Workers’ compensation rates have shrunk to such a low level in Florida, at least for some classifications, that they are causing problems and could be masking issues that will lead to higher premiums in coming years, Florida roofing contractors said Thursday.

“I’m not asking. I’m begging you to freeze rates for roofing classifications,” said Ralph Davis, of Streamline Roofing, in Tallahassee.

Davis, a member of the Florida Roofing and Sheet Metal Contactors Association, spoke Thursday at a hearing of the Florida Office of Insurance Regulation that examined a proposed overall, average workers’ compensation rate decrease of 15.1% and a 22% decrease for roofing jobs. The new rates were recommended by actuaries with the National Council on Compensation Insurance and would be some of the largest rate cuts in Florida history. If approved by OIR, the rates would take effect Jan. 1.

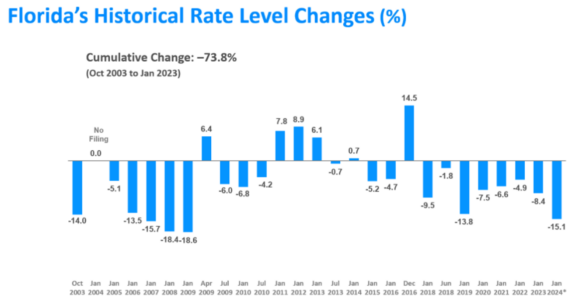

The NCCI, which analyzes and recommends rates and loss costs for 38 states, has proposed – and the OIR has approved – workers’ comp rate decreases in Florida for each of the last seven years, including an 8.4% overall average cut early this year.

But Davis and others with the FRSA said repeated rate slides can be too much of a good thing. Rates already are so low and reinsurance costs are so high that the FRSA’s 68-year-old Self-Insurers Fund is facing some challenges.

“If we have to keep seeing lower premiums from lower rates, that could make it harder to provide dividends to our members,” said Debbie Guidry, administrator of the fund.

A continued downward trend on rates could lead to unexpected effects, she added. The self-insurance fund could ask for a deviation on rates, but private carriers may not. At the same time, rates that get too low could encourage some carriers to leave the state. All of that could force more contractors into the Florida Workers’ Compensation Joint Underwriting Association, a type of residual insurer.

Davis and Les Sims, of Armstrong Roofing, warned that the NCCI’s recommended rate may not be considering the true number of injuries in the construction business. Many roofing and construction companies rely heavily on immigrant labor, hired through subcontractors or professional employee organizations, also known as temporary staffing firms.

Subcontractors may show certificates of insurance, but injured workers, if they are undocumented, may be discouraged from filing a claim and will go to a hospital emergency room without mentioning that it was a work injury, Sims said. That long-followed labor system is now in question, thanks in part to a new Florida law that requires more documentation for workers and has scared some immigrants away from the state, economists have said.

A labor shortage is forcing roofers to hire more inexperienced workers, which will likely lead to more injuries. If more workers are put on contractors’ payrolls and start showing up with injury claims, workers’ comp rates could boomerang to much more painful levels, the roofers said.

“We appreciate the lower rates we’ve all seen over the years, but the pendulum will swing, just like it did with property insurance rates,” Sims said at the hearing.

OIR officials did not comment on the roofing association’s demand for a rate freeze. NCCI Executive Director Brett Foster said at the hearing that job classification code 5551, for all kinds of roofing jobs, has seen rate decreases in seven consecutive filings by the NCCI. Freezing rates now would likely block future decreases and savings to employers of about 30%, he said.

Arguing that rates are too low is a far cry from the late 1990s and early 2000s, when roofers, construction contractors and others in Florida were seeing steep annual comp increases. Florida lawmakers in 2003 approved a number of changes to the state’s workers’ compensation system which many have credited with reducing benefits, medical expenses and legal costs to employers. In late 2003 and again in 2006, employers saw average annual rate drops of almost 14%.

Since then, rates in Florida have dropped 17 times – a 74% cumulative decline since 2003, NCCI said. That mirrors comp rate decreases seen across the country, due in part to improved safety and fewer workplace injuries, experts have said.

The latest proposed decrease filing in Florida is based on improvements in experience, trends and benefits in policy years 2020 and 2021. Lost-time claims frequency has declined over the past decade. Medical expense trends also have dropped, despite a 2023 Florida court ruling that upheld a change in hospital reimbursement that carriers have said would raise some costs.

Going forward, medical expenses could drop slightly due to the new fee schedules adopted by the state Division of Workers’ Compensation, Foster said. Carriers also have seen improved yields from bonds and higher interest rates in the past year.

“That seems like it’s absolutely fantastic news,” OIR actuary Greg Jaynes said at the rate hearing. “More than a few pistons are firing towards an enhanced workers’ comp environment in need of lower rates.”

“I do believe the Florida workers’ comp market is healthy,” Foster said.

The roofing contractors and a carrier executive weren’t so sanguine.

“We are greatly concerned for the state of work comp,” said Laurie Zdanis, president of Michigan Commercial Insurance Mutual, which writes workers’ comp policies in Florida and several other states. “Rates continue to erode and inflation across Florida is 7.3% to 9%, and we don’t see that being taken into consideration.”

She urged OIR officials to hold rates at current levels for at least a year and examine more data.

Written comments on the proposed rate decrease will be accepted at OIR through Oct. 19. The office will not make a final decision until after that date, a spokesperson said.

Update: This article has been updated to include more information from the FRSA Self-Insurers Fund.

Topics Carriers Florida Workers' Compensation

Was this article valuable?

Here are more articles you may enjoy.

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh

Q4 Global Commercial Insurance Rates Drop 4%, in 6th Quarterly Decline: Marsh  Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed

Nine-Month 2025 Results Show P/C Underwriting Gain Skyrocketed  How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions

How One Fla. Insurance Agent Allegedly Used Another’s License to Swipe Commissions