The U.S. cyber insurance market saw what Fitch Ratings called an unexpected 1% decline in direct written premiums in 2023 following a 160% increase from 2020 to 2022.

According to Fitch Ratings’ U.S. Cyber Insurance Market Update, standalone cyber written premium declined by 3% while package coverage increased 5% in 2023.

Managing Director Jim Auden said, “Market concentration has become diluted as more insurers enter the cyber market attracted by longer-term growth opportunities.”

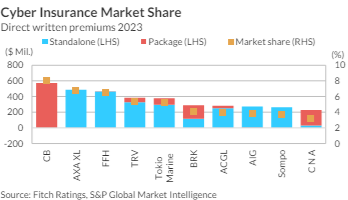

The top 10 writers of cyber insurance in 2023 accounted for 50% market share whereas the top 10 held a 69% as recently as 2019 as a result of recent substantial price increases for coverage as well as changes in underwriting practices—specifically more restrictive requirements for cyber hygiene and risk management.

Fitch Ratings said cyber has been one of the most profitable commercial business lines from 2019 to 2023, with an average direct loss and DCC (defense and cost containment) ratio of 55%.The average cost of the claims payment has been fairly steady over the last couple of years, with 6,200 standalone cyber claims closed in 2023 at an average payment of $186,000. The average payment on package cyber claims dropped to $148,000.

These factors have attracted more competition and underwriting capacity, leading to a reversal in pricing trends. Recent commentary from broker Marsh reported cyber renewal prices were down 6% during first quarter 2024.

“Underwriters risk management practices continue to improve, but large incidences of data breaches, business e-mail compromises and ransomware attacks continue to present a long-term threat,” said Senior Director Gerry Glombicki. “Cyber loss risk is also affected by expansion in regulatory and compliance requirements that increase potential for litigation risks and substantial fines and penalties for not properly disclosing data breaches.”

Nevertheless, the global cyber market—which currently represents less than 2% of all industry commercial lines—is expected to grow gross written premiums by more than double to $29 billion, according to Munich Re.

Topics Trends USA Cyber Pricing Trends

Was this article valuable?

Here are more articles you may enjoy.

‘Structural Shift’ Occurring in California Surplus Lines

‘Structural Shift’ Occurring in California Surplus Lines  Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance

Insurify Starts App With ChatGPT to Allow Consumers to Shop for Insurance  Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  World’s Growing Civil Unrest Has an Insurance Sting

World’s Growing Civil Unrest Has an Insurance Sting