Florida’s besieged property insurance industry is hoping the second time will be the charm, after Gov. Ron DeSantis announced that he is working with lawmakers to schedule another special session to help stablilize the market.

The governor’s office did not provide details or a copy of an executive order calling the session, but at an event in hurricane-ravaged southwest Florida, the governor said lawmakers could convene after the Nov. 8 election and before the end of the year, according to news reports. House and Senate leaders and insurance industry activists indicated they are ready to tackle issues facing an insurance industry that has seen six insurers become insolvent this year while others have raised premiums significantly.

“We support it. We’re hoping to see more legal reforms, especially on one-way attorney fees,” said Michael Carlson, lobbyist and president of the Personal Insurance Federation of Florida, which represents a number of carriers.

A special session held in May approved two measures that aimed to reduce claims litigation, bar plaintiffs’ attorney fees in assignment-of-benefits claims, provide insurers with a layer of state-provided reinsurance, and allow policies to pay only for roof repairs, not full replacement, in many cases.

But insurance executives and advocates have said much more is needed to stabilize a market that appears to be overwhelmed with litigation and soaring reinsurance costs. DeSantis said Thursday that he wanted some further steps in Mayt that the Legislature as not willing to go along with, according to Politico, a news site.

Several ideas have been discussed in the industry for the upcoming special session, including:

- AOBs. Revising state law to allow insurance policies that bar assignment of benefits agreements. Florida’s chief financial officer, Jimmy Patronis, on Wednesday – the day before DeSantis announced the special session plans – proposed an outright ban on AOBs. But it wasn’t clear Friday if DeSantis and legislative leaders are on board with that for a special session. It’s also not clear if such a ban would stand court scrutiny, Carlson said, since Florida law has long allowed people to assign contracts.

- Cat fund. Lowering the retention level, or deductible, that Florida insured losses must reach before insurers can access the Florida Hurricane Catastrophe Fund. The state-created fund provides less-expensive reinsurance after major hurricanes, but accessing it sooner could save some carriers millions of dollars on their reinsurance tab, advocates of the idea have said. Providing another layer of state-backed reinsurance, at reduced premiums, also has been kicked around.

- Attorney fees. At the heart of Florida’s insurance crisis, many insurers have said, are Florida statutes that allow claimants’ attorneys to win large fees when they prevail in litigation, even if fees are much more than the judgment award or settlement. The May special session banned plaintiffs’ attorney fees but only in AOB cases.

Industry insiders and company leaders have said waiting until the 2023 regular session of the Legislature to make reforms will be too late and would not give insurers relief before the reinsurance renewal deadlines next summer. Reinsurance prices spiked this year and are expected to rise again.

Whatever measures the Legislature considers to rescue the property insurance industry, those must be accompanied with some type of short-term relief for homeowners, many of whom have seen premiums double or triple in the last two years, some insurance advocates have said.

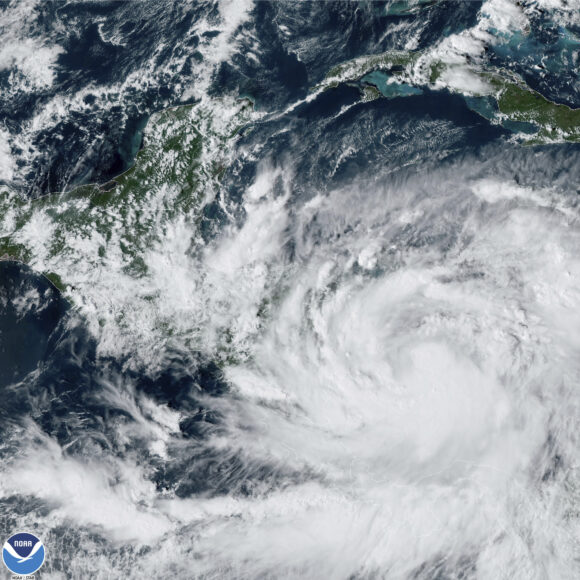

Carlson and others have said that Hurricane Ian, which raked across the state Sept. 28 and Sept. 29, may have provided the final straw needed to prompt state leaders to consider another session and take broader measures. Patronis, insurance agents and policyholders have reported that the hard-hit Fort Myers area has been flooded with public adjusters, plaintiff attorney advertisements, and contractors hoping to benefit from property owners filing insurance claims.

As of Thursday, Oct. 20, the Florida Office of Insurance Regulation reported that 564,399 insurance claims had been filed from Hurricane Ian, with estimated insured losses so far reaching more than $6.6 billion.

The call for a special session also came a week after Democratic gubernatorial candidate Charlie Crist blasted DeSantis for not fully addressing the crisis and allowing premiums to soar.

“No one believes that Ron will finally do the right thing and fix his broken insurance market in his last month in office,” Crist said in a press release, according to Politico.

Topics Florida

Was this article valuable?

Here are more articles you may enjoy.

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals

Zurich Insurance’s Beazley Bid Sets the Stage for More Insurance Deals  The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets

The $3 Trillion AI Data Center Build-Out Becomes All-Consuming for Debt Markets  Uber Jury Awards $8.5 Million Damages in Sexual Assault Case

Uber Jury Awards $8.5 Million Damages in Sexual Assault Case  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage