The chief executive of W.R. Berkley Corp. said his company is very focused on the impacts of tariffs on loss costs, and ultimately pricing for short-tail lines of business.

But the possibility of impacts of other lines, including workers’ compensation, is something that should not be overlooked, W. Robert Berkley Jr. suggested during a first-quarter 2025 earnings conference call.

Highlighting the potential impact on pharmaceutical costs, he noted a lot of drugs are manufactured outside of the United States, highlighting a potential link between tariffs and workers comp medical costs.

“As you would expect, we’re particularly focused on—both auto, particularly around the physical damage, as well as property. But I think it would be a mistake for one to discount other lines,” Berkley said.

Describing the whole tariff situation as very fluid, Berkley added, “We are doing our best to try and read the tea leaves, and we are actively doing a variety of different analyses to try and figure out what this means for loss picks and how that would instruct rate need.”

During a number of past conference calls, Berkley has spoken about his reservations regarding the workers comp line—specifically the unappreciated impact of medical severity of claims costs even as frequency has trended downward and pricing decreases have continued. So much so that he felt the need on the first-quarter 2025 call to explain why his company reported 11.8% growth in premiums for the line. He said the growth came from high-risk specialty areas in which standard markets are less likely to compete.

Related: Executives Deliver Divergent Views on Sustainability of Workers Comp Profits

Addressing the broader economic picture for the U.S. economy, an analyst asked Berkley to discuss the potential impact of recession on the workers comp insurers, specifically asking whether higher-than-historical wage inflation levels had been a tailwind for the industry in recent years. Could comp remain a profitable line during a recession?

Berkley agreed that significant wage inflation emerged when the country was “coming out of COVID,” and that the wage inflation “comfortably outpaced” medical inflation to create “more tailwind or wiggle room for the industry.” But he added that “medical costs are a little bit more than 50% of every claims dollar. So, one should not, in our opinion, underestimate the significance around that.”

When asked about the tariff impact on short-tail lines, the CEO said the tariff discussion “is still a bit of a moving target,” and it is not yet possible to pin down the impact to a range of numbers.

“I’m hoping that that’s something we can do, give or take 90 days from now…But right now, I think it would be premature,” Berkley said, adding that if the tariff policy comes as it was originally laid out, it will increase loss costs. “My message to you is that we are very focused on it and making sure that we will take the appropriate action from a loss ratio [perspective]—[and figure out] what those implications are from a pricing perspective as well.”

Another question related to the economic outlook was addressed to the company’s chairman, William R. Berkley, who started the company in the late 1960s, a few years before the U.S. experienced a period of stagflation. Asked how the commercial insurance industry fared during the 1970s when the high inflation, low growth economy prevailed, the chairman said while there was no broad-brush answer, larger companies tended to do better than smaller ones.

“The industry…went through a tough period of pricing pressures, but it wasn’t a disaster by any means,” he said. “The industry was able to move along, raising prices…But there was less [premium] growth because the economy really wasn’t growing.”

“Flexible, modest-sized and larger-sized companies did well. Not a lot of new companies [were] getting started,” the elder Berkley added, noting that W.R. Berkley was one of the few startups.

Q1 Earnings

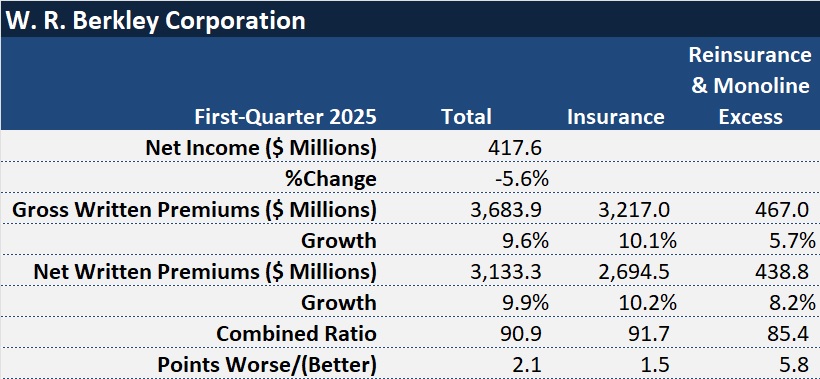

As for W.R. Berkley’s first-quarter earnings, they included a growing top line—with gross premiums and net written premiums rising around 10% to record levels of $3.7 billion and $3.1 billion—and a 5.6% drop in bottom-line net income to $417. 6 million.

The company recorded an annualized return on beginning of year equity of 19.9%, with Chief Financial Officer Rich Baio reporting stability in underwriting earnings and continued growth in net investment income as key contributors.

The combined ratio for the quarter was 90.9, compared 88.8 for last year’s first quarter. Catastrophe losses from the California wildfires added 3.7 points to the combined ratio.

While net investment income increased 12.6% to $360 million, investment gains (including a “change in allowance for credit losses on investments” fell to $16.4 million, compared to $23.8 million.

A line-of-business breakdown of net premiums revealed that W.R. Berkley reported double-digit growth in workers comp, auto and short-tail insurance lines, as well as property reinsurance, while shrinking in casualty reinsurance and growing just under 5% in professional liability insurance.

Topics Workers' Compensation Talent

Was this article valuable?

Here are more articles you may enjoy.

Preparing for an AI Native Future

Preparing for an AI Native Future  CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer

CFC Owners Said to Tap Banks for Sale, IPO of £5 Billion Insurer  Experian Launches Insurance Marketplace App on ChatGPT

Experian Launches Insurance Marketplace App on ChatGPT  AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’

AIG’s Zaffino: Outcomes From AI Use Went From ‘Aspirational’ to ‘Beyond Expectations’