Hurricane Idalia, with estimates of insured losses as low as $2 billion, will nonetheless affect underwriting results for a number of carriers, the AM Best financial rating firm said in a report released Friday.

“Hurricane Idalia will most likely be an earnings event for the insurance industry,” the report said. “In addition to above-average cat losses for the first half of the year from severe convective storms and secondary perils, we expect underwriting results for 2023 to remain under pressure.”

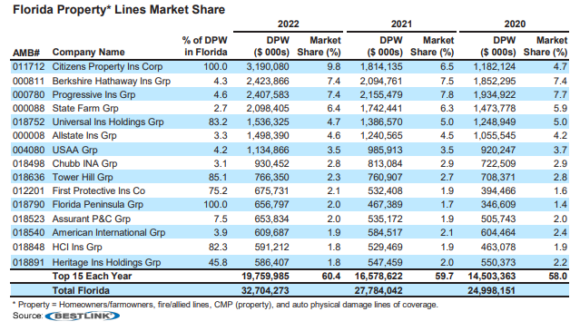

Citizens Property Insurance Corp., the state-created wind insurer, continues to have the highest market share in Florida. The carrier had not released estimated losses from the storm as of Friday morning.

Idalia’s impact on reinsurers will be minimal, but could still force some re firms to continue to be selective about the risks they will reinsure, “further challenging the Florida property writers,” AM Best noted. Losses paid by reinsurers, compared to assumed premium from Florida property carriers, has soared in the last decade, from 15% to more than 30%, the report found.

Despite significant reinsurance price increases for Florida carriers in the last two years, though Florida personal property insurers make up less than 5% of most of the reinsurers’ total portfolios, the report noted. Heritage Property & Casualty Insurance Co. in 2022 had ceded the most to reinsurers.

Idalia, which came ashore in the relatively sparsely populated Big Bend area of Florida, with wind speeds less than expected, is being seen as mostly a flood event, with heavy storm surge in coastal areas. That may have an impact on the growing private flood market.

As AM Best had reported last month, private flood coverage in Florida has seen notable growth, thanks in part to FEMA’s Risk Rating 2.0, which has raised National Flood Insurance Program premiums for many property owners, while lowering rates for others. Five companies now make up 95% of the annual growth. Kin Interinsurance Network leads the way in growth, the rating firm report shows.

The 4-page report can be seen here.

Chart: Property insurers’ market share in Florida, as determined by AM Best.

Topics Florida Underwriting Reinsurance AM Best

Was this article valuable?

Here are more articles you may enjoy.

Pipeline Explodes at Delfin LNG Planned Project in Louisiana

Pipeline Explodes at Delfin LNG Planned Project in Louisiana  Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer

Maine Plane Crash Victims Worked for Luxury Travel Startup Led by Texas Lawyer  US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  Florida Insurance Costs 14.5% Lower Than Would Be Without Reforms, Report Finds

Florida Insurance Costs 14.5% Lower Than Would Be Without Reforms, Report Finds