resulting from both the greater frequency of weather-related damages and the inflation-affected cost of repairs.”

Properties with the largest increases in insurance expenses are located in the following markets:

Topics Trends

Was this article valuable?

Here are more articles you may enjoy.

Law Firms Smell Opportunity as Supreme Court Guts Agency Powers

Law Firms Smell Opportunity as Supreme Court Guts Agency Powers  Cancer Victims Lose Bid to Block Proposed J&J Talc Bankruptcy

Cancer Victims Lose Bid to Block Proposed J&J Talc Bankruptcy  Ryan Specialty Announces Succession Plan: Pat Ryan to Exec Chair, Turner to Be CEO

Ryan Specialty Announces Succession Plan: Pat Ryan to Exec Chair, Turner to Be CEO  Changes at American Coastal Insurance After Florida OIR Action on ‘No-Fly List’

Changes at American Coastal Insurance After Florida OIR Action on ‘No-Fly List’