The 2024 Atlantic hurricane season, predicted to be unusually intense, officially began this week and it could soon bring the first test of a North Carolina law that some insurance experts have said weakens building codes in the state and could lead to greater insured losses.

“I would like to see the legislature listen to all sides on this, not just the home builders,” North Carolina Insurance Commissioner Mike Causey said last week.

The North Carolina Home Builders Association in 2023 pushed for modifications to the state’s building codes in an effort to speed up home inspections and home building— to help ease a housing crunch in the state, according to news reports.

House Bill 488, enacted last fall after lawmakers overrode the governor’s veto, created a separate, residential building code council, with many members appointed by lawmakers, not just the governor. The law also bars adoption of newer energy-efficiency codes, a move that could prevent federal funding for community resiliency efforts.

It also blocks local governments in some areas from requiring inspections of plywood sheathing during home construction, although it stiffened requirements in some high-wind areas. Correct fastening of sheathing on walls and roofs can make a crucial difference in high winds, critics of the new law have said. But builders have argued that construction often grinds to a halt while waiting on overloaded local inspectors.

The Insurance Institute for Business and Home Safety, a well-regarded, nonprofit scientific research organization funded in part by property insurers, along with a former head of the Federal Emergency Management Agency, called House Bill 488 a step backwards for a state that is increasingly vulnerable as hurricanes grow in strength and frequency.

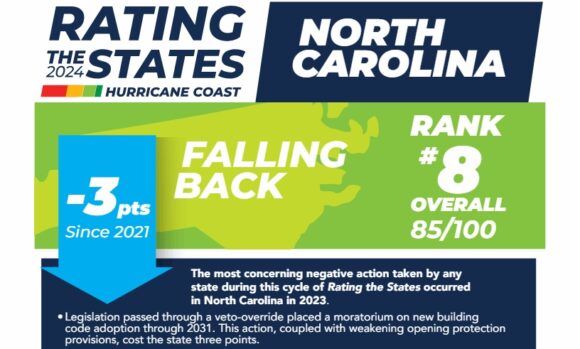

“In 2023, the State of North Carolina undertook one of the most detrimental steps of any state, reducing its building code system of protections,” the IBHS noted in a rating of the states report it publishes regularly. “The actions taken by the state legislature are unfortunate and will create unnecessary vulnerabilities to buildings that face nearly all types of severe weather.”

Because of the changes, North Carolina lost three points in the IBHS storm-resiliency rating system, keeping the state at number eight in the nation, behind No. 1 Virginia; No. 2 Florida; No. 3 South Carolina; No. 4 New Jersey; No. 5 Louisiana; No. 6 Connecticut; and No. 7 Rhode Island. With the law, the Tar Heel State is stuck in the 2015 building code requirements, overlooking some key protections that other states have adopted, the Institute said.

Further weakening, expected later this year with House Bill 893 and other bills, could push North Carolina out of the coveted “good” category for states with strong resiliency measures, the IBHS reported.

The law and its consequences come as insurance experts and legislators around the country seem to have adopted a view that better building codes and aggressive mitigation techniques are a key to reducing losses and keeping a lid on property insurance premiums.

“If the insurance companies don’t have to pay for the loss, that will reduce costs,” Charles Nyce, professor of risk management and insurance at Florida State University, said in December.

Nyce has advocated for billions of dollars in mitigation funding to fortify properties against coming storms.

Multiple studies and observations of hurricane-hit areas have shown that modern fortification and building protocols have drastically reduced damage to newer homes that follow those requirements.

“You’ve got to have a balance,” Causey said about building codes in storm-prone states. “You can’t have them so tough that houses can’t get built, but if you allow shoddy construction, consumers will get hurt.”

A piece of good news for North Carolina insurers is that a highly praised wind-mitigation roof program has continued to increase the number of grants each year for homeowners. So far this year, the programs, administered by the NC Joint Underwriting Association and the NC Insurance Underwriting Association, have seen more than 8,500 fortified roofs completed, with another 2,900 in progress.

An analysis by the North Carolina State University Institute for Advance Analytics and others found that the programs produced a 35% reduction in claims, with a 23% reduction in losses per building after hurricanes in recent years, the associations reported. The programs are similar to mitigation grant programs in at least four Southeastern states.

The NC underwriting associations are now pushing for Congress to make states’ fortification grants untaxed income for homeowners. U.S. House Bill 4070 and Senate Bill 1953 were both introduced last year and are awaiting action by federal lawmakers.

Some federal mitigation grants already are non-taxed by law, but the Internal Revenue Service has taken the position that state-based programs should be considered taxable income, the underwriting associations have explained.

Top graphic: From the Insurance Institute for Business & Home Safety.

Topics Catastrophe Natural Disasters Hurricane North Carolina

Was this article valuable?

Here are more articles you may enjoy.

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  Insurance Issue Leaves Some Players Off World Baseball Classic Rosters

Insurance Issue Leaves Some Players Off World Baseball Classic Rosters  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  AIG Underwriting Income Up 48% in Q4 on North America Commercial

AIG Underwriting Income Up 48% in Q4 on North America Commercial