A rise in first quarter losses in the homeowners insurance line of business primarily put U.S. property/casualty underwriting results in the red, according to AM Best.

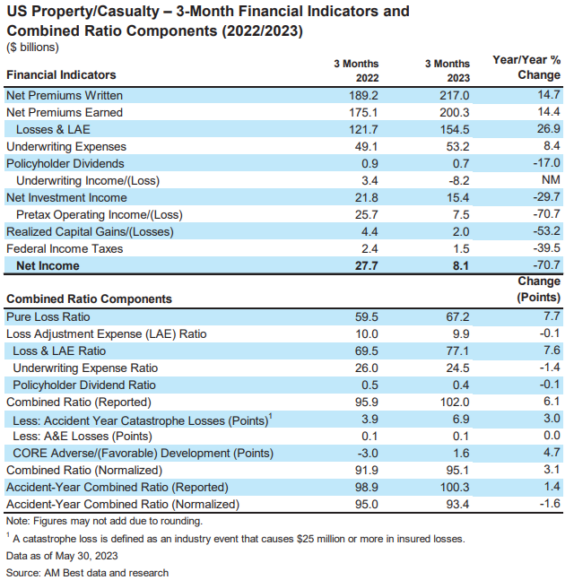

The U.S. P/C industry booked a $8.2 billion underwriting loss during for the first quarter compared with a profit of $3.4 billion during the same time in 2022.

Q1 2023 net income for the industry was down about 70.7% to $8.1 billion compared to $27.7 billion for the first three months of 2022, and the combined ratio was an unprofitable 102 from 95.9. AM Best said estimated that catastrophe losses accounted for 6.9 points to the Q1 combined ratio.

More than 14% of growth to Q1 net earned premiums and a 17% decline in policyholder dividends were eclipsed by a nearly 27% rise in incurred losses and loss adjustment expenses (LAE) as well as a rise in underwriting expenses of 8.4%, AM Best said.

*AM Best’s First Look report provides early insight into the current financial state of the US property/casualty industry based on data from companies whose three-month 2023 interim period statutory statements were received as of May 30, 2023. These companies account for an estimated 98% of total industry net premiums written and 98% of policyholder surplus.

Topics USA Profit Loss Underwriting AM Best Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Without Reforms, Report Finds  Portugal Deadly Floods Force Evacuations, Collapse Main Highway

Portugal Deadly Floods Force Evacuations, Collapse Main Highway  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan