Risk retention groups may not be the sexiest of insurance topics, but they have gained new attention this week after the Florida House of Representatives approved a bill that would require strong financial ratings for the groups that operate in the state.

With just a week left in the 2023 regular legislative session, the House last week voted 84-30 in favor of House Bill 57, by Rep. Keith Truenow, R-Tavares. A companion bill in the Senate was approved by three Senate committees. But with a flurry of questions about it – and fierce opposition from some small trucking companies – it’s suddenly less than certain that the measure will now pass the full Senate.

The National Risk Retention Association, in a strongly worded email blast Monday, said the bills would unnecessarily raise insurance costs for small businesses that depend on member-owned retention groups, groups that can provide lower-cost liability insurance than commercial carriers can. The association claimed that adoption of the measure will have a devastating impact for retention groups and will create a monopoly for one insurance rating firm – AM Best.

“This defectively drafted bill is ironically being sponsored by a risk retention group for construction contractors which already has an A.M. Best ‘A’ rating, with its own capital surplus exceeding $100 million,” the NRRA statement said.

Risk retention groups, similar to some captive insurance plans, sell coverage only to eligible members. Unlike insurance carriers, they do not need to be licensed in every state they operate in and do not need to participate in insolvency guaranty programs, such as the Florida Insurance Guaranty Association. The groups do not submit rate filings, explains a Florida legislative analysis of SB 516. Regulations also allow “fronting” by admitted insurance carriers – the practice of insurers offering policies on behalf of retention groups, for a fee.

Some 25 retention groups are licensed in Florida, but few are large enough or have financial ratings high enough to meet the bill’s requirements, opponents of the bill said at at Senate hearing last month.

Smaller trucking companies and others have said the retention groups provide affordable liability coverage, especially in Florida, where market-based insurance premiums have soared in recent years.

“Removing risk retention groups from that market would have a disastrous impact on all small-business truckers in Florida, whether or not they insure through a risk retention group,” the Owner-Operator Independent Drivers Association’s executive vice president, Lewie Pugh, told Land Line trade news outlet in March.

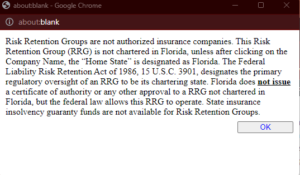

The bills are the result of a pop-up window that has appeared on the Florida Office of Insurance Regulation’s active company search page for the past two months. The window warns that risk rentention groups “are not authorized insurance companies” and are not chartered in Florida.

That messaging has caused trouble for some trucking companies hoping to do work for the state, stakeholders explained. State agency officials seeing the pop-up have lately become skittish about hiring haulers that aren’t backed by admitted insurance carriers, people on both sides of the debate explained.

As a work-around, the American Contractors Insurance Group, a large RRG based in Dallas, went to state Sen. Nick DiCeglie, R-St. Petersburg, to craft a bill that would give a stamp of respectability to larger retention groups. DiCeglie is chairman of the Senate Transportation Committee and runs a sanitation business that owns trucks.

His measure, Senate Bill 516, would require RRGs that cover construction vehicles in Florida to have an AM Best financial strength rating of “A” (Excellent) or better. They also would have to be of a certain size – rated “category VIII” or higher.

The bill also would allow surplus lines insurers of that size and financial strength to provide commercial vehicle insurance.

“We didn’t mean to exclude any groups,” Robert Reyes, a registered lobbyist with the contractors insurance group, testified at a Senate committee hearing in April.

The Florida Association of Insurance Agents’ supports the bill. But opposition and questions about the plan have grown in recent weeks. At the same Senate Appropriations Committee hearing, hauling company owner Linda Allen said she has to spend $36,000 a year to insure two trucks through a retention group, which is a better price than she can get from insurance carriers.

“Florida is a hard state to do trucking business in,” Allen said. “Insurance is higher here than almost any place else.”

Allen has been with the same RRG for 12 years, without problems, she noted. Requiring the top financial rating and the requisite surplus levels would force her retention group to leave Florida or raise rates significantly, she said.

NRRA has argued that the bill would mostly benefit the American Contractors Insurance Group, and would allow its members to avoid the $25,000 fronting fee to an insurance carrier that some smaller RRGs have to pay. The Florida bills also are unconstitutional and conflict with federal law that already address risk retention group regulation, the association has maintained. The NRRA also is concerned that passage of the measure could open the door to similar efforts in other states, and has launched a fundraising campaign in a last-ditch effort to defeat it, or to pursue legal action to block it if it becomes law.

Others argued that the bills are unfair to smaller RRGs and would require a financial review from only one rating firm – when several other rating firms provide similar analyses. And insurance companies do not face similar requirements.

“There’s nowhere in statute that requires any insurance company to have a rating, and certainly not a (category) VIII size requirement,” said Paul Handerhan, president of the Federal Association for Insurance Reform. The group is working with NRRA to oppose the bill.

A late amendment to the Senate bill may have been intended to narrow the scope, but it only limited it to “public and private” construction and infrastructure projects, he noted.

At a House floor vote on HB 57 last week, it seemed clear that the bill’s sponsor, Truenow, had not fully considered the intricacies of the legislation. State Rep. Hillary Cassel, D-Dania Beach, asked Truenow what is required to achieve a category VIII financial size rating from AM Best, as would be mandated by the bill.

“I don’t know the answer to the question,” Truenow replied. He later added that he believed the size rating required at least “$100 million to $200 million” by the insurer.

Other answers may not sit well with the other rating firms, such as Demotech and KBRA. When Cassel asked why HB 57 appears to create a monopoly for AM Best on retention group ratings, Truenow responded: “We’re not trying to create a monopoly. What we’re trying to do is use the highest and best standard.”

Despite the questions from Cassell and from Rep. Tommy Gregory, House members overwhelmingly approved the bill. But with the legislative session set to adjourn on Friday, May 5, there may be little time left in the Senate to resolve some of the issues that have been raised. As of late Monday, the bill had not been scheduled for a third reading or a final floor vote.

Was this article valuable?

Here are more articles you may enjoy.

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch

A 10-Year Wait for Autonomous Vehicles to Impact Insurers, Says Fitch  Insurance Broker Stocks Sink as AI App Sparks Disruption Fears

Insurance Broker Stocks Sink as AI App Sparks Disruption Fears  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call