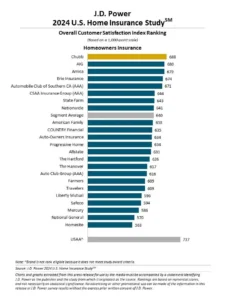

Chubb, AIG, and Amica lead other insurers in J.D. Power’s assessment of customer satisfaction for home insurance, but the consumer intelligence company said more people are shopping around.

The good news for insurers is that only 2.2% actually switched—and that’s down from results two years ago, according to J.D. Power’s 2024 U.S. Home Insurance Study. Based on a survey of more than 14,000 homeowners and renters, a record 6.8% of home insurance customers are actively shopping for another policy.

“Many shoppers have ended up staying put because there are so few alternatives available, but carriers need to recognize that steady rate increases put policy retention at risk and has a negative effect on customer satisfaction,” warned Breanne Armstrong, director of insurance intelligence at J.D. Power, in a statement.

In July, J.D. Power said auto insurance shopping also reached a new high, but more customers took the next step to switch carriers. Its newest home insurance study similarly found, like auto, a rate increase was the major force in at least deciding to see what else is out there. After all, home and renters costs have eclipsed average auto insurance rate increases and the rate of inflation, according to J.D. Power. Among those who have received a home insurance rate increase, 37% said they were likely to start shopping, and customer satisfaction was 92 points lower (594, on a 1,000-point scale) compared to customers that didn’t get a rate increase.

Customers switching auto insurers over home insurers appears to have the momentum when looking at bundling as well. J.D. Power said bundling has “declined significantly” in 2024 versus 2023, and there is more intent to switch auto carriers while leaving home insurers alone. In the latest survey, 21% of respondents said they “definitely will” switch home if they switch auto. That’s down from 24% a year ago.

Maybe Chubb, AIG, Amica, and other home-insurance competitors explained rate increases clearer than others. Customers that have an understanding are less likely to shop, and will more likely think their insurer puts the interest of customers first, J.D. Power said.

Amica also ranks among the top three in renters insurance satisfaction. Erie tops the list, with Lemonade in third.

Topics Homeowners

Was this article valuable?

Here are more articles you may enjoy.

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?

Fingerprints, Background Checks for Florida Insurance Execs, Directors, Stockholders?  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation

Trump’s Repeal of Climate Rule Opens a ‘New Front’ for Litigation