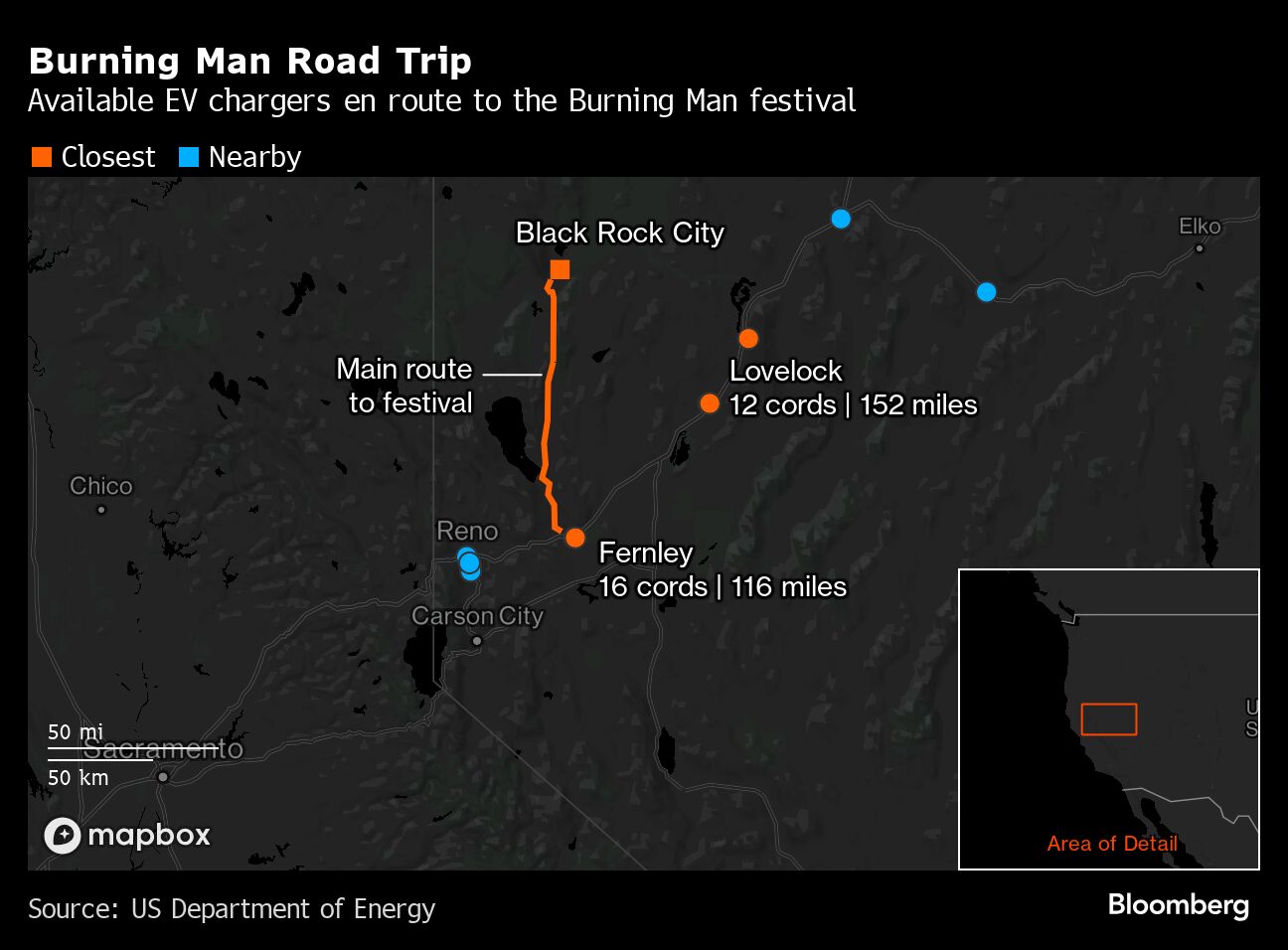

In Fernley, Nevada, east of Reno, there are 16 cords that rapidly charge electric vehicles — not bad for a city of just 24,000 people.

This weekend, that ratio will be upended. Roughly 30,000 vehicles are expected to roll through town en route to the Black Rock Desert 113 miles (182 kilometers) to the north, best known as the site of the annual art and music festival Burning Man. If even 1% of those cars are EVs whose drivers attempt to charge at the same time in Fernley, the stations will be staring down significant wait times.

Luckily for Burners — if not the planet — the risk of charger congestion is low. The Burning Man Project, the nonprofit that oversees the event’s ticketing and much of its build, says fewer than 1% of attendees get there via battery-powered car. But as EV adoption picks up in the US, events like Burning Man represent the next big challenge for the US charging network: having enough chargers to handle bursts of localized travel, such as Thanksgiving week in New England or July in Yellowstone National Park.

“Once you hit 40% utilization, for sure anyone coming to your place is going to have a hard time finding a charger,” says Rick Wilmer, chief executive officer of ChargePoint Holdings Inc., which operates about 3,000 fast-charging stations across the US.

The roads that bring people to Burning Man — literally, not spiritually — are emblematic of the first big challenge for US public charging: scarcity. Almost two-thirds of Nevada’s stations came online in the past three years. Fernley was an early adopter; its Tesla station opened in 2015, followed by a bank of Electrify America cords in 2019. Thanks to that infrastructure, it’s now possible for an intrepid EV driver to do “a Burn” sans gasoline.

“You’ve got just enough range to get in and out,” says Jamie Schiel, an occasional Burner and chief technology officer of Stable Auto, which helps networks decide where to put new stations.

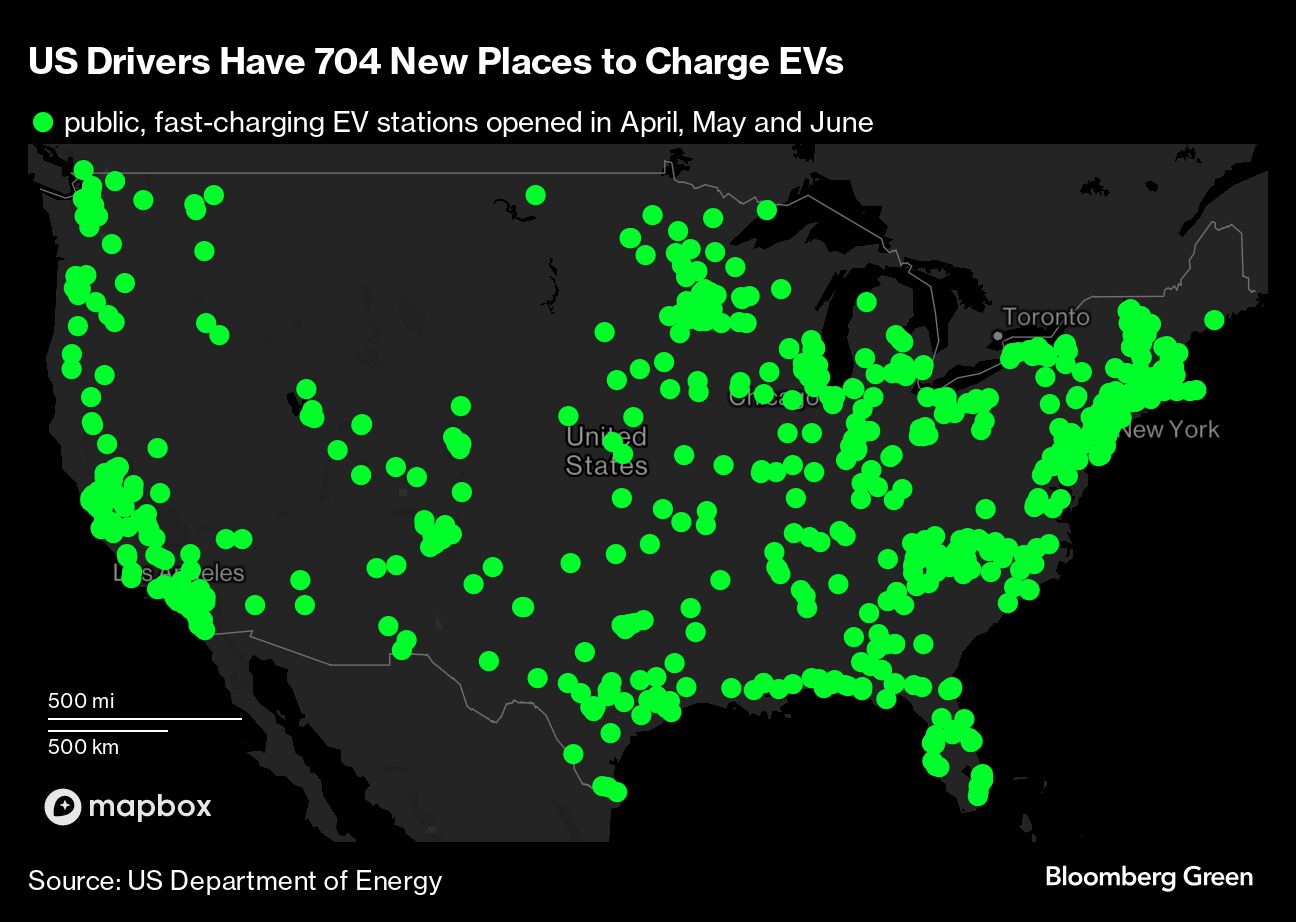

As in Nevada, the US charging network is also entering its post-scarcity era. There are now about 4 million EVs on the road and roughly 9,000 public, fast-charging sites, a figure that rose 9% in the second quarter. The proliferation of plugs means that most iconic American road trips — including Route 50 — are now possible via electric car, though it’s still wise to research routes in advance.

To glimpse charging’s next challenge — redundancy — look to China. EVs now account for one in three new car sales there. During the Lunar New Year in February, a major travel holiday, Chinese EV drivers experienced long wait times at highway charging stations.

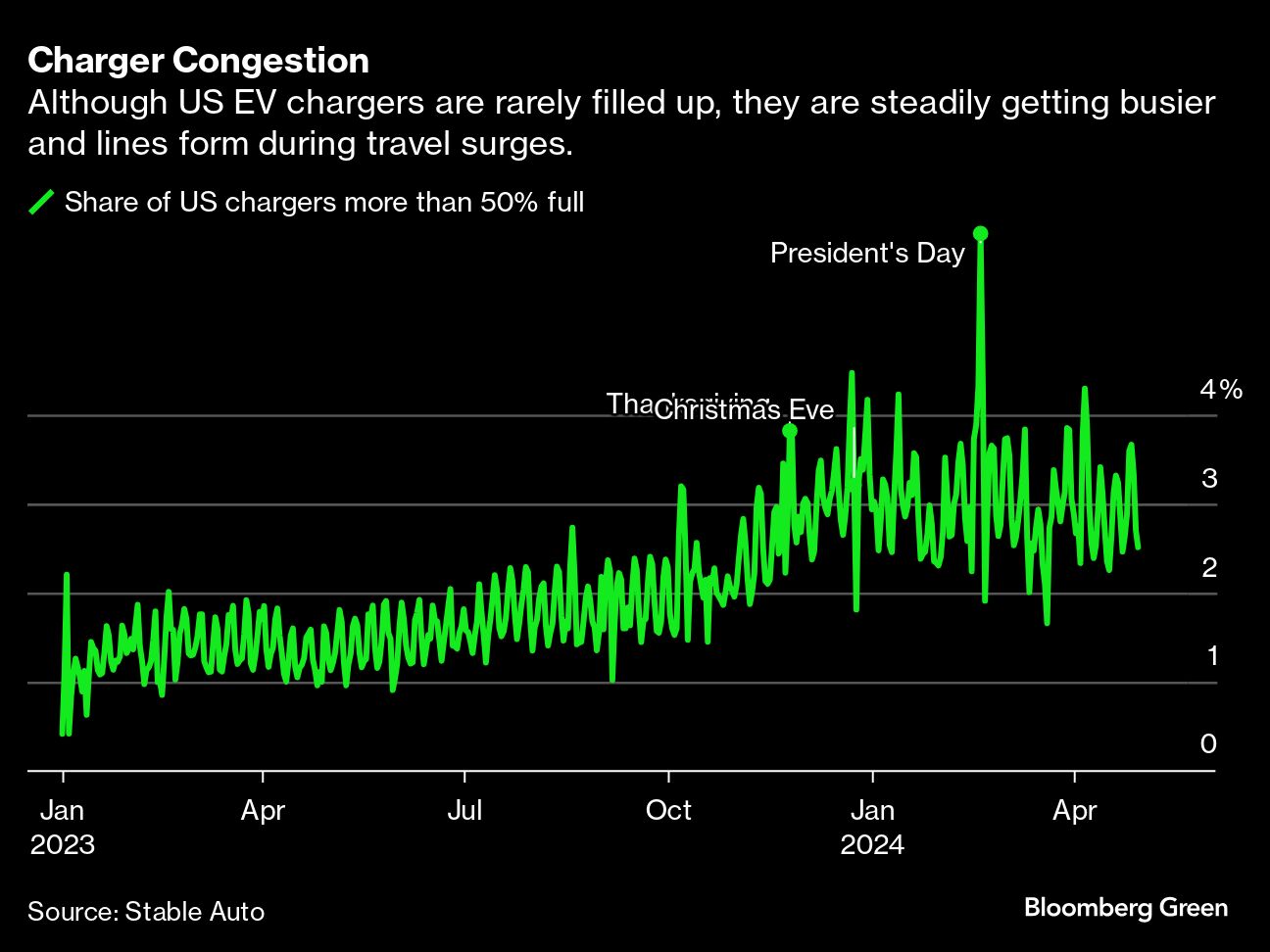

The US is starting to see flashes of this future. While its longest charging lines occur over Presidents’ Day weekend — likely because people underestimate it as a travel holiday — April’s solar eclipse created several charging hotspots along the path of totality. Some EV drivers found themselves waiting in massive lines to juice up.

From a potential congestion standpoint, the US’s charger-to-EV ratio is one of the worst in the world. (The Netherlands, for example, has one public charger for every five battery-powered cars.) Still, the system mostly works because American EV owners tend to charge at home, and because most of them don’t drive at the same time. This year through April, US public chargers were more than half full just 4% of the time, according to Stable Auto.

Those dynamics are shifting as EV sales ramp up. The newer cohort of buyers tend to drive more than those who made the switch earlier, and are less likely to have a charging option at home. Already, fast-charging stations are full roughly 20% of the time. EVgo Inc., which operates about 1,000 of them in the US, says its busiest 15% of stations are full almost half the time.

To accommodate demand, ChargePoint and EVgo are building more stations. At the end of June, EVgo had 730 plugs under construction, according to CEO Badar Khan; 16% of its sites now have six or more stalls. Electrify America, meanwhile, is trialing a “congestion-reduction” plan that stops a charge when the car is 85% full.

Still, periodic travel surges are almost impossible for a charging network to plan for, at least profitably. One strategy: The industry is slowly steering toward dynamic pricing — lower rates during slow periods and higher rates when demand is high. That kind of pricing would juice returns during big events like Burning Man or an eclipse, helping cover fallow periods that eat into the bottom line.

At first glance, Burning Man seems like the perfect candidate for levels of EV adoption so enthusiastic they outpace public plugs. But in reality, the “Leaving No Trace” event has a 100,000-ton carbon footprint that mostly comes from attendee travel, according to estimates from nonprofit startup incubator Black Rock Labs.

In 2019, the Burning Man Project released a sustainability roadmap that includes buying offsets, planting trees, adding solar panels and using renewable diesel generators and batteries to build and maintain its itinerant city. Last year, the festival generated 7 MWh of solar energy — enough to power the average US home for eight months — which almost half of attendees tapped into at some point.

In the future, EVs could become a bigger part of Burning Man’s carbon calculus. “As local EV charging infrastructure improves, and as battery-management software and grid-balancing technology matures, we are confident EVs will play an increasingly important role in getting [Black Rock City] off of fossil fuel,” a spokesman said.

For now, though, the Black Rock Desert is a bit of an EV desert, too. Tony Pham, a Burner who has only missed two years since 2008, says he seldom sees electric vehicles there. Even conventional cars often can’t handle the heat and occasional mud.

“There are just so many things that have a decent chance of going wrong,” Pham says. Among those risks is simply getting back to Fernley. “Unless you’re leaving before the man burns, you’re definitely going to be sitting in traffic,” he explains. “There are years where it might take you eight hours.”

Top Photo: A Volkswagen ID.4 electric vehicle (EV) at a Rivian charging station in San Francisco, California, US, on Tuesday, June 25, 2024. Volkswagen AG is taking another swing in its long struggle to catch up with Tesla Inc., plowing $5 billion into a tie-up with the US company’s closest would-be rival, Rivian Automotive Inc. (David Paul Morris/Bloomberg)

Related: California Needs a Million EV Charging Stations — But That’s ‘Unlikely’ and ‘Unrealistic’

Topics USA

Was this article valuable?

Here are more articles you may enjoy.

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI

US Appeals Court Rejects Challenge to Trump’s Efforts to Ban DEI  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  BMW Recalls Hundreds of Thousands of Cars Over Fire Risk

BMW Recalls Hundreds of Thousands of Cars Over Fire Risk