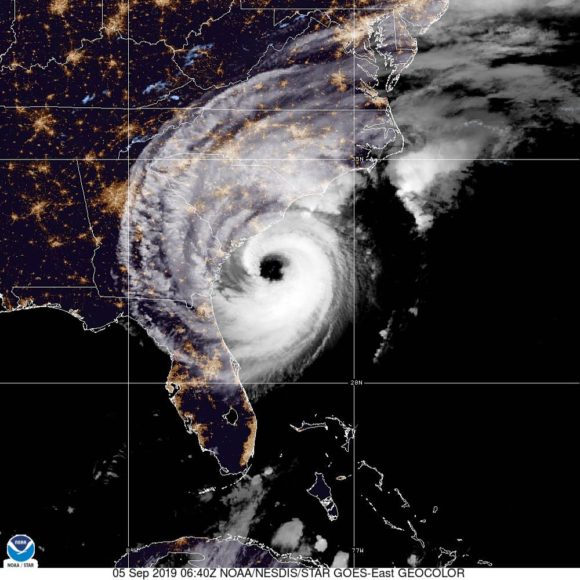

The wrath of Hurricane Dorian isn’t over yet and many more communities in its path are at risk and are bracing for the storm after it demolished the Bahamas earlier this week.

The extremely slow-moving hurricane is finally reaching the U.S., though it has weakened significantly from its previous Category 5 status and stayed off the Florida coast where earlier predictions had it making landfall with the potential to cause significant damage.

CoreLogic Principal Research Scientist Daniel Betten said the amount of time Dorian stayed over the Bahamas as a Cat 5 caused the ocean water to cool down and weaken the eye, which kept it from moving quickly and hitting Florida like some of the models showed last week.

“It would have been able to maintain at least a Category 4 intensity if it had made landfall [in Florida], but because it stalled out over the Bahamas, it came down to a Category 2 hurricane,” he said.

Since moving west of the Bahamas, Dorian has run parallel to the coast of the Southeast and is expected to cause problems in the Carolinas as it moves north over the next day or so.

The National Hurricane Center said in an 8 p.m. EST advisory Thursday the storm was recording sustained winds of 110 miles per hour, just 1 mph short of regaining Category 3 status.

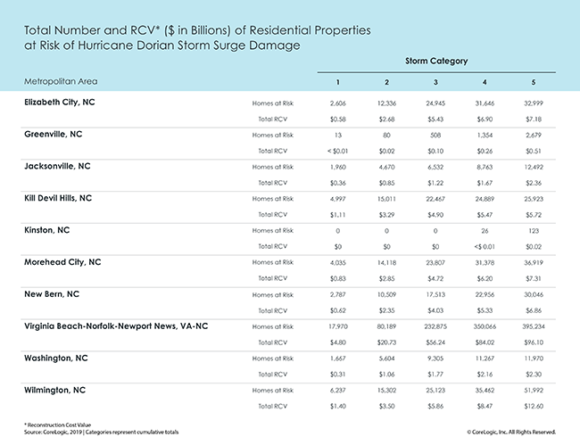

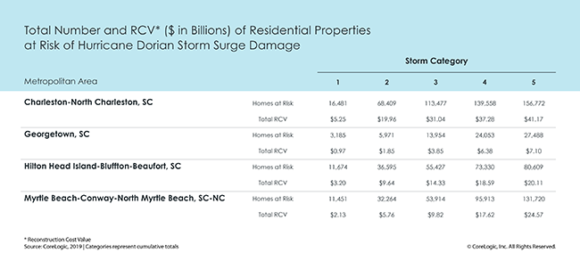

CoreLogic estimated if the storm is a Category 2, nearly 158,000 residential properties in North Carolina communities and about 143,000 in South Carolina would be at risk. The combined reconstruction cost value (RCV) to North and South Carolina would be close to $70 billion, CoreLogic said. If the storm is a Category 3 status, nearly 600,000 homes in the Carolinas would be at risk with a combined RCV of more than $143 billion.

Betten said regardless of if the storm makes landfall on the Southeast coast, the heavy rainfall and storm surge the storm could produce could lead to significant flooding issues for places likes Charleston, S.C.

“It’s going to be highly dependent on how the cone is oriented to the winds and how close the eye gets to that point,” he said.

The National Hurricane Center said storm surge could range from 4 to 8 feet in parts of South Carolina and North Carolina, and surge-related flooding will depend on how close the center of Dorian comes to the coast. Rainfall could range from four to 15 inches in the Carolinas.

Actuarial firm Milliman said Thursday that 1.4 million single family homes – primarily in Georgia and the Carolinas, as well as parts of Florida and Virginia – are at risk of inland flooding due to Dorian. Only about 18% of those – or 250,000 – have a flood insurance policy from the National Flood Insurance Program (NFIP), which provides the majority of flood insurance for homeowners in the U.S. Milliman defined homes expected to be at risk of inland flooding from Dorian as single-family residences in locations with an expected 7-day cumulative precipitation greater than 5 inches.

Milliman estimated that between 2016 to 2018 there were approximately 25,000 NFIP claims totaling more than $900 million in the areas affected by Hurricane Matthew (2016), Hurricane Irma (2017) and Hurricane Florence (2018). Hurricane Florence, which hit the Carolinas last September as a Category 1 storm, was primarily a water event and resulted in nearly $20 billion in uninsured flood losses, by some estimates.

North and South Carolina’s insurance departments have made addressing the flood insurance gap a priority the last couple years, with educating consumers a key focus.

Just over 134,000 homeowners in North Carolina had insurance through the NFIP in the wake of Hurricane Florence, according to North Carolina Insurance Commissioner Mike Causey, who at the time called the figure disappointing.

The North Carolina Department of Insurance planned five flood insurance conferences across the state this year between July and September to educate residents on the need for flood insurance and offered insurance agents continuing education course credits for participating.

Ray Farmer, director of the South Carolina Department of Insurance, said last year the state had just over 200,000 flood insurance policies in force, concentrated mainly on the coast.

“A better job is needed to communicate that homeowners insurance does not cover flood,” Farmer said during a PCIA panel discussion last fall.

Topics Catastrophe Florida Flood Hurricane North Carolina Homeowners South Carolina

Was this article valuable?

Here are more articles you may enjoy.

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Florida Insurance Costs 14.5% Lower Than Would Be Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Would Be Without Reforms, Report Finds