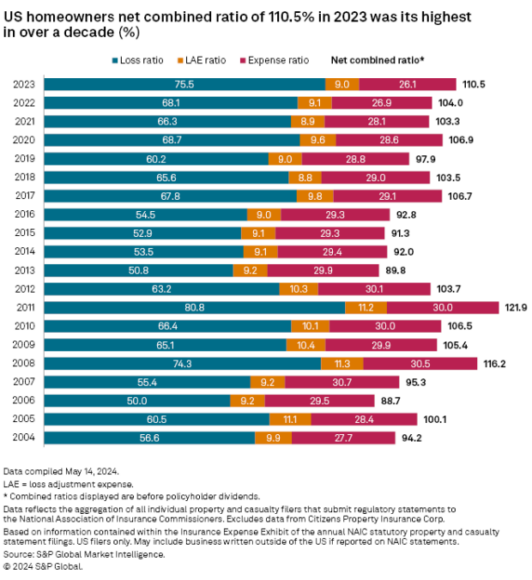

The U.S. homeowners insurance segment posted its worst underwriting results in over a decade in 2023, according to an analysis by S&P Global Market Intelligence.

The net combined ratio for the homeowners business, excluding policyholders’ dividends, was 110.5 in 2023, the highest since 2011 (121.9).

S&P said inflationary pressures, the devastating wildfire in Hawaii and a record-breaking number of billion-dollar loss events from convective storms weighed on the industry’s results.

Despite boosting rates across the U.S., homeowners insurers saw net underwriting losses of about $15 billion in 2023, compared to about $5.9 billion during the previous year, excluding state-backed insurers of last resort, S&P said in its market analysis.

U.S. homeowners insurers saw their net losses and loss adjustments expenses jump to about $101.3 billion in 2023, a year-over-year increase of 21.3%, while net premiums earned grew by 10.8% to about $119.9 billion. Other underwriting expenses equaled $33.4 billion during the year compared to $30.6 billion during 2022, according to the analysis.

Among the 20 largest U.S. homeowners insurers, only Chubb Ltd. and Amica Mutual Insurance Co. saw combined ratios under 100 in 2023. Chubb’s net combined ratio was 89.6 in 2023, while Amica posted a combined ratio of 97.4.

Florida’s Citizens Property Insurance Corp. became one of the 10 largest U.S. homeowners underwriters in 2023, knocking Progressive into the No. 11 spot. Citizens reported direct premiums written of about $3.2 billion—up 42.2% percent year-over-year.

In aggregate, the P/C homeowners industry recorded $152.5 billion in direct premiums written during the most recent year compared to $133.8 billion in 2022.

See the full S&P Global Market Intelligence report for more information.

Topics USA Carriers Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Beryl’s Remnants Spawned 4 Indiana Tornadoes, Including an EF-3: NWS

Beryl’s Remnants Spawned 4 Indiana Tornadoes, Including an EF-3: NWS  Project 2025 Plan to End NFIP Welcomed by Some, Rejected by Others in Insurance

Project 2025 Plan to End NFIP Welcomed by Some, Rejected by Others in Insurance  FM Global Rebrands As FM

FM Global Rebrands As FM  The Battle Over J&J’s Bankruptcy Plan to End Talc Lawsuits

The Battle Over J&J’s Bankruptcy Plan to End Talc Lawsuits