Steel prices have been anything but steady in recent years. With renewed discussions around tariffs and trade restrictions, another wave of volatility may be on the horizon.

While much attention is paid to how rising material costs impact builders and developers, there’s another, often overlooked ripple effect: insurance. Particularly, California’s surplus lines market may be especially sensitive to swings in steel prices.

Steel is more than just a building material; it’s also a barometer of construction costs. From commercial high-rises to critical infrastructure, steel is a cornerstone of many large-scale projects. When prices climb, so do total project costs, which in turn raise insured values. Insurers respond accordingly.

In the surplus lines market, where flexibility meets higher risk, premiums tend to rise in parallel to reflect that increased exposure.

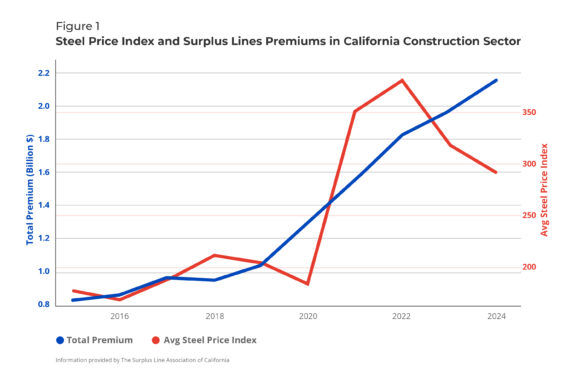

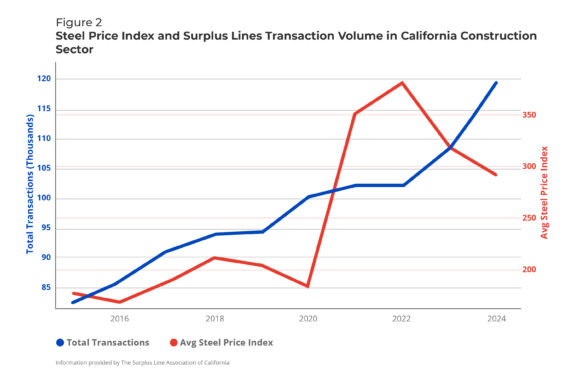

Historical data from 2015 to 2024 shows a compelling trend: As steel prices rose, so did surplus lines premiums in the California construction sector. Figure 1 highlights this upward movement, while Figure 2 adds another layer: a rise in the number of surplus line transactions. The implication? High material costs may be nudging more projects toward surplus lines, especially when they exceed coverage thresholds or carry pricing volatility that standard markets avoid.

Measuring the Impact of Steel Prices

Our statistical analysis shows a strong positive relationship between steel prices and construction-related premiums. Specifically, we find that a 1-point increase in the steel price index corresponds to an estimated $4.4 million increase in annual surplus lines premiums in California’s construction sector (holding all else constant).

Our analysis also highlights a statistically significant relationship between steel prices and the total number of surplus line transactions. Specifically, we find that a 1-point increase in the steel price index corresponds to an average increase of roughly 85 surplus lines transactions per year in California’s construction sector (holding all else constant). While smaller in magnitude than the premium effect, this increase in transaction volume suggests that more construction projects may be turning to surplus lines coverage as costs rise—particularly when higher material prices push total insured values beyond the limits typically supported by admitted carriers.

Anticipating the Future Impact

If trade policies or global supply constraints were to trigger a rise in steel prices, we would expect a corresponding increase in both surplus lines premiums and policy volume in the California construction sector. Projects facing inflated construction costs may no longer qualify for standard admitted insurance due to valuation thresholds or risk volatility, pushing more business into the surplus lines market.

To better understand the implications of a potential spike in steel prices, we modeled a scenario using 2024 data as a baseline, assuming a 25% increase in the steel price index. Our estimates suggest that such an increase could lead to a $321 million rise in annual surplus lines premiums and roughly 6,200 additional transactions in California’s construction segment of the surplus lines market—holding all else constant.

Historical trends and empirical analysis point to a clear link between rising steel prices and increased premiums and policy counts in California’s surplus lines construction market. As policymakers revisit trade policy and global supply chains continue to shift, insurers would be well-served to prepare for the ripple effects of material cost inflation. The surplus lines market has proven to be a flexible and responsive safety valve, and its role may become even more critical if steel prices surge again in the years ahead.

Gorshunov is a data scientist at The Surplus Line Association of California.

Topics California Excess Surplus Construction

Was this article valuable?

Here are more articles you may enjoy.

Judge Awards Applied Systems Preliminary Injunction Against Comulate

Judge Awards Applied Systems Preliminary Injunction Against Comulate  The $10 Trillion Fight: Modeling a US-China War Over Taiwan

The $10 Trillion Fight: Modeling a US-China War Over Taiwan  Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators

Florida’s Commercial Clearinghouse Bill Stirring Up Concerns for Brokers, Regulators  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market