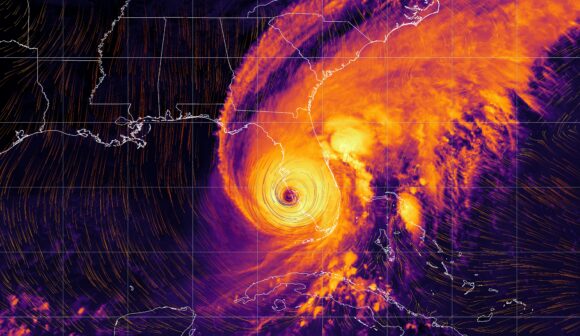

U.S. population growth in hurricane-prone states, coupled with the increasingly heavy rainfall which accompany these storms, has generated costlier insurance claim payouts for wind and flood-caused property damage, according to the Insurance Information Institute.

“While wind speeds and storm surge in coastal areas grab headlines, inland flooding is on the rise,” the Institute said in an Issues Brief, Hurricanes: State of the Risk. “In August 2021, Hurricane Ida brought strong winds and heavy flooding to the Louisiana coast before delivering so much water to the Northeast that Philadelphia and New York City saw flooded subway stations days after the storm passed. Ida also caused a surprising death toll thousands of miles from where the storm first made landfall.”

Last year’s Hurricane Ian caused catastrophic flooding in central Florida after making landfall in southwest Florida as a Category 4 major hurricane.

Triple-I found the greatest dollar growth in the value of NFIP claim payouts over the past 20 years occurred in the following areas of the U.S.

- Texas coast and inland Louisiana

- Coastal northern Florida, Georgia, and the Carolinas

- Inland northern New York, Vermont, and New Hampshire

“When adjusted for inflation, nine of the 10 costliest hurricanes in U.S. history have struck since 2005,” the paper noted. “This is due mainly to the fact that more people have been moving into harm’s way since the 1940s, and Census Bureau data show that homes being built are bigger and more expensive than before.”

According to the Census Bureau data, the most significant population growth in the U.S. between 2011 and 2020 came in: Texas (15.6%), Florida (13.5%), South Carolina (11.3%), North Carolina (10.3%), and Georgia (9.5%).

Was this article valuable?

Here are more articles you may enjoy.

Pipeline Explodes at Delfin LNG Planned Project in Louisiana

Pipeline Explodes at Delfin LNG Planned Project in Louisiana  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  Allstate CEO Wilson Takes on Affordability Issue During Earnings Call

Allstate CEO Wilson Takes on Affordability Issue During Earnings Call